Alphabet Stock Outlook: Is a Rebound Coming After Friday’s 1.6% Drop

Alphabet Inc. (GOOGL/GOOG) stock ended the week with a notable decline, but promising pre-market activity suggests a potential battle between bulls and bears is brewing for Monday’s open. For traders evaluating their next move, analyzing Friday’s price action and the underlying financial data is crucial to determining if now is the right time to invest.

Friday’s Market Action: A Day of Selling Pressure

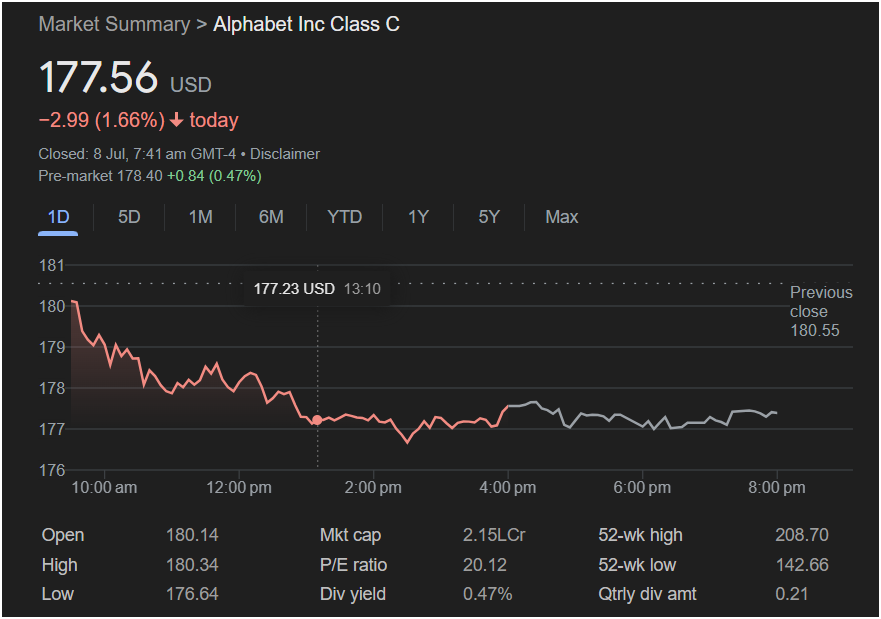

The provided market summary for Alphabet Inc. Class C on Friday, July 8th, reveals a distinctly bearish session:

-

Closing Price: The stock closed at 177.56 USD, down -2.99 or -1.66% for the day.

-

Intraday Trend: The chart shows a sharp sell-off right from the market open. The stock began at 180.14, far below the previous close of 180.55, and trended downwards for most of the morning, hitting a low of 176.64.

-

Afternoon Stabilization: After hitting its low, the stock found some support and traded sideways in a tight range for the remainder of the session. This stabilization could indicate that the selling pressure was exhausted by the afternoon.

The Bullish Indicator: A Positive Pre-Market Signal

The Bullish Indicator: A Positive Pre-Market Signal

Despite the negative close, a key piece of data offers hope for a recovery. The screenshot shows pre-market trading at 178.40, a gain of +0.84 (+0.47%).

This pre-market uptick is a significant signal for traders. It suggests that buyers are viewing the lower price as an attractive entry point, potentially setting the stage for a positive open on Monday.

Key Financial Metrics Every Trader Should Know

A comprehensive view of Alphabet’s stock requires looking at its core financial metrics:

-

Closing Price (Jul 8): 177.56 USD

-

Day’s Range: 176.64 (Low) – 180.34 (High)

-

52-Week Range: 142.66 (Low) – 208.70 (High)

-

Market Cap: 2.15Lcr (approximately $2.15 Trillion USD)

-

P/E Ratio: 20.12

-

Dividend Yield: 0.47% (Quarterly dividend of 0.21 per share)

Notably, Alphabet’s P/E ratio of 20.12 is relatively low for a dominant tech company, suggesting a more reasonable valuation compared to other high-growth tech stocks. This, combined with a modest dividend, can make the stock attractive to both growth and value investors, especially after a price dip.

Monday’s Forecast: Is It the Right Time to Invest in Alphabet Stock?

With conflicting signals from Friday’s close and Monday’s pre-market, here’s a breakdown for traders.

The Bullish Argument (A Buying Opportunity):

Traders might interpret Friday’s 1.66% drop as a healthy pullback within a broader uptrend. The combination of:

-

Afternoon price stabilization on Friday.

-

Positive pre-market gains.

-

A strong fundamental valuation (P/E of 20.12).

This suggests that the stock is poised for a rebound. An aggressive trader might consider entering a position at or near the open, anticipating a move back towards the $180 level.

The Cautious Approach (Wait for Confirmation):

A more risk-averse trader might see the sharp morning sell-off as a sign of underlying weakness. The pre-market gain is encouraging but not a guarantee. It would be wise to wait for the market to open and see if the stock can decisively break and hold above key resistance levels.

-

Key Support Level: The day’s low of 176.64 is the critical support to watch. A break below this level would be a strong bearish signal.

-

Key Resistance Level: The $180 mark, which coincides with Friday’s open and the previous day’s close, is the major hurdle. A sustained move above this level would confirm bullish momentum.

for Traders:

Alphabet stock is presenting a classic “buy the dip” scenario versus a potential continuation of selling pressure. The positive pre-market data and strong fundamentals lean slightly in favor of the bulls for Monday. However, volatility is to be expected.

The smart move for most traders will be to watch the opening price action closely. If Alphabet stock can open strong and push through the $180 resistance, it could signal a profitable entry point for a short-term trade. If it fails at that level or breaks below Friday’s low, it would be a clear sign to stay on the sidelines.