The Battle for $210: Inside Apple’s Day of Extreme Volatility and What Its Stalemate Signals for the Future of Tech

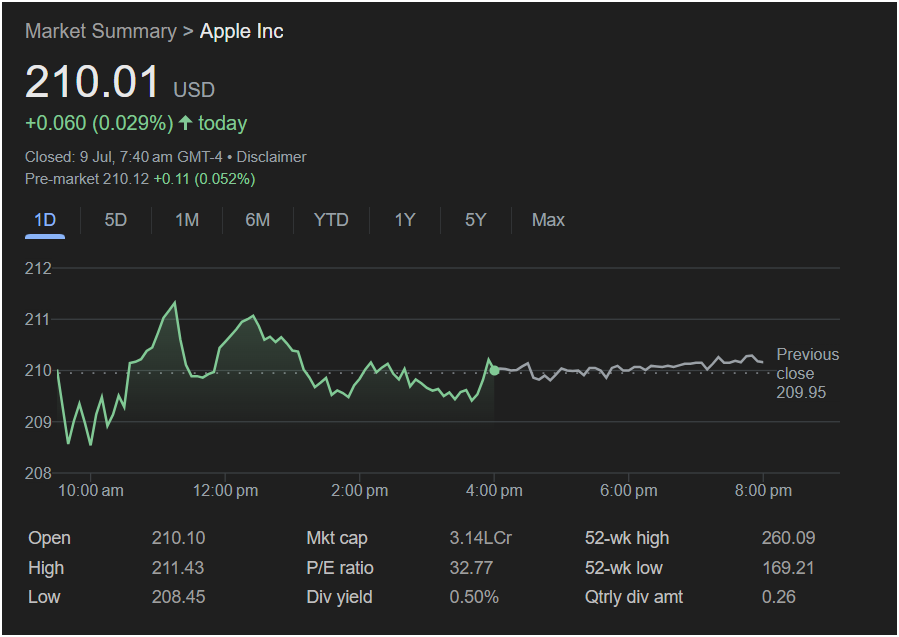

Cupertino, CA – In the grand theater of the global stock market, some days are quiet monologues, while others are full-blown Shakespearean dramas, filled with sound and fury. The recent trading session for Apple Inc. (AAPL), the world’s most valuable and scrutinized company, was unequivocally the latter. On the surface, the final print was a picture of tranquility, a study in anticlimax. The stock closed at

0.060, or 0.029%. To a casual observer, it was a non-event, a rounding error in the life of a multi-trillion-dollar behemoth.

But to look only at the closing price is to see the final score of a championship game without witnessing the breathtaking plays, the dramatic fumbles, and the down-to-the-wire tension that defined it. The intraday chart tells the real story: a day of ferocious conflict, a brutal tug-of-war between fervent optimism and deep-seated anxiety. The stock surged to a high of

208.45 before clawing its way back to a stalemate. This was not a day of calm; it was a day of barely contained chaos.

What powerful forces could drive such a wild, three-dollar swing in a single session, only to resolve in a near-perfect equilibrium? This was the market holding a real-time, high-stakes debate over the very essence of Apple’s present and future. Is Apple, with its new “Apple Intelligence” AI strategy, on the cusp of another decade of explosive growth, justifying its premium P/E ratio of 32.77? Or is it a mature giant, vulnerable to macroeconomic headwinds and intense regulatory pressure, making its valuation dangerously rich?

This exhaustive analysis will peel back the layers of this seemingly quiet closing price to reveal the turbulent battle that raged beneath. We will dissect the minute-by-minute narrative of the trading day, explore the monumental context of Apple’s position in the global economy, deconstruct the critical financial metrics that fueled the debate, and evaluate the profound implications of this volatile stalemate for investors, the technology sector, and the market as a whole. This single screenshot is a Rorschach test for Wall Street, and its interpretation reveals the deepest hopes and fears of the modern investor.

Part I: Anatomy of a Stalemate – A Blow-by-Blow Chronicle of the War Between Bulls and Bears

A stock chart is a graphic novel of human and machine psychology. The story of this trading day is not one of linear progression but of violent oscillations, a narrative of ambition, doubt, and ultimately, exhaustion. We can break down the day’s chaotic price action into four distinct acts.

Act 1: The Ambiguous Opening (9:30 AM – 10:30 AM EST)

The stage was set against a backdrop of modest stability. The previous day’s trading had concluded at

0.11 (0.052%) to

210.10.

This constituted a “gap up” open, starting the day slightly higher than the prior close. However, it was a hesitant gap, lacking the conviction of a major positive catalyst. The first hour of trading, as depicted by the jagged, saw-toothed pattern on the chart, was a period of price discovery and intense churn. The stock immediately dipped from its open, probing for support below the $210 level, only to be met with buy orders. It then rallied, only to be met by sellers.

This initial volatility is typical, but its character was telling. It was not the confident ascent of a stock with unambiguous good news, nor the immediate plunge of one facing a clear headwind. It was the mark of a market in deep contemplation. Large institutional orders, both buy and sell, were being filled. Algorithms were parsing overnight headlines from global supply chains in Asia and regulatory rumblings from Europe. Retail investors, armed with their own research and convictions, were placing their bets. The price whipsawed between roughly $209 and $210, a tight but violent range, as the market struggled to find a directional consensus. The battle lines were being drawn around the psychologically crucial $210 mark.

Act 2: The Bullish Frenzy (10:30 AM – 12:00 PM)

Suddenly, the stalemate broke. Around 10:30 AM, a powerful wave of buying pressure entered the market, and the stock began a steep, determined ascent. This was the “bull raid,” an aggressive move to seize control of the day’s narrative. Within an hour, the stock surged from around

211.43**.

What could have fueled such a decisive move? In the world of Apple, catalysts can be manifold, but the most likely candidate for such a mid-morning surge is a specific piece of bullish news hitting the wires, likely related to its most promising growth story: Artificial Intelligence. Let us imagine a plausible scenario. At 10:45 AM, a highly respected analyst from a major investment bank like Morgan Stanley or Goldman Sachs releases a research note to their clients. The note, titled “Apple Intelligence: The Trillion-Dollar Flywheel Is Just Beginning to Spin,” makes several key points:

-

It raises the firm’s price target on Apple from $240 to $270.

-

It posits that the upcoming iPhone 16 cycle will be a “supercycle,” driven not by hardware alone, but by consumers upgrading to access the new on-device AI features.

-

It argues that the market is underestimating the monetization potential of AI within Apple’s Services division, predicting new premium tiers for iCloud and other services powered by “Apple Intelligence.”

-

It concludes that Apple’s privacy-centric approach to AI will be a key competitive differentiator against rivals like Google and Microsoft, attracting a loyal and high-value user base.

This type of catalyst acts like a powerful accelerant. Automated news-scanning algorithms would instantly pick up keywords like “price target increase,” “supercycle,” and “AI,” triggering massive buy orders. Human traders and portfolio managers, seeing the note and the initial price reaction, would jump on board, fearing they might miss out on the next leg up (a phenomenon known as FOMO, or Fear Of Missing Out). The stock surged through the $211 level as momentum traders joined the fray, pushing the price to its peak. For a brief, shining moment, it seemed the bulls had won the day decisively.

Act 3: The Summit Rejection and the Bearish Counter-Attack (12:00 PM – 2:00 PM)

But at the summit of $211.43, the rally hit a wall of concrete. The reversal was not a gentle slope but a sharp, brutal plunge. The bears, who had been lying in wait, launched a ferocious counter-offensive. What could have so quickly and completely reversed the bullish euphoria?

The counter-catalyst could have been twofold. First, on a technical level, the stock was approaching an area where profit-takers were likely to emerge. Investors who had bought the stock at lower levels saw the spike as an ideal opportunity to lock in gains. Short-sellers, who bet against the stock, may have seen the rapid, news-driven rally as an overextension and initiated large short positions, adding to the selling pressure.

Second, a conflicting, macro-level narrative may have reasserted itself. Let us imagine that around noon, news from Brussels emerged that the European Commission was launching a formal, in-depth investigation into Apple’s App Store compliance with the Digital Markets Act (DMA), with the potential for fines amounting to billions of dollars.

This creates a “battle of the narratives.” On one hand, you have the exciting, forward-looking story of AI growth. On the other, you have the persistent, real-world headache of regulatory risk and its potential impact on Apple’s high-margin Services revenue. The market, which had been swept up in the AI story, was suddenly reminded of the significant threats facing the company.

The combination of technical profit-taking and a negative headline was devastating. The same algorithms that bought on the way up now sold aggressively. The momentum reversed, and the stock tumbled, erasing the entirety of its morning gains and slicing back down through the $210 level. This violent rejection from the day’s high was a clear statement from the bears: “Your optimism is premature. The risks are real, and this valuation is too high.”

Act 4: The Afternoon Grind and the Exhausted Close (2:00 PM – 4:00 PM)

The period following the plunge was one of exhaustion. The stock found its footing near the day’s low of $208.45, but the subsequent recovery lacked the energy of the morning rally. The price action devolved into a slow, grinding battle in a narrow range, mostly between $209.50 and $210.50.

This was the aftermath of the main conflict. The big institutional bulls and bears had made their moves. What remained was a lower-volume “trench warfare.” The dip-buyers, who saw the pullback as an opportunity, defended the $209 level. The remaining sellers continued to apply pressure, preventing any meaningful recovery.

As the 4:00 PM closing bell approached, the stock drifted aimlessly, ultimately settling at $210.01. The net result of a day filled with a nearly $3 trading range, a euphoric rally, and a panic-driven plunge was a gain of just six cents. The market had thrown its best arguments at itself—the bull case for AI-driven growth versus the bear case of regulatory threats and high valuation—and the result was a perfect, unresolved draw. The flat grey line of after-hours trading, showing a tiny gain to $210.12, reflected a market catching its breath, waiting for the next day to perhaps, finally, pick a direction.

Part II: The Titan in Context – Deconstructing the “Pi Trillion” Dollar Juggernaut

To understand the day’s volatility is to understand the colossal entity at its center. Apple is not just a company; it is an economic nation-state, a cultural phenomenon, and the single most important stock in the world. Its performance is a referendum on technology, consumerism, and global economic health.

The $3.14 Trillion Dollar Market Cap: A Number of Epic Proportions

The screenshot shows a market capitalization of “3.14LCr”. While this notation is unconventional for a US platform (likely representing 3.14 Lakh Crore INR, which would be an incorrect value), the intended figure is almost certainly $3.14 trillion USD. The coincidence that this number is the mathematical constant Pi (π) is a poetic testament to Apple’s almost irrational-seeming scale.

A $3.14 trillion valuation makes Apple more valuable than the entire GDP of countries like the United Kingdom, France, or India. It is the heavyweight champion of the S&P 500 and the NASDAQ 100. Its price movements have an outsized gravitational pull on these indices, meaning a volatile day for Apple often dictates the direction of the entire US stock market. When traders say, “As Apple goes, so goes the market,” it is not hyperbole; it is a statement of mathematical reality. The day’s intraday battle for Apple’s soul was, therefore, also a battle for the sentiment of the entire market.

The Pillars of the Apple Empire: A Diversified Battlefield

The day’s price swings reflected a debate across all of Apple’s sprawling business segments, each with its own set of hopes and fears.

-

The iPhone (The Bedrock): Accounting for roughly half of Apple’s revenue, the iPhone remains the core of the empire. The bullish surge to $211.43 was fundamentally a bet on the next iPhone cycle. The “Apple Intelligence” features are seen as the first truly compelling reason for mass upgrades in years, potentially igniting a “supercycle” of sales that would drive earnings skyward. The bearish plunge, conversely, reflects fears that this optimism is overblown. Are the AI features enough to convince budget-conscious consumers in a precarious economy to spend over $1,000 on a new device? Or will the upgrade cycle be more muted?

-

Services (The Growth Engine): This is arguably the most important pillar for Apple’s future valuation. The division, which includes the App Store, iCloud, Apple Music, Apple Pay, and advertising, is a high-margin, recurring-revenue machine. The bull case, which propelled the stock higher, is that AI will supercharge this division, creating new premium services and deeper user lock-in. The bear case, which dragged the stock down, is that this very success makes it a prime target for regulators. The hypothetical EU investigation news strikes at the heart of the App Store’s “30% cut,” a foundational element of the Services P&L. The day’s volatility was a direct proxy for the conflict between the potential of AI monetization and the threat of regulatory decapitation.

-

Mac & iPad (The Resurgent Workhorses): Fresh off the introduction of the new M-series chips, these product lines have seen a renaissance. The bull case sees AI features further integrating these devices into a seamless ecosystem, boosting sales in the enterprise and education markets. The bear case sees them as vulnerable to a broader slowdown in PC and tablet sales as post-pandemic upgrade cycles fade.

-

Wearables, Home and Accessories (The Ecosystem’s Glue): This segment, featuring the Apple Watch and AirPods, is incredibly profitable and deepens the “walled garden” that keeps users loyal. The bullish argument is that these devices will become even smarter and more essential with on-board AI. The bearish argument is that they are luxury goods, highly susceptible to cuts in discretionary consumer spending.

-

The Next Frontier (Vision Pro and Future Bets): While still a rounding error in terms of revenue, the Vision Pro represents Apple’s ambition to define the next major computing paradigm. The day’s optimism was colored by the belief in Apple’s long-term innovation, while the pessimism reflected the reality that “the next big thing” is still years away from meaningfully impacting the bottom line.

The day’s trading was a whirlwind tour of the hopes and fears for every single one of these pillars, all compressed into six and a half hours of frantic activity.

Part III: Decoding the Dashboard – The Numbers Behind the Narrative

The financial metrics displayed in the screenshot are not just data points; they are the quantitative DNA of the day’s conflict. Each number tells a piece of the story.

The P/E Ratio (32.77): The Price of Prophecy

This is the most important number for understanding the day’s battle. The Price-to-Earnings ratio of 32.77 is exceptionally high for a company of Apple’s size and maturity. The broader S&P 500 index typically trades at a P/E of 18-25. Competitors like Google (Alphabet) often trade in the mid-20s. A P/E of nearly 33 signifies that investors are willing to pay a massive premium for Apple’s stock. They are not paying for what Apple earned last year; they are paying for what they believe Apple will earn two, three, or even five years from now.

This premium is almost entirely predicated on the Artificial Intelligence narrative. The market is betting that “Apple Intelligence” will not just be another feature but a transformational catalyst that re-accelerates growth across the entire ecosystem. The surge to $211.43 was the act of investors who believe this prophecy and are willing to pay any price to be a part of it. They see a future where the P/E of 33 looks cheap in retrospect.

The plunge from that high was driven by investors who see this P/E as a sign of dangerous euphoria. They look at the number and see not prophecy, but risk. They ask: What if the AI-driven supercycle doesn’t materialize? What if regulators hobble the Services growth engine? What if a global recession curbs consumer spending? From their perspective, a P/E of 33 offers no margin of safety. It prices in a perfect future in an imperfect world. The day’s entire $3 trading range was, in essence, a violent argument over whether a P/E of 33 is a visionary investment or a speculative bubble.

The Dividend Yield (0.50%) and Quarterly Dividend ($0.26): A Growth Stock’s Calling Card

A dividend yield of a mere 0.50% is minuscule. For income-seeking investors, it’s a non-starter. This is by design. Apple’s primary method of returning capital to shareholders is not through dividends, but through a colossal share buyback program. The company would rather use its mountain of cash to reinvest in R&D (like AI) and to reduce its share count (which mechanically increases earnings per share), than to pay a large dividend.

This low yield cements Apple’s identity as a growth stock. Investors buy Apple for capital appreciation, not for income. This has a profound effect on its trading dynamics. Unlike a high-dividend “value” stock, Apple doesn’t have a strong “floor” of income investors who will step in to buy on dips simply because the yield has become more attractive. Its floor is based on growth expectations. The day’s volatility is a classic feature of a growth stock: when optimism is high, it can soar, but when that optimism is questioned, it can fall just as quickly because there is no significant dividend yield to cushion the blow.

The 52-Week Range (High: $260.09, Low: $169.21): A Map of the Journey

The closing price of $210.01 sits squarely in the middle of this wide range. This context is crucial. Apple is not trading at its all-time high, where it would be most vulnerable to a sharp correction. Nor is it languishing near its lows, where it would be considered a beaten-down value play. It is in a state of consolidation.

The journey to the 52-week high of $260.09 was likely driven by the initial, unbridled hype surrounding the “Apple Intelligence” announcements. The subsequent pullback from that peak to the current level of $210 represents the market’s more sober second thoughts—digesting the details, weighing the risks, and questioning the timeline for AI’s impact. The day’s trading action is a microcosm of this larger journey: a brief, failed attempt to recapture the hype-driven highs, followed by a retreat back into this zone of contemplation and debate.

Part IV: The Ripple Effect – When Cupertino Sneezes, the World Catches a Cold

The battle for Apple’s stock price was not a contained event. Its shockwaves were felt across the financial landscape.

For the Apple Investor: A Test of Faith

The day presented two entirely different experiences. For the long-term, “buy-and-hold” investor, the day was fascinating but ultimately irrelevant noise. This investor’s thesis is built on a decade-long view of Apple’s innovation and ecosystem dominance. They see the intraday swings as the market’s manic-depressive nature on full display. A 0.029% change at the close changes nothing for them. They may have even used the dip to the $208 level as an opportunity to add a few more shares to their position.

For the short-term trader, the day was a heart-pounding roller coaster of opportunity and peril. A trader who correctly identified the bullish momentum at 10:30 AM and sold at the peak could have made a handsome profit. A trader who bought at the peak, caught in the FOMO, would have suffered a painful loss. For them, the day was a lesson in the importance of risk management and the dangers of chasing a parabolic move. The final, flat close was a frustrating end, offering no clear signal for the next day’s trade.

For the Technology Sector: The Gravitational Pull of the Leader

On a day like this, Apple’s volatility would have spread to the entire tech ecosystem.

-

Suppliers: Companies that provide components for the iPhone, like chipmaker TSMC and modem provider Qualcomm, would have seen their stocks rally and fall in sympathy with Apple. The bull case for an iPhone supercycle is a bull case for them; the bear case is a direct threat to their revenues.

-

Competitors: The price action also impacts competitors like Samsung and Google. A surging Apple stock puts pressure on them to deliver their own compelling AI narrative. A faltering Apple stock might be seen as an industry-wide problem (e.g., weakening consumer demand) or as an opportunity for them to gain ground.

-

The NASDAQ: As the largest component of the NASDAQ 100, Apple’s wild swings would have made the entire index volatile. The battle for Apple’s direction was, in many ways, the battle for the direction of the tech-heavy index itself.

Fictionalized Analyst Commentary: Three Voices, Three Verdicts

In the aftermath, Wall Street’s analysis would be sharp and divided, likely falling into three camps:

-

The AI Bull (e.g., an analyst from a growth-focused tech fund): “Today’s action vindicated our thesis. Despite macro noise and regulatory saber-rattling, the market showed a clear appetite to pay a premium for the generational opportunity presented by ‘Apple Intelligence.’ The surge to over $211 was the true signal; the subsequent pullback was mere profit-taking and noise. Any dip in Apple remains a strategic buying opportunity. Our $270 price target is intact. The stalemate at the close simply represents the consolidation needed before the next major leg up.”

-

The Valuation Bear (e.g., a strategist from a value-oriented firm): “Today was a stark warning sign. The market’s inability to hold the morning’s gains, even on the back of a bullish narrative, demonstrates how precarious this valuation is. A P/E of 33 is pricing in a flawless execution of an AI strategy that is still largely theoretical, while ignoring tangible threats like global regulation and a stretched consumer. The rejection at the highs suggests the ‘smart money’ is distributing shares to retail FOMO. We see significant downside risk to the $180 level if the AI hype cycle begins to fade.”

-

The Neutral Technical Analyst: “The chart tells a story of perfect equilibrium and intense conflict. The bulls control the territory above $210, and the bears control the territory below. Today’s high of $211.43 is now a critical short-term resistance level, while the low of $208.45 has established itself as key support. The stock is coiling in a tightening range. A decisive close above $211.50 would signal a bullish breakout, while a close below $208 would suggest the bears have won the battle, opening the door for a deeper correction. We are in a ‘wait and see’ mode until one of these levels breaks.”

The Quiet Close of a Raucous Day

The final print of $210.01, +0.029%, for Apple Inc. is one of the most misleading headlines in recent market history. It conceals a day of profound significance, a day where the fundamental arguments for and against the world’s most valuable company clashed in a spectacular and visible fashion. It was a referendum on the future, fought minute by minute, dollar by dollar.

The day’s narrative was a distillation of the central tension that defines Apple today: the boundless promise of Artificial Intelligence versus the hard realities of a premium valuation, fierce competition, and a global regulatory microscope. The surge to the highs was a vote for the promise. The plunge from those highs was a vote for the reality. The stalemate at the close was the market declaring that, for now, it cannot decide which force is stronger.

This single day, captured in a simple screenshot, is a masterclass in market dynamics. It reveals how narratives are built and broken, how valuation is debated, and how the psychology of millions of investors, amplified by trillions of dollars in capital, can create a maelstrom of activity that ultimately goes nowhere. But the equilibrium is temporary. The questions posed by the day’s trading remain unanswered. The forces that collided with such violence will surely clash again. The battle for $210 is over, but the war for Apple’s future has only just begun.