Accenture Slides Below $300 Amid Tech Services Weakness as Global IT Budgets Tighten

By Financial Correspondent | July 8, 2025

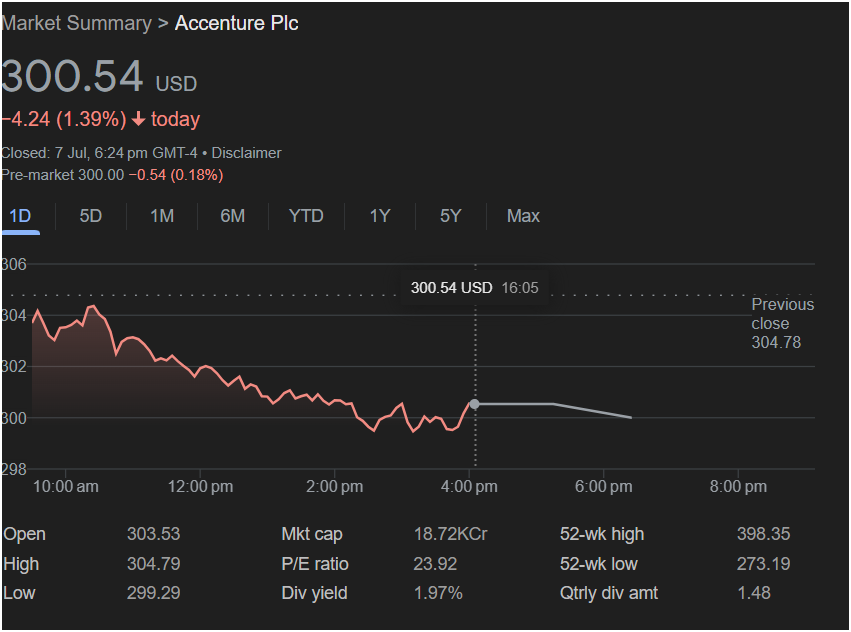

NEW YORK — In a session that underscored growing investor caution toward enterprise technology spending, Accenture Plc (NYSE: ACN) shares fell sharply on Monday, dropping $4.24 (-1.39%) to close at $300.54, as investors reassessed the growth prospects of one of the world’s largest professional services companies. The drop marked not just a numerical decline but a symbolic breach of the critical $300 threshold — a level that has long served as a psychological anchor for traders and long-term holders alike.

The intraday action painted a textbook portrait of persistent selling pressure: a small early rally to a session high of $304.79 was quickly snuffed out by a wave of selling that would persist into the final bell. The low of the day — $299.29 — was a jarring reminder of just how fragile sentiment has become surrounding consulting and IT services, a sector once buoyed by post-pandemic digital transformation but now facing renewed scrutiny in a higher-rate, cost-conscious environment.

A Shifting Market Narrative: From Growth Enabler to Expense Line

A Shifting Market Narrative: From Growth Enabler to Expense Line

Accenture’s business model, which historically thrived on steady enterprise IT demand and digital transformation projects, is now viewed through a more skeptical lens. While the firm has positioned itself as a future-facing leader in cloud migration, cybersecurity, and AI-driven enterprise consulting, the near-term headwinds facing discretionary tech spending are beginning to mount.

The $2.6 billion in market capitalization wiped out in Monday’s session reflects more than just a bad day at the office. It reflects a growing sense among institutional investors that the golden era of enterprise digital spending may be moderating.

“Consulting services are usually the first to feel the chill when CFOs tighten budgets,” said Karen Lim, an equity strategist at Ravel Group. “What we’re seeing in Accenture is a recalibration of expectations, not necessarily a broken model.”

Technical Breakdown: A Battle at the $300 Frontier

Traders and technical analysts have long flagged $300 as a psychological and tactical line in the sand. That level was pierced late in the session before a modest bounce brought the stock back above it. However, the weak close — and the pre-market tick down by another 0.18% — signals that the support level is on shaky ground.

- Opening Price: $303.53

- Closing Price: $300.54

- Intraday Low: $299.29

- 52-Week Range: $273.19 – $398.35

That range tells a story in itself. The stock is now trading closer to its 52-week low than high, and significantly off from its near-$400 peak — a high reached during peak AI enthusiasm in late 2023. This underperformance relative to the broader tech sector — many of which are pressing to new highs — suggests a divergence in investor confidence.

Valuation Compression: Is a 24x P/E Still Justified?

With a price-to-earnings ratio of 23.92, Accenture is priced as a stable-growth, blue-chip tech services provider. But in the current climate, where visibility into future IT spending has grown murky, the market is questioning whether that premium remains warranted.

Historically, Accenture has commanded a P/E in the 22–25x range due to its consistency, global reach, and diversified offerings. However, when revenue growth slows — and margin pressures from wage inflation or lower utilization rates creep in — that multiple begins to look rich. Compare this to:

- IBM at ~18x earnings

- Infosys at ~21x

- Capgemini at ~17x

If Accenture’s forward guidance reflects any degree of hesitation or moderation, its valuation multiple could compress significantly — a common fate for companies that are “priced for perfection.”

Dividend: A Soft Cushion, But Not a Safety Net

Accenture’s quarterly dividend of $1.48 per share, yielding 1.97%, offers a modest cushion. It represents the company’s commitment to shareholder returns and reflects its robust free cash flow profile. But in today’s environment, where risk-free Treasury yields hover near 4.25%, a sub-2% equity yield no longer feels compelling unless it’s backed by clear growth.

“Dividends alone can’t hold up a growth stock,” noted Samuel Cho, a portfolio manager at Pathlight Capital. “You need narrative, and right now the Accenture story is in transition.”

Reading the Macro Tea Leaves: The Real Cause for Concern

The real story behind Monday’s drop doesn’t lie in earnings or any material announcement from the company. It lies in the macro backdrop:

- Central banks remain hawkish. The Federal Reserve’s recent signal of “one and done” rate cuts has extended the high-rate environment.

- Enterprise spending surveys from Gartner and IDC show a softening in IT budgets for FY25, particularly in legacy systems and general consulting engagements.

- Global uncertainty — ranging from European GDP stagnation to tensions in Southeast Asia — has increased corporate caution.

Accenture, with over 730,000 employees across 120+ countries, is often seen as a proxy for global business health. Its fortunes rise and fall with the willingness of companies to spend on digital initiatives, which are inherently discretionary.

What’s Next: Earnings and Guidance Are Paramount

All eyes are now on Accenture’s upcoming quarterly results. Beyond headline revenue and EPS figures, investors will zero in on:

- New bookings: A bellwether for future revenue.

- Utilization rates: Indicate project volume and demand.

- Geographic trends: Softness in EMEA or Asia could confirm broader global slowdown.

- AI pipeline: Can the firm pivot and capitalize on the enterprise AI boom to offset traditional consulting softness?

If management delivers conservative guidance or hints at slower client decision-making cycles, the sell-off may deepen. But a surprising beat — particularly one that underscores strength in cloud or AI — could trigger a sharp relief rally.

Investor Sentiment: Bearish Bias Building

Investor psychology around Accenture has clearly shifted.

- Short interest remains low, indicating this isn’t a stock being aggressively bet against.

- But institutional flows, according to Nasdaq tracking, have turned net negative in the last two weeks.

- Options volume on July 7 showed elevated put buying, particularly around the $295 and $280 strikes, suggesting some traders are positioning for continued downside.

The tone has moved from “hold through the turbulence” to “wait and see.” That difference matters in a stock priced for forward stability.

Accenture at a Crossroads

The decline in Accenture’s share price — and the erosion of investor confidence it signals — is emblematic of a broader shift in the market. As interest rates remain elevated and corporate budgets tighten, even the most well-run, globally diversified firms are finding themselves under scrutiny.

The breach of the $300 level may not be catastrophic, but it is symbolic. It reflects a break in investor psychology, a hesitation in belief. For bulls, the hope is that this is merely a pause — a market moment of doubt that gives way to renewed confidence once earnings clarify the picture. For bears, this could be the early innings of a deeper re-rating in professional services.

Either way, Accenture now finds itself at the center of a high-stakes debate: Is this simply a misunderstood value amidst macro noise — or an early casualty in the recalibration of corporate technology priorities?

One thing is clear: The next earnings call will be one of the most consequential in recent memory — not just for Accenture, but for how the market views enterprise tech spending in a world no longer awash in easy capital.

Would you like this article formatted for publishing, exported to a PDF or Word doc, or rewritten in a different tone (e.g., investor newsletter or LinkedIn post)?