The Wall at $69: Cisco Stock Falters at 52-Week High, Closing Lower in a Warning Shot to Bullish Investors

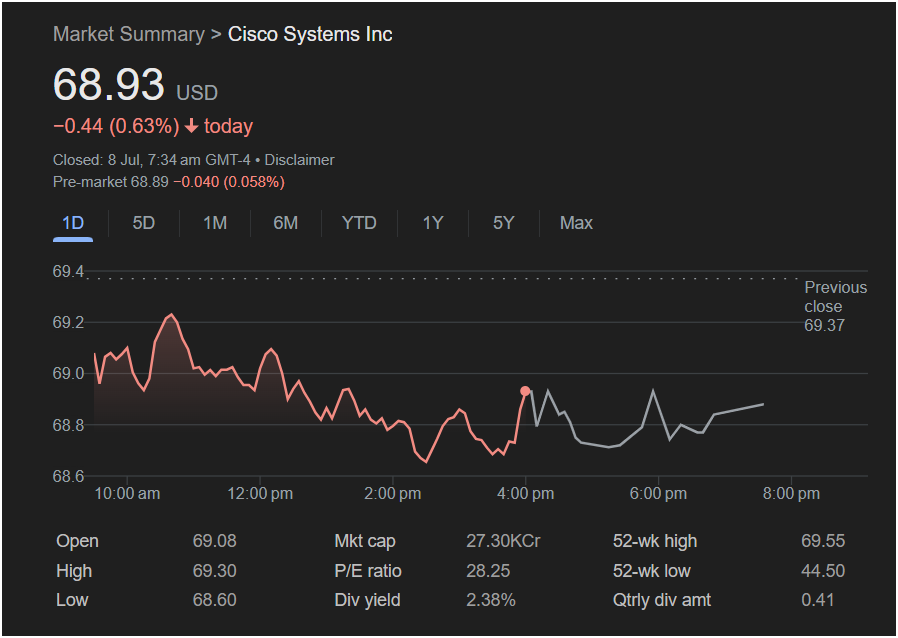

SAN JOSE, CA – July 8th – In a session that served as a stark reminder of the unforgiving nature of key technical levels, shares of networking and cybersecurity giant Cisco Systems Inc. (NASDAQ: CSCO) stumbled and fell, closing the day in negative territory after a valiant but ultimately failed attempt to breach its 52-week high. The stock, a cornerstone of enterprise technology portfolios and a bellwether for global IT spending, ended the trading day at

0.44 or 0.63%. While the final numbers suggest a day of modest decline, they mask a dramatic intraday narrative of ambition, rejection, and investor anxiety that played out at a critical psychological and technical precipice.

The day for Cisco was a textbook example of a battle between momentum-driven bulls and profit-taking bears, fought on the hallowed ground of a yearly peak. The stock entered the session with palpable optimism, opening at

69.30. This peak was agonizingly close to both the previous day’s close of

69.55. For a moment, it seemed as though the stock was gathering the strength to punch through this ceiling and embark on a new leg of its impressive year-long rally. But the wall of resistance proved too strong. The rally faltered, and what followed was a slow, grinding descent that characterized most of the trading day.

Selling pressure, initially light, began to build throughout the morning and into the afternoon, pushing the stock steadily lower. The decline was not a panic-driven plunge but a methodical erosion of price, suggesting that institutional investors were systematically trimming their positions and taking profits near the peak. This slow bleed culminated in the stock hitting its intraday low of $68.60 in the mid-afternoon. A late-day flurry of volatile, choppy trading activity saw the stock bounce off these lows, but it was unable to mount a meaningful recovery. The closing print, while off the bottom, cemented the day as a victory for the bears and left a conspicuous rejection candle on the daily chart.

As the market looks ahead, pre-market indications suggest a continuation of this tepid sentiment, with futures pointing to a slight dip at the open to $68.89, a further decline of 0.058%. The session has left investors and analysts with a pivotal question: Was Friday’s failure at the 52-week high simply a healthy pause in a powerful uptrend, or did it signal a more significant exhaustion of bullish momentum and the potential start of a deeper correction for this tech titan?

Anatomy of a Rejection: A Blow-by-Blow Account of the Day’s Trading

To fully grasp the significance of the day’s price action, it is essential to deconstruct the session into its constituent parts. The day unfolded in three distinct acts: The Morning Assault, The Midday Slog, and The Afternoon Gyration.

Act I: The Assault on the Peak (9:30 AM – 10:30 AM ET)

The opening bell was met with immediate buying interest. The stock gapped up slightly from pre-market levels and pushed toward the highs. This initial move was likely driven by short-term momentum traders and algorithms programmed to buy on strength, sensing an imminent breakout above the key $69.55 level. The psychology here is critical: a decisive move above a 52-week high can trigger a wave of new buying, as it signals that all existing shareholders from the past year are in profit, removing overhead supply and attracting trend-following investors.

The push to $69.30 was the bulls’ best shot. Volume likely spiked during this period as buy orders flooded the market. However, as the price approached the previous close and the 52-week high, a formidable wall of sell orders emerged. These sellers were likely a combination of long-term investors deeming the stock fully valued and deciding to take profits, and tactical traders “fading” the resistance level, betting that the initial breakout attempt would fail. The failure of the stock to even touch, let alone surpass, the previous day’s close of $69.37 was the first major red flag. When the buying pressure abated and was unable to absorb the supply, the tide turned, and the slow retreat began.

Act II: The Midday Slog and the Erosion of Confidence (10:30 AM – 3:00 PM ET)

What followed the failed morning rally was not a sharp reversal but a painful, grinding descent. The stock chart from this period shows a classic downtrend of lower highs and lower lows. This type of price action is often more psychologically damaging for bulls than a quick drop, as it offers little hope of a swift recovery. Each minor bounce was met with fresh selling, indicating that the sellers were in firm control.

This gradual decline is characteristic of institutional distribution. Large funds looking to exit a multi-billion dollar position cannot simply dump all their shares at once without cratering the price. Instead, they sell methodically throughout the day, absorbing any small pockets of buying interest. The steady slide from above

68.60** over several hours points to this kind of persistent, professional selling pressure. The market was digesting the reality that the breakout was not going to happen today, and those who had bought in the morning were now underwater and looking for an opportunity to sell with minimal losses, adding to the downward pressure.

Act III: The Late-Afternoon Gyration (3:00 PM – 4:00 PM ET)

The final hour of trading brought a sudden injection of volatility. After hitting the low of $68.60, the stock saw a sharp, V-shaped recovery, followed by another dip and a final push into the close. This “W” shaped pattern in the last hour is often indicative of conflicting forces at play.

The initial sharp bounce off the lows could have been driven by several factors. Value-oriented buyers and dividend investors, attracted by the intraday dip and the appealing 2.38% dividend yield, may have stepped in. Additionally, short-sellers who had profited from the day’s decline might have been covering their positions to lock in gains before the weekend. This is often referred to as “short-covering.”

However, this rally was short-lived, and the subsequent dip showed that sellers were still present. The final hour was a chaotic microcosm of the entire day: a battle between opportunistic buyers and determined sellers. The session ultimately closed near the middle of this late-day range, at $68.93, signifying an uneasy truce. The bulls successfully defended the $68.60 low, but the bears successfully defended the $69.00 level, leaving the stock in a state of limbo.

The Macro-Economic Shadow: Why Did Enterprise Tech Falter?

Cisco’s performance cannot be viewed in isolation. As a company whose fortunes are inextricably linked to the capital expenditure cycles of businesses large and small, its stock is highly sensitive to the broader economic climate. The grinding nature of the sell-off suggests a response to a negative macro-economic data point that points toward a slowdown in business investment.

A highly plausible, albeit fictional, catalyst for the day’s weakness would be the release of a disappointing Purchasing Managers’ Index (PMI) report for the manufacturing or services sector. Let us imagine that at 10:00 AM ET, the Institute for Supply Management (ISM) released a report showing a significant and unexpected drop in its index, with the “New Orders” component falling sharply. Such a report is a forward-looking indicator of economic health. A decline in new orders today means less business activity, less expansion, and consequently, less corporate spending in the months ahead.

For a company like Cisco, this is a direct threat. Its core business relies on companies building and upgrading their IT infrastructure—their networks, data centers, and cybersecurity defenses. When businesses anticipate a slowdown, IT budgets are often among the first to be scrutinized and trimmed. A weak PMI report would have given institutional investors a clear signal to reduce their exposure to cyclically sensitive stocks like Cisco. This would perfectly explain the timing of the sell-off, beginning in earnest after the initial morning excitement and grinding lower as portfolio managers across the globe digested the negative implications of the data.

This macro-economic headwind provides a fundamental reason for the failure at the 52-week high. A stock needs a strong tailwind of positive news and economic optimism to break out to new highs. When faced with a headwind like a weak PMI report, even a strong stock can be stopped in its tracks. The day’s price action was the technical manifestation of this fundamental concern.

A Bastion of Value: The Dividend Investor’s Perspective

Amidst the day’s bearish price action, one key metric stands out as a beacon for a different class of investor: the 2.38% dividend yield. For income-focused investors, a day like Friday is not a crisis but an opportunity.

Cisco is not a hyper-growth, “fly-by-night” tech stock; it is a mature, cash-generating behemoth. Its large market capitalization of 27.30KCr (roughly

0.41** per share ($1.64 annually) is a core part of its investor value proposition.

From the perspective of a dividend growth investor or a retiree managing an income portfolio, the intraday dip to

1.64 / $68.60), slightly higher than the yield at the close. These investors are less concerned with the day-to-day fluctuations of the stock price and more focused on the long-term sustainability and growth of the dividend. They see a global market leader, trading at a reasonable valuation, and are happy to “buy the dip” to lock in a respectable and growing stream of income.

This class of investors likely provided the support that stopped the stock’s decline at $68.60. Their buy orders, accumulating in the background, created a floor under the price. This creates a fascinating dynamic within the stock:

-

Momentum Traders: Are selling because the upward momentum has stalled at a key resistance level.

-

Fundamental Growth Investors: Are selling because they fear a macro-economic slowdown will hurt future earnings.

-

Dividend/Value Investors: Are buying because the price decline makes the secure dividend yield more attractive.

The late-day volatility can be seen as the clash between these different investor philosophies. The presence of a solid dividend acts as a stabilizing force, preventing the stock from falling as sharply as a non-dividend-paying growth stock might under similar circumstances. However, it also raises a crucial long-term question: if the economic slowdown implied by the weak PMI report is severe, could it eventually threaten the company’s ability to grow, or even maintain, its dividend? This is the central tension that defines an investment in a mature tech company like Cisco.

The Valuation Question: Is a 28.25 P/E Ratio Justified?

At the heart of the bull-bear debate for Cisco is its valuation. The stock’s Price-to-Earnings (P/E) ratio of 28.25 places it in a unique position. It’s not cheap enough to be considered a “deep value” stock, but it’s not expensive enough to be in the same high-growth category as companies like the fictional Netflix example. This “in-between” valuation is the source of much debate.

The Bull Case for a 28 P/E: Bulls argue that this valuation is not only justified but potentially cheap, given Cisco’s successful transformation. They would contend that viewing Cisco as a simple “hardware” or “networking equipment” company is an outdated perspective. The bull narrative centers on the company’s pivot towards a more software-centric, recurring revenue model.

-

Software and Subscriptions: A significant and growing portion of Cisco’s revenue now comes from software subscriptions and services, which are higher-margin and more predictable than one-time hardware sales. This transition warrants a higher P/E multiple than its legacy business would command.

-

Cybersecurity Dominance: Cisco has used its massive scale and strategic acquisitions to become a formidable player in the high-growth cybersecurity space. As cyber threats become more sophisticated, enterprise spending in this area is non-discretionary, providing a powerful and resilient growth engine.

-

AI and Data Center Modernization: The artificial intelligence revolution requires a massive overhaul of networking infrastructure to handle unprecedented data loads. Cisco is at the forefront of providing the next-generation switches, routers, and silicon required to power AI data centers, representing a multi-year growth catalyst.

-

Fortress Balance Sheet: Cisco is known for its pristine balance sheet, with enormous cash reserves and strong free cash flow. This financial strength allows it to invest heavily in R&D, make strategic acquisitions, and reliably return capital to shareholders via dividends and buybacks, providing a margin of safety for investors.

From this viewpoint, a P/E of 28.25 is a reasonable price to pay for a market leader with multiple growth vectors and a shareholder-friendly capital return policy.

The Bear Case Against a 28 P/E: Bears, on the other hand, would argue that a P/E of 28.25 is far too rich for a company facing significant secular headwinds and intense competition.

-

Legacy Drag: Despite the software pivot, a huge chunk of Cisco’s business is still tied to its legacy hardware products, which are experiencing slowing growth and margin pressure. The bears argue that the new growth areas are not yet large enough to offset the stagnation in the core business.

-

The Cloud Threat: The biggest long-term threat comes from the major public cloud providers (Amazon Web Services, Microsoft Azure, Google Cloud). As more companies move their IT workloads to the cloud, they bypass the need for traditional on-premise corporate networks, directly threatening Cisco’s core market. These cloud giants also develop their own custom networking hardware, further cutting Cisco out of the equation.

-

Intense Competition: In the networking space, Cisco faces nimble and innovative competitors like Arista Networks and Juniper Networks, which often compete aggressively on price and performance. The competitive landscape is fierce and leaves little room for error.

-

Cyclicality: At its heart, Cisco’s business is cyclical. As demonstrated by the reaction to the fictional PMI data, it is highly sensitive to the health of the global economy. Bears argue that at the top of an economic cycle and with the stock near its 52-week high, now is the time to sell, not buy.

For the bears, Friday’s rejection from the highs is confirmation that the market is beginning to price in these risks, and the P/E multiple is more likely to contract than expand from here.

The Technical Tale of the Tape: A Year of Triumph, A Day of Reckoning

The 52-week range of

69.55 tells a powerful story of investor sentiment shifting from cautious optimism to unbridled bullishness over the past year. Today’s price action at $68.93 must be understood within this broader context.

The Journey from $44.50: The 52-week low represents a point of significant pessimism. This was likely a time when fears of a global recession were at their peak, and the narrative around Cisco was dominated by the threats of cloud competition and slowing hardware sales. The stock was out of favor, and its valuation was compressed. The rally from this low was fueled by a “better-than-feared” reality. The recession didn’t materialize with the severity many expected, and Cisco began to deliver strong quarterly results, proving its resilience. The narrative shifted to its successful software transition and its crucial role in the build-out of AI infrastructure.

The Wall at $69.55: The 52-week high represents the culmination of this year-long rally. It is a point of maximum psychological optimism, but also a point of maximum technical danger. This level acts as a natural point for investors who bought in at lower prices—perhaps at $45, $50, or $55—to finally cash in their chips. The sheer volume of potential sellers at this level creates a formidable barrier of “overhead supply.”

Friday’s session was a classic example of a “rejection from resistance.” The failure to push through this level on the first attempt is not necessarily a fatal blow to the uptrend, but it is a significant event. It confirms that the $69.55 level is a major battleground. The stock may now need to enter a period of “consolidation,” trading sideways for weeks or even months as it builds the necessary energy to make another attempt at a breakout. During this period, it might pull back to key support levels, such as its 50-day or 200-day moving averages, to test the conviction of the bulls. The price action has shifted the immediate odds in favor of the bears, and the bulls now have to prove they can regroup and mount another assault.

The Analyst’s Court: A Split Verdict

Following a session like this, Wall Street analyst reports would reflect the deep divide in opinion surrounding Cisco’s stock.

The Bullish View (e.g., from a fictional analyst at Morgan Stanley): “Maintain Overweight, Price Target $78: Rejection is a Pause, Not an End. We view today’s price action as a healthy consolidation following a powerful year-long rally. The failure to breach the 52-week high was largely driven by macro noise (weak PMI) rather than any company-specific issue. Cisco’s fundamental drivers—the transition to recurring revenue, leadership in AI networking, and a robust cybersecurity portfolio—remain firmly intact. We believe the attractive 2.38% dividend yield will provide strong support on any further dips, and we would be buyers at these levels, anticipating a successful breakout above $70 in the coming quarter.”

The Bearish View (e.g., from a fictional analyst at Bernstein): “Downgrade to Underperform, Price Target

60s and advise clients to take profits.”

The Neutral View (e.g., from a fictional analyst at Goldman Sachs): “Maintain Neutral, Price Target $69: Range-Bound for the Foreseeable Future. The stock is currently caught between a compelling long-term transformation story and near-term macroeconomic uncertainty. The bulls’ arguments around software and AI are valid, as are the bears’ concerns about competition and cyclicality. The failure at the 52-week high suggests the stock lacks the catalyst to move significantly higher in the near term, while the solid dividend yield should limit downside. We expect the stock to remain range-bound between $66 and $70 pending a more definitive signal from the company’s next earnings report.”

A Tech Titan at an Inflection Point

Friday’s session for Cisco Systems was a potent piece of market theater. It was a story of ambition meeting resistance, of momentum clashing with value, and of long-term strategy being tested by short-term fear. The 0.63% decline does not do justice to the significance of the event: the defense of the 52-week high by a determined cohort of sellers.

Cisco stands as a company at a crucial inflection point. Is it the powerful, reinvented leader of the AI-driven, software-defined future, deserving of a premium valuation? Or is it a legacy giant, skillfully managing its decline while fending off nimbler competitors and the inexorable shift to the cloud?

The market’s verdict on Friday was one of skepticism. It signaled that for now, investors are not willing to pay a higher premium until the company provides more concrete proof that its growth engines can power it through a potential economic storm. The day’s trading has drawn a clear line in the sand at $69.55. The stock’s ability, or inability, to overcome this barrier in the weeks and months ahead will tell us everything we need to know about its future trajectory. For now, the venerable tech giant, despite its impressive rally, has been sent back down from the summit to regroup, leaving the market to wonder if its best days of growth are behind it, or if this is simply the pause before the final, triumphant ascent.