Microsoft Slips in Quiet Session, but Poised to Breach $500 Milestone as AI Fervor Continues Unabated

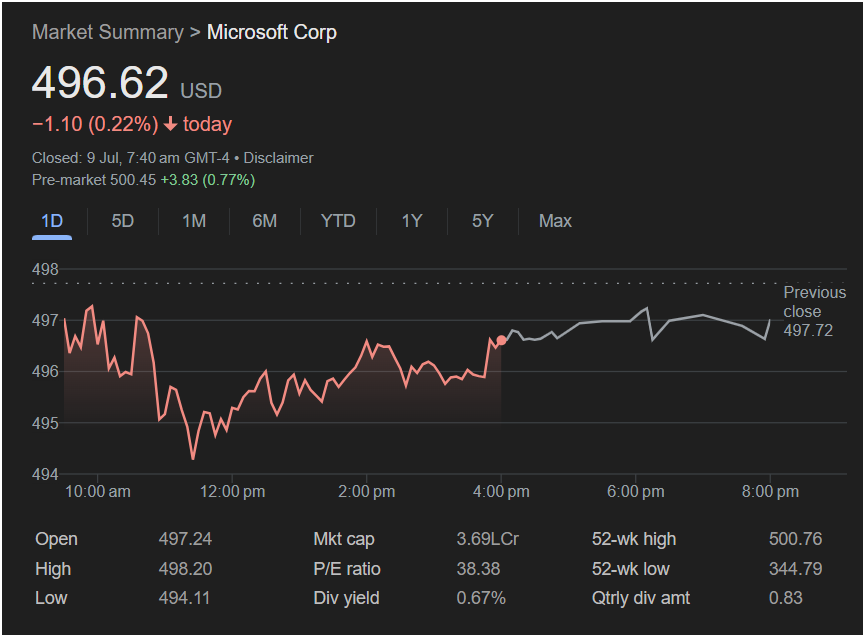

REDMOND, Wash., July 9 – Shares of technology titan Microsoft Corp. (NASDAQ: MSFT) experienced a day of modest consolidation, concluding the trading session with a slight decline. The stock closed at

1.10 or 0.22%. This minor dip, however, occurred within a stone’s throw of the company’s all-time high, painting a picture not of weakness, but of a market taking a brief, collective breath before a potential new ascent.

The day’s trading was characterized by a quiet tug-of-war between sellers taking profits near peak valuations and buyers stepping in to support one of the world’s most influential companies. After opening at $497.24, slightly below the previous close of $497.72, the stock quickly touched its intraday high of $498.20 before succumbing to selling pressure that drove it to a low of $494.11. The remainder of the session was a slow, grinding recovery that, while resilient, failed to push the stock back into positive territory.

Despite the day’s red finish, the underlying sentiment for the software and AI behemoth remains powerfully bullish. This was vividly illustrated in pre-market trading for the following session, where shares were already indicated at

500.45∗∗,asignificantjumpof∗∗500.45**, a significant jump of **

3.83 or 0.77%. This suggests that Microsoft is on the cusp of breaking the psychologically crucial $500 per share barrier for the first time, a testament to the market’s unwavering conviction in its artificial intelligence-driven growth story.

Section 1: Anatomy of a Consolidation Day – A Microscopic View

The seemingly unremarkable 0.22% loss hides an intraday narrative of early-session pressure followed by steadfast, albeit incomplete, resilience. Analyzing the flow of the session reveals the subtle dynamics at play.

The Morning Pressure (9:30 AM – 12:00 PM EST)

The session began on a slightly defensive footing. The opening price of $497.24 was immediately below the prior day’s close, signaling a lack of overnight momentum. In the opening minutes, a brief flurry of buying activity pushed the stock to its daily high of $498.20. This move likely represented the fulfillment of buy orders placed overnight, but it quickly exhausted itself against a wall of sellers.

This initial high water mark was significant because it fell just short of the previous close of $497.72 being decisively held and well short of the 52-week high. From there, the trend for the next two hours was definitively downward. The stock methodically stepped down, breaking through the $496 and $495 support levels. This decline culminated around 11:30 AM EST, when the stock printed its intraday low of $494.11.

This morning weakness can be attributed to several potential factors. First, with the stock trading so close to its all-time high, a degree of profit-taking is natural and healthy. Investors who have enjoyed the monumental run-up in Microsoft’s share price may have seen this as an opportune moment to lock in some gains. Second, the movement could have been influenced by broader market sentiment or sector-specific rotations, where capital flows out of recent high-flyers and into other areas of the market. The lack of a sharp, panic-driven sell-off suggests this was an orderly, controlled decline rather than a reaction to any negative company-specific news.

The Afternoon Grind (12:00 PM – 4:00 PM EST)