Tesla’s Tumultuous Day: Stock Climbs 1.32% After a Rollercoaster Ride of Investor Sentiment

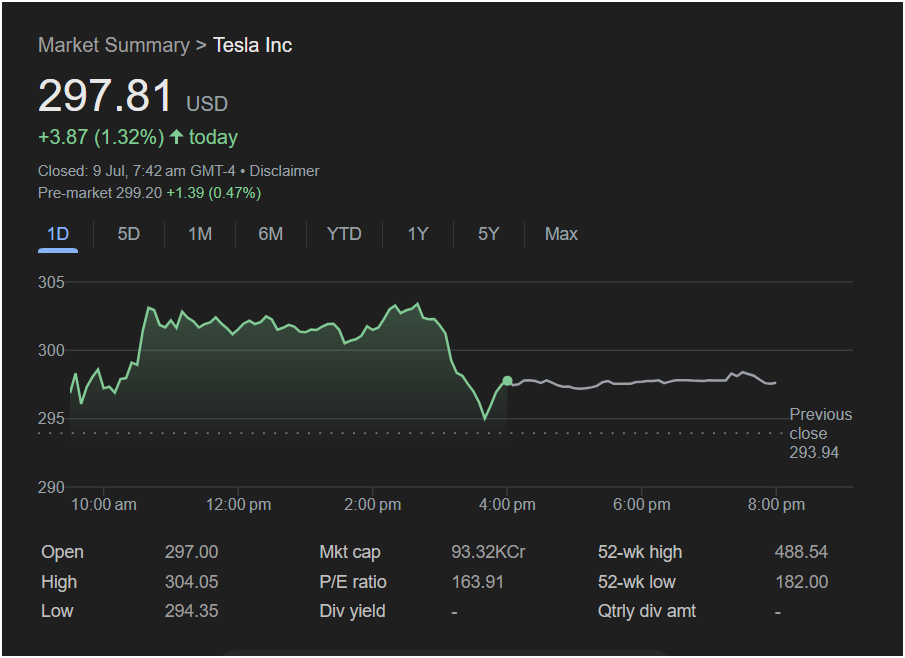

NEW YORK, July 9 – Shares of electric vehicle behemoth Tesla Inc. (NASDAQ: TSLA) concluded a volatile trading session on a positive note, rewarding investors who weathered a day marked by a powerful morning rally and a dramatic afternoon plunge. The stock closed at

3.87 or 1.32% for the day. However, the final closing price belies the intraday drama that saw the stock swing nearly ten dollars between its highest and lowest points, serving as a stark reminder of the high-stakes sentiment that perpetually surrounds the world’s most valuable automaker.

The day’s trading painted a picture of a classic battle between bullish conviction and bearish opportunism. Opening the session at $297.00, just shy of its eventual close, the stock initially dipped before finding its footing and embarking on a formidable ascent. This surge pushed Tesla’s shares through the psychologically significant

304.05**. Yet, the victory was short-lived. As the closing bell approached, a wave of selling pressure erased the bulk of the day’s gains, dragging the stock down to a low of $294.35 before a modest recovery into the close.

This turbulent performance, while ultimately ending in the green, highlights the complex array of factors influencing Tesla’s valuation. From macroeconomic whispers and competitive pressures to the ever-present influence of CEO Elon Musk, every trading day for Tesla is a microcosm of the broader debate over its future. Further fueling optimism for the next session, pre-market data indicated continued positive momentum, with the stock quoted at $299.20, up another 0.47%.

Section 1: An Autopsy of the Trading Day – A Tale of Two Halves

To truly understand the day’s outcome, one must dissect its two distinct phases: the bullish morning surge and the bearish afternoon reversal.

The Morning Surge (9:30 AM – 3:00 PM EST)

The trading day began with a sense of cautious optimism. After opening at $297.00, the stock saw a brief, customary dip as opening orders were filled, touching its low of $294.35 relatively early in the session. This dip proved to be a powerful buying opportunity. From approximately 10:00 AM EST, a steady and confident wave of buying volume entered the market.

The climb was methodical. The stock first reclaimed its opening price and then set its sights on the previous day’s close of $293.94, easily surpassing it and turning the day’s performance positive. The true test, however, lay at the $300 mark. In technical analysis, round numbers often act as psychological levels of resistance or support. For Tesla bulls, pushing the stock decisively above $300 was a key objective.

By late morning, around 11:00 AM, they had succeeded. The stock broke through $300 and continued its ascent to the day’s peak of $304.05. For nearly four hours, Tesla managed to defend this higher ground, trading consistently in the

303 range. This period of consolidation above a key psychological level suggested strong institutional support and a prevailing bullish sentiment. Potential catalysts for such a strong morning could include a positive analyst note, a broader market rally, or perhaps renewed optimism about Tesla’s upcoming production numbers or advancements in its Full Self-Driving (FSD) technology. Without a specific news event, the rally appeared to be driven by pure technical momentum and a risk-on appetite from investors.

The Afternoon Reversal (3:00 PM – 4:00 PM EST)

The market’s mood shifted dramatically in the final hour of trading. At approximately 3:00 PM EST, the floor gave way. A torrent of sell orders hit the market, initiating a rapid and steep decline. In a matter of minutes, the stock shed its gains, crashing through the $300 level it had fought so hard to conquer.

The sell-off was aggressive, pushing the stock price from over $302 down past $295 in a precipitous drop. This type of price action is often attributed to a combination of factors. Day traders and short-term investors who had ridden the morning wave likely began to take profits, fearing a reversal. This initial selling may have triggered stop-loss orders placed by other investors, creating a cascading effect. Furthermore, institutional algorithmic trading programs, designed to react to shifts in momentum, would have likely amplified the selling pressure.

The stock ultimately found a floor at $294.35, its intraday low, before staging a minor bounce. It spent the final minutes of the session consolidating around the $298 level, closing slightly below it. This late-day capitulation served as a powerful reminder of the inherent volatility in a high-growth, high-expectation stock like Tesla. While the bulls won the day on paper, the bears delivered a significant final-hour blow, setting a more cautious tone for the after-hours session.

Section 2: Decoding the Data – A Fundamental Snapshot

Beyond the intraday chart, the provided market summary offers a wealth of data that puts the single day’s performance into a broader, more meaningful context.

Market Capitalization (Mkt cap): 93.32KCr

The market capitalization figure, listed as “93.32KCr,” points to a platform likely geared toward an Indian audience, where “Cr” stands for Crore (10 million) and “K” for a thousand. This notation represents an immense valuation, translating to approximately **

297.81) by the total number of outstanding shares.

A market cap approaching one trillion dollars places Tesla in an elite class of global companies, alongside tech giants like Apple, Microsoft, and Amazon. It dwarfs the valuation of legacy automakers like Toyota, Volkswagen, and General Motors combined, underscoring the market’s belief that Tesla is not merely a car company, but a technology, AI, and energy powerhouse poised for disruptive future growth.

P/E Ratio: 163.91

The Price-to-Earnings (P/E) ratio of 163.91 is perhaps one of the most debated figures associated with Tesla. This ratio measures the company’s current share price relative to its per-share earnings. For context, the average P/E ratio for the S&P 500 index typically hovers between 15 and 25. Traditional automakers often have P/E ratios in the single digits.

A P/E of over 160 is exceptionally high and signifies that investors are willing to pay a significant premium for Tesla’s stock based on massive expectations of future earnings growth. This valuation is not based on Tesla’s current profitability alone; it is a forward-looking bet on the company’s ability to dominate the electric vehicle market, solve autonomous driving, revolutionize energy storage, and successfully launch new ventures like the Optimus robot. Critics point to this high P/E as evidence of a speculative bubble, while proponents argue it is justified by the company’s unprecedented innovation and expansion potential.

Dividend Yield: –

The dash next to “Div yield” and “Qtrly div amt” confirms that Tesla does not pay a dividend. This is typical for a high-growth company. Instead of returning profits to shareholders in the form of cash payments, Tesla reinvests 100% of its earnings back into the business. This capital is used to fund research and development (R&D) for new models like the Cybertruck and a future affordable EV, to build new Gigafactories across the globe, and to scale up its AI and battery production capabilities. For Tesla investors, the return is expected to come from capital appreciation (a rising stock price) rather than income.

52-Week Range: $182.00 – $488.54

This range provides crucial context for the day’s closing price of $297.81. It reveals that while the stock has significantly recovered from its 52-week low of $182.00, it remains substantially below its 52-week high of $488.54. The current price sits almost exactly in the middle of this vast range.

This positioning suggests the stock is at a critical juncture. It has demonstrated resilience and has rewarded investors who bought near the lows. However, it still faces a long and arduous climb to reclaim its former peaks. This journey will likely depend on the company’s ability to execute flawlessly on its ambitious roadmap while navigating a landscape of rising interest rates, inflationary pressures, and intensifying competition in the EV space.

Section 3: The Broader Narrative – Forces at Play

A single stock chart never tells the whole story. Tesla’s daily performance is inextricably linked to a larger, ongoing narrative shaped by technology, competition, and economic conditions.

The Competitive Landscape: While Tesla remains the leader in the EV space, it is no longer the only player. Legacy automakers like Ford (with its Mustang Mach-E and F-150 Lightning) and GM (with its Ultium platform), as well as pure-play EV rivals like Rivian, Lucid, and Chinese giant BYD, are ramping up production and introducing compelling new models. Every new vehicle launch and every sales report from a competitor is scrutinized by investors and can directly impact Tesla’s stock.

The Cult of Personality and Vision: It is impossible to separate Tesla the company from Elon Musk the man. His pronouncements on X (formerly Twitter), his ambitious vision for the future, and his leadership at other ventures like SpaceX and xAI all have a profound, and often immediate, effect on Tesla’s stock price. The market hangs on his every word regarding FSD progress, new product timelines, and artificial intelligence, making him a unique and powerful variable in the company’s valuation.

Macroeconomic Headwinds: Like all companies, Tesla is subject to the whims of the global economy. Rising interest rates make it more expensive for consumers to finance new vehicles, potentially dampening demand. Supply chain disruptions, as seen during the pandemic, can hamper production. Geopolitical tensions and shifting trade policies can impact the cost of raw materials and access to key markets like China and Europe. The day’s late sell-off could easily have been triggered by a broader market downturn in response to unfavorable economic data.

The AI and Technology Bet: More than ever, Tesla’s valuation is tied to its ambitions beyond cars. The progress of its Dojo supercomputer, the real-world data collected by its fleet for training FSD, and the development of the Optimus humanoid robot are central to the bull case. Investors who buy the stock at a P/E of 163 are not just buying a car company; they are buying a stake in what they believe will be a leading robotics and artificial intelligence firm.

A Bullish Day with a Cautious Asterisk

The trading session of July 9th was, in essence, Tesla in a nutshell: ambitious, volatile, and ultimately forward-looking. The 1.32% gain represents a victory for the bulls, who successfully defended the stock against a sharp afternoon sell-off and demonstrated underlying strength. The ability to push past $300, even temporarily, signals a potent buying interest.

However, the severe reversal in the final hour serves as a critical warning. It indicates that significant profit-taking pressure exists at higher valuations and that the stock’s path upward will be anything but linear. Investors were given a clear view of both the powerful upside momentum and the swift, unforgiving downside risk that define this stock.

As indicated by the positive pre-market activity, sentiment appears to be leaning bullish heading into the next day. But as this session proved, in the world of Tesla, the tide can turn in an instant. Investors will be keenly watching to see if the stock can once again challenge the $300 level and, more importantly, if it can hold it, transforming what is currently a psychological resistance into a new floor of support for its next leg up.