AbbVie Stock Analysis: Failed Rally Puts High-Yield Appeal to the Test

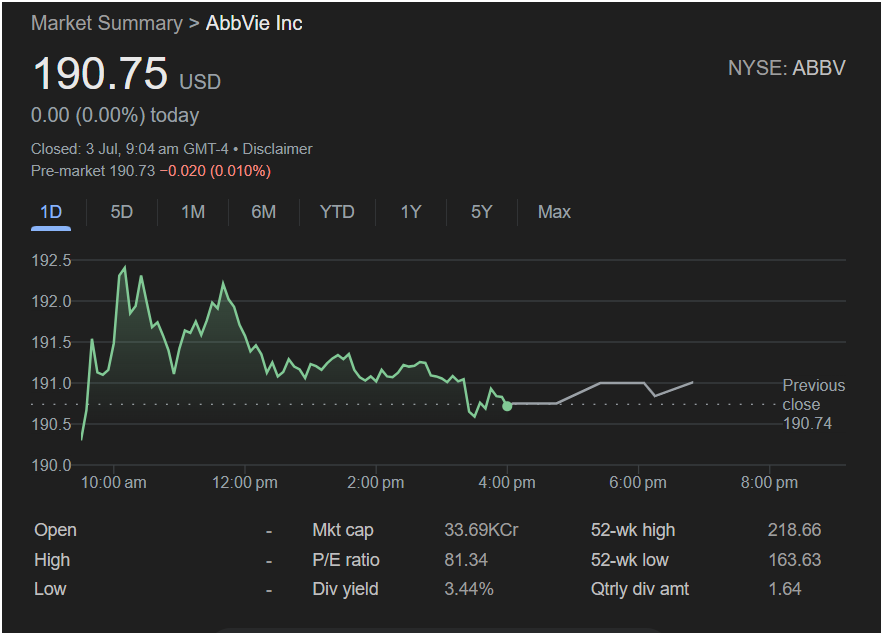

AbbVie Inc. (NYSE: ABBV) stock presents a complex picture for investors and traders heading into Monday’s session. A flat close from the previous day masks what was a highly volatile session, marked by a powerful but ultimately failed rally. Now, with the stock in a state of indecision, traders are weighing its attractive dividend against a high valuation.

Last Session’s Performance: A Story of a Failed Breakout

While AbbVie stock closed at $190.75 USD with a negligible change, the intraday chart reveals a battle that the bulls lost. Here’s what traders need to see:

-

The day began with a surge of buying pressure, rocketing the stock from near the

192.50.

-

This strong upward move was decisively rejected. Sellers took control and pushed the stock all the way back down, erasing the entire 2-dollar gain.

-

The stock spent the rest of the day consolidating near its lows before closing just above the previous day’s finish of $190.74.

This price action, known as a failed rally or intraday reversal, is a bearish signal. It indicates that despite initial enthusiasm, sellers were strong enough to overwhelm buyers at higher prices.

The Core Conflict: Key Metrics for Traders

AbbVie’s fundamentals present a classic conflict between value and growth metrics that every trader must consider:

-

High Dividend Yield: With a substantial dividend yield of 3.44%, ABBV stock is a magnet for income-seeking investors. This strong yield often acts as a support level, as buyers step in on dips to lock in the attractive payout.

-

High P/E Ratio: In sharp contrast, the Price-to-Earnings (P/E) ratio stands at a very high 81.34. This lofty valuation suggests that the market has priced in significant future growth, making the stock potentially overvalued and vulnerable to pullbacks if it fails to meet these high expectations.

-

Pre-Market Indecision: The pre-market quote is $190.73, down an insignificant -0.020 (0.010%). This flat pre-market activity confirms the market’s current state of indecision following the failed rally.

Outlook for Monday: Will AbbVie Stock Go Up or Down?

Given the failed rally, the outlook for AbbVie stock on Monday is neutral to slightly bearish.

The inability to hold gains is a significant red flag. The market will be watching to see if buyers can mount another attempt or if sellers will push the price below the key support established during the previous session.

-

Key Support: The intraday low around $190.50 is the critical level to watch. A break below this support would confirm the bearish momentum and could lead to a further decline.

-

Key Resistance: The peak of the failed rally, around $192.50, is now a major resistance level. The stock would need to break through this convincingly to restore bullish sentiment.

Is it right to invest today?

Today calls for a “wait-and-see” approach.

-

For Short-Term Traders: The bearish reversal pattern from the last session suggests caution. It is not an ideal time to initiate a new long (buy) position. A more strategic approach would be to wait for either a confirmed breakdown below support (

191.50) for a potential long trade.

-

For Income Investors: The primary appeal is the 3.44% dividend yield. For these investors, the volatility is less of a concern. A dip towards the $190 support level might be seen as an opportunity to add to a position and capture that high yield, provided they are comfortable with the stock’s high P/E ratio.

In conclusion, AbbVie stock is at an inflection point. The strong dividend provides a safety net, but the failed rally and high valuation are warning signs. Monday’s session will be a tug-of-war between these conflicting forces.

Disclaimer: This article is for informational purposes only and is based on the analysis of the provided image. It does not constitute financial advice. All investors should conduct their own research and consult with a financial professional before making any investment decisions.