Blackstone Stock’s Wild Ride: Is the Strong Close a Buy Signal or a Trap

Blackstone Inc. (BX) closed the last trading session with a solid gain, but the intraday chart reveals a day of extreme volatility, marked by sharp swings that signal a fierce battle between buyers and sellers. While a last-hour, V-shaped recovery has bulls hopeful, the preceding price action leaves traders on edge. This analysis will dissect Friday’s tumultuous session and outline what to watch for at the start of the new trading week.

Friday’s Trading Session: A Rollercoaster Day

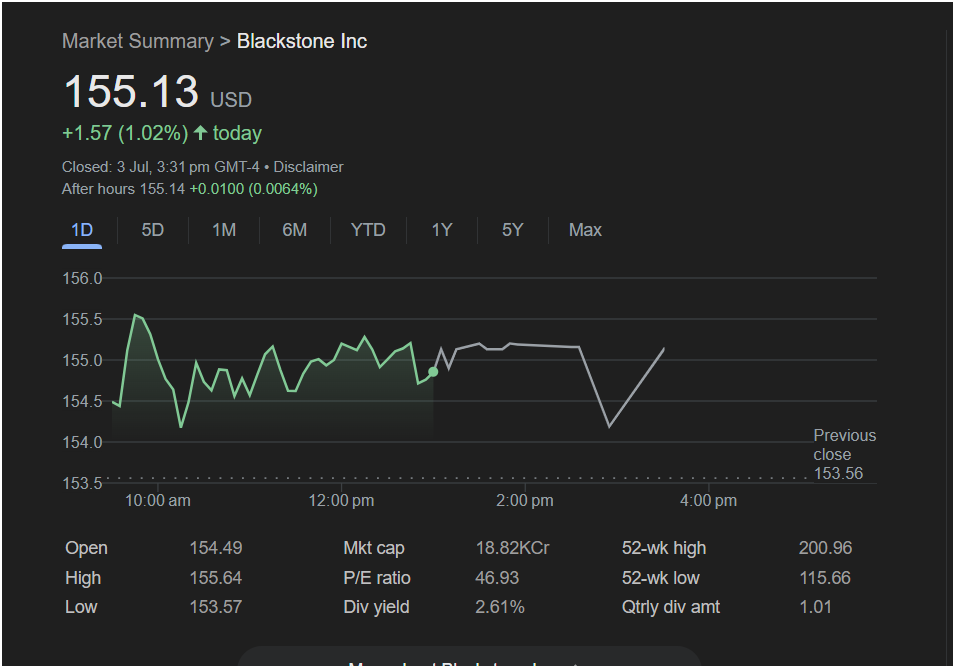

Blackstone’s stock performance on Friday, July 3rd, was anything but straightforward. While it ended the day up, the journey was choppy and unpredictable. Here are the crucial numbers from the session:

-

Closing Price:

1.57 (+1.02%).

-

After-Hours Trading: The stock was virtually unchanged at $155.14, indicating a pause in the action after a volatile day.

-

Day’s Range: Blackstone opened at

155.64**, and a low of $153.57.

The intraday chart tells a dramatic story. The stock rallied to its daily high shortly after the open, but then failed to hold these gains, entering a volatile, sideways chop for most of the day. In the mid-afternoon, a sharp wave of selling pushed the price down significantly, only to be met by an aggressive V-shaped recovery into the close. This pattern—a sharp drop followed by a sharp recovery—is the very definition of market indecision and high volatility.

Key Takeaways for Traders

1. Volatility is the Main Event:

The most important signal from Friday’s chart is the extreme volatility. The wide price swings and the battle between a morning high and an afternoon low indicate that both bulls and bears are active and fighting for control. This is not a market with a clear, calm trend.

2. Key Levels Define the Battlefield:

Friday’s price action has carved out a clear trading range for the short term.

-

Immediate Resistance: The day’s high of $155.64 is the key ceiling. The failure to hold this level early in the day shows that sellers are present at this price.

-

Critical Support: The day’s low of $153.57 (and the previous close of $153.56) is the ultimate floor. A break below this would be a major bearish development.

3. A Tale of Two Fundamentals:

-

High P/E Ratio: With a Price-to-Earnings ratio of 46.93, Blackstone is richly valued. This high valuation requires the company to continue delivering strong growth and can make the stock more susceptible to sharp declines if market sentiment turns negative.

-

Attractive Dividend Yield: In contrast, the 2.61% dividend yield is quite attractive and provides a strong incentive for income-oriented investors to hold the stock, creating a potential cushion of support.

Market Outlook: Will Blackstone Stock Go Up or Down on Monday?

Given the conflicting signals, the outlook for Monday is highly uncertain and depends entirely on which side wins the opening battle.

The Bullish Case:

The bulls’ entire argument rests on the strong finish. The V-shaped recovery into the close suggests buyers saw the afternoon dip as a bargain and stepped in with force. If this momentum carries over, and the stock can break decisively above the $155.64 resistance, it would signal that buyers have won the battle and could trigger a new leg higher.

The Bearish Case:

The bears will point to the intraday weakness and extreme volatility as a warning sign. The sharp afternoon sell-off proves that sellers can take control quickly. If the stock fails to push higher at the open and starts to drift back down towards the $154 level, it could indicate that the late-day recovery was a “bull trap,” potentially leading to a retest of Friday’s lows.

Is It Right to Invest Today?

This is a stock that demands a clear strategy due to its volatility.

-

For the Day Trader: The volatility is an opportunity, but it requires discipline. The key is to trade the edges of the range—

153.57 on the low side. Entering a trade in the middle of this choppy range is a high-risk proposition.

-

For the Swing Trader: The current indecision makes this a poor entry point. It is prudent to wait for confirmation. A swing trader should wait for a sustained breakout above resistance or a confirmed bounce off of major support before committing capital.

-

For the Long-Term Investor: As a leader in the alternative asset management space with a strong dividend, Blackstone remains a compelling long-term holding. The day-to-day volatility is less of a concern, and any significant dips caused by this short-term chop could be viewed as a buying opportunity.

In conclusion, Blackstone stock is coiled in a tight spring of volatility. While the closing price was positive, the underlying price action signals significant uncertainty. The first hour of trading on Monday will be critical to see if the late-day buyers remain in control or if the sellers re-emerge.

Disclaimer: This article is for informational purposes only and is not financial advice. All trading and investment decisions should be made with the consultation of a qualified financial professional and after conducting your own research.