Costco Stock Defies Gravity in Major Reversal, Eyes Push Towards $1,000 Mark Amid Bullish Sentiment

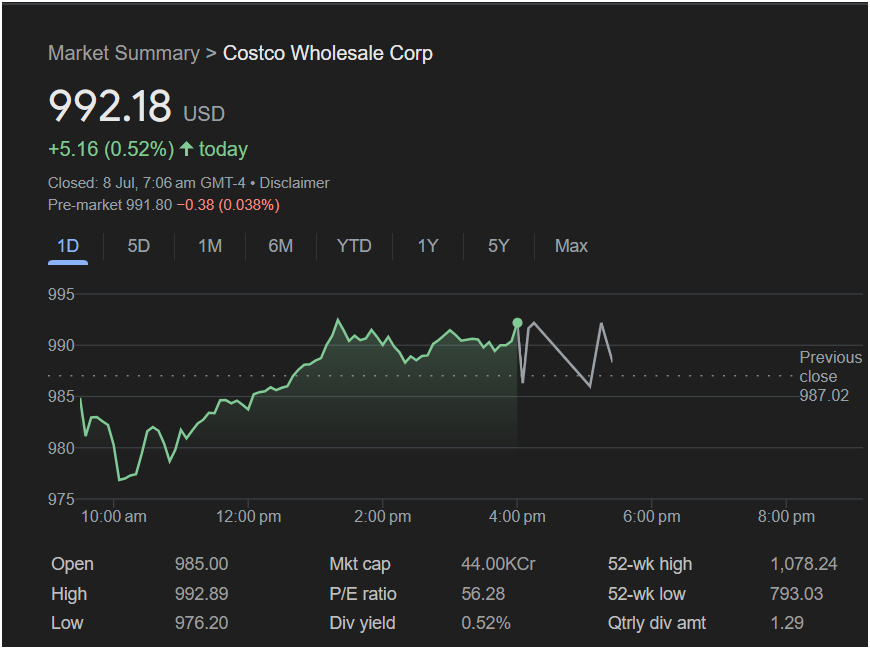

NEW YORK – July 8 – In a powerful display of investor conviction, shares of Costco Wholesale Corp (NASDAQ: COST) staged a dramatic intraday comeback on Monday, erasing early losses to close with significant gains. The retail behemoth ended the session at

5.16 (+0.52%), signaling that dip-buyers remain a formidable force and that the appetite for high-quality consumer staples stocks is far from satiated.

The trading day unfolded as a textbook narrative of resilience. After closing the previous session at $987.02, Costco shares opened lower at

976.20**, a point that would prove to be a critical inflection point. It was here that the market’s tide turned, as a wave of buying interest entered the market, absorbing the selling pressure and establishing a firm floor for the day.

From that mid-morning low, the stock embarked on a steady and methodical ascent that characterized the remainder of the trading day. Rather than a frantic, volatile spike, the upward trajectory was measured, suggesting a broad base of institutional and retail support. The stock methodically reclaimed the previous day’s closing price and continued its climb, ultimately peaking at an intraday high of $992.89 just moments before the closing bell. This strong finish, near the pinnacle of its daily range, is a classic bullish indicator, suggesting that momentum is firmly on the side of the buyers heading into the next trading session.

A Deeper Look at the Technical Landscape

Monday’s price action provides a rich canvas for technical analysts, offering several key insights into the stock’s current health and potential future direction.

The successful defense of the $976 level is paramount. This price point now stands as a crucial near-term support level. The V-shaped recovery from this low demonstrates that investors are actively watching for entry points and perceive pullbacks as buying opportunities, a hallmark of a strong uptrend.

By closing above the previous day’s finish of $987.02, the stock nullified any immediate bearish sentiment that may have been brewing from the weak open. This level will now likely act as a secondary support zone. Looking ahead, the immediate hurdle for Costco is to decisively break through the day’s high of

1,000 milestone**. Crossing this threshold could trigger further buying, including from momentum-based algorithms and investors who see the four-digit price as a new era for the company.

The broader context remains overwhelmingly positive. Monday’s close brings the stock another step closer to its 52-week high of $1,078.24. While still some distance away, the current trajectory suggests a challenge to this peak is well within the realm of possibility in the medium term. The stock remains comfortably above its 52-week low of $793.03, highlighting the powerful rally it has experienced over the past year.

Pre-market data for the upcoming session showed the stock ticking down slightly to $991.80, a marginal decline of 0.038%. This minor dip is typical of post-close consolidation and does not, in itself, detract from the powerful bullish statement made during Monday’s regular trading hours.

Valuation and Fundamentals: The Bedrock of Belief

While the daily chart tells a story of momentum, Costco’s underlying fundamentals provide the long-term narrative that keeps investors committed. The stock currently trades at a Price-to-Earnings (P/E) ratio of 56.28. This is a premium valuation by any standard, especially for a retail company, and significantly higher than the S&P 500 average. Such a high P/E ratio indicates that the market has baked in substantial expectations for future growth, confident in Costco’s ability to continue expanding its revenue and profits at an impressive clip.

This confidence is built on the company’s legendary business model: a membership-based warehouse club that offers a curated selection of high-quality goods at low prices. This model creates a loyal customer base and a highly predictable, recurring revenue stream from membership fees, which cushions the company against the thin margins typical of the retail sector.

Further supporting the fundamental picture is the company’s dividend. While the dividend yield of 0.52% is modest, reflecting its status as more of a growth-oriented investment, the quarterly dividend of $1.29 per share represents a consistent return of capital to shareholders. Costco is also well-known for periodically issuing large special dividends, a practice that rewards long-term holders and is not captured in the standard yield calculation.

The market capitalization, listed as “44.00KCr” (an abbreviation for 44,000 Crore Indian Rupees), translates to approximately $440 billion USD. This places Costco firmly in the mega-cap category, making it a cornerstone holding in many global portfolios and a key bellwether for the health of the American consumer.

Market Outlook and Forward-Looking Analysis

Investors and analysts will now be watching for several key developments. The primary question is whether Monday’s bullish reversal can serve as a launchpad for a sustained rally toward all-time highs. The path forward will likely be defined by a battle between bullish momentum and concerns over the stock’s rich valuation.

Bull Case: Proponents will point to Costco’s defensive strengths. In an uncertain economic environment, its value proposition becomes even more compelling for consumers looking to stretch their budgets. Continued strength in monthly sales reports, successful international expansion, and any announcement of a long-anticipated membership fee increase could all serve as powerful catalysts.

Bear Case: Skeptics will focus on the high P/E ratio, arguing that the stock is priced for perfection and vulnerable to a sharp correction if it fails to meet lofty growth expectations. A slowdown in consumer spending, increased competition from Amazon and other major retailers, or margin pressures from inflation could pose significant headwinds.

In the immediate term, the price action around the $1,000 level will be the main event. A decisive break and hold above this level would be a major victory for the bulls. Conversely, a failure to breach it, followed by a move back below Monday’s support level of $976, could signal a period of consolidation or a deeper pullback.

Ultimately, Monday’s trading session was a microcosm of the broader market’s faith in Costco. It weathered an early storm, found its footing on solid ground, and marched confidently into the close, leaving investors optimistic about the journey ahead.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. The information provided is based on data from the supplied screenshot and general market knowledge. Investors should conduct their own research and consult with a qualified financial professional before making any investment decisions.