Meta Platforms (META) Navigates Volatile Session to Secure Gains, Eyes Further Upside

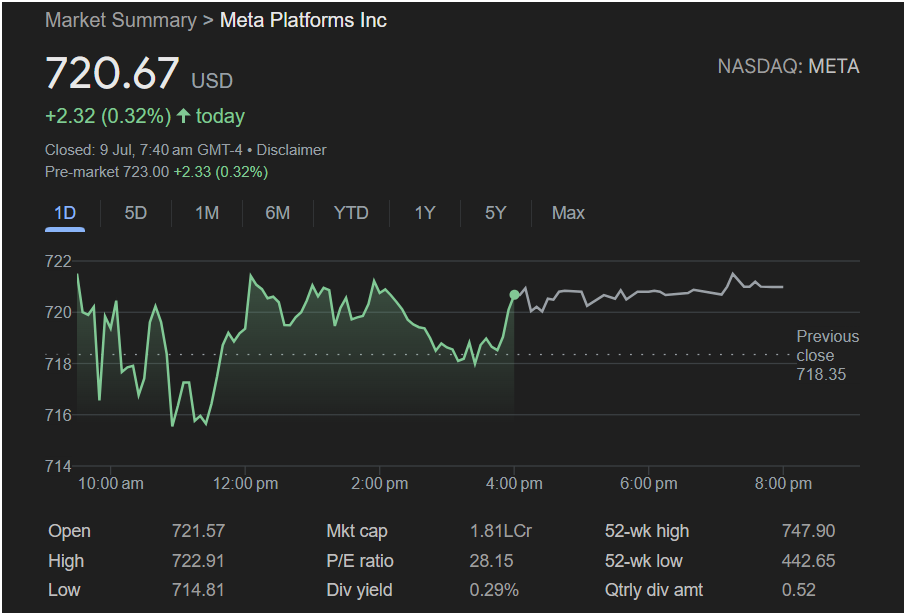

CUPERTINO, CA — Shares of social media and technology behemoth Meta Platforms Inc. (NASDAQ: META) concluded a turbulent trading day with a modest gain on Tuesday, July 9th. The stock demonstrated considerable resilience, overcoming an early session dip to close in positive territory, signaling persistent investor confidence in the tech giant. As the closing bell rang, META shares were priced at

2.32, or 0.32%.

The positive momentum appeared set to continue, with pre-market data for the following session showing the stock trading even higher at $723.00, suggesting an optimistic open for Wednesday’s market. This performance underscores the dynamic yet ultimately bullish sentiment surrounding one of the world’s most influential companies.

A Day of Push and Pull: Intraday Trading Unpacked

The one-day chart for Meta painted a vivid picture of a classic battle between buyers and sellers. The session opened at

721.57∗∗,slightlybelowtheday′seventualhighbutnotablyabovethepreviousday′scloseof∗∗721.57**, slightly below the day's eventual high but notably above the previous day's close of **

718.35. However, initial momentum was to the downside. In the first two hours of trading, sellers exerted pressure, pushing the stock down to its intraday low of $714.81.

This level, however, proved to be a critical support point. Around 11:30 AM, a wave of buying interest emerged, reversing the morning’s losses and initiating a strong rally that would define the middle of the trading day. The stock surged upwards, breaking back through the previous close line and climbing steadily. By early afternoon, it had peaked at its session high of $722.91.

The latter part of the day saw some profit-taking and consolidation, with the price fluctuating in a range between $718 and $722. In the final hour leading up to the 4:00 PM close, a final push by buyers ensured the stock settled firmly at $720.67, securing a win for the day. The journey from the low of $714.81 to the close represents an impressive intraday recovery of nearly $6 per share, highlighting the stock’s robust liquidity and the active participation of traders.

Fundamental Strength: A Look at the Numbers

Beyond the daily price action, the provided data offers a snapshot of Meta’s formidable financial stature and valuation.

-

Market Capitalization: The company’s market cap is listed as 1.81LCr, which, in the context of a US-listed stock, is understood to represent $1.81 Trillion. This valuation firmly places Meta in the exclusive club of “megacap” technology companies, alongside giants like Apple, Microsoft, and Nvidia. A market capitalization of this magnitude reflects not only the company’s vast current operations but also the market’s immense expectations for its future growth and profitability.

-

P/E Ratio: Meta’s Price-to-Earnings (P/E) ratio stands at 28.15. This key valuation metric, which compares the company’s stock price to its earnings per share, suggests that investors are willing to pay $28.15 for every dollar of Meta’s annual earnings. For a mature yet still-growing tech company, a P/E in this range is often considered reasonable. It indicates that the market anticipates solid future earnings growth, fueled by its core advertising business as well as its significant investments in artificial intelligence (AI) and the metaverse.

-

Returning Value to Shareholders: The Dividend

A significant piece of the puzzle is Meta’s dividend. The data shows a Dividend Yield of 0.29% and a Quarterly Dividend Amount of $0.52 per share. This translates to an annual dividend of $2.08 per share. The introduction of a dividend in early 2024 marked a pivotal moment in Meta’s corporate history, signaling a strategic evolution from a pure-growth stock reinvesting all its profits into a more mature company committed to returning capital directly to its shareholders. This move broadens its appeal to a new class of income-focused investors and reflects the confidence of management in the company’s long-term cash flow generation capabilities.

Broader Context and Outlook

The day’s closing price of $720.67 places the stock firmly in the upper echelon of its 52-week trading range. With a 52-week low of $442.65 and a 52-week high of $747.90, Meta’s stock has delivered spectacular returns for investors over the past year. The current price is approximately 63% above its 52-week low, though it still sits about 3.6% below its recent peak. This context suggests that while the long-term trend is strongly positive, the stock may be in a period of consolidation as it approaches its all-time highs.

The modest 0.32% gain on a volatile day could be interpreted in several ways. It might reflect a broader market that is treading water, with investors weighing macroeconomic factors like inflation and interest rate policy against corporate fundamentals. In such an environment, a positive close for a major index component like Meta can be seen as a sign of relative strength.

Looking ahead, investors will be closely monitoring several key catalysts. The upcoming quarterly earnings report will be paramount, providing a crucial update on revenue growth, user engagement across its family of apps (Facebook, Instagram, WhatsApp), and the financial progress of its Reality Labs division. Furthermore, any announcements regarding new AI product integrations or advancements in its metaverse strategy could serve as significant drivers for the stock price.

In conclusion, while the single-day gain was not dramatic, the story of the day for Meta Platforms was one of resilience and underlying strength. The ability to absorb early selling pressure and rally to a positive close, combined with strong pre-market indications and a solid fundamental backdrop, provides a constructive outlook for shareholders. The stock remains a core holding for many, representing a powerful blend of established market dominance and future-facing technological ambition.