Walmart Inc Stock Analysis: A Flat Close After a Volatile Day, What’s Next for WMT

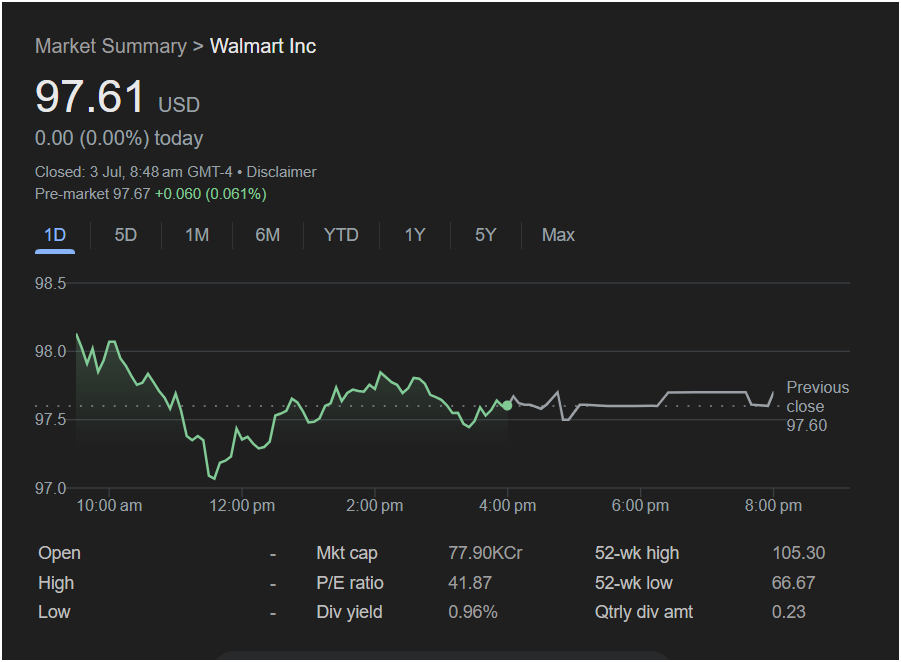

Bentonville, AR – Walmart Inc (WMT) stock ended the last trading session in a rare state of equilibrium, closing completely flat at

0.00 (0.00%) change. This dead-heat close masks a day of significant volatility, where the retail giant’s stock was caught in a tug-of-war between buyers and sellers. As traders gear up for Monday, a slightly positive pre-market signal is providing a glimmer of hope for the bulls.

This article dives into the critical data points to provide a comprehensive forecast for Walmart’s stock performance in the upcoming session.

The Bullish Case: Resilience and a Positive Start

Investors looking for positive signs can find them in the stock’s resilient behavior and early indications for Monday:

-

Slightly Positive Pre-Market: Pre-market data shows the stock trading at $97.67, a modest gain of +0.060 (+0.061%). While small, this uptick suggests that the initial sentiment heading into the new week is positive.

-

Strong Recovery from Lows: The intraday chart shows a sharp sell-off in the morning that took the stock down to a low near the $97.00 mark. However, buyers stepped in decisively, pushing the price back up and helping it recover all losses by the close. This indicates strong support at lower levels.

-

Holding a Key Level: The stock successfully defended the $97.50 – $97.60 zone (which includes the previous close), turning what could have been a negative day into a neutral one. This stability can be seen as a sign of underlying strength.

The Bearish Case: Indecision and Valuation Concerns

On the flip side, several factors point to potential weakness and should be on every trader’s radar:

-

Complete Lack of Momentum: A 0.00% change is the definition of indecision. The inability of the stock to push higher after recovering from its lows suggests a lack of buying conviction and that sellers are still active at these prices.

-

High Valuation: A P/E ratio of 41.87 is notably high for a mature retail company. This rich valuation could make the stock more susceptible to selling pressure if there are any signs of slowing growth or negative market sentiment.

-

Distance From Highs: The stock is currently trading significantly below its 52-week high of $105.30, indicating it has been in a corrective phase and is facing overhead resistance from investors who bought at higher levels.

Key Data and Levels for Traders to Watch

To effectively trade Walmart stock on Monday, focus on these critical technical and fundamental data points:

-

Immediate Resistance: The intraday high, seen near $98.10 on the chart, is the first major hurdle for the bulls to overcome.

-

Key Support Zone: The $97.50 – $97.60 area is the most critical support. The price consolidated here, and the previous close is located in this range. A firm break below this level would be a bearish signal.

-

Major Support Floor: The intraday low, around $97.00 – $97.05, represents the line in the sand. If this level is breached, it could trigger a more significant downward move.

-

Fundamentals: The high P/E ratio (41.87) is a primary risk factor, while the 0.96% dividend yield offers a minor incentive for long-term investors but is unlikely to sway short-term traders.

Outlook for Monday: Is It the Right Time to Invest?

The outlook for Walmart stock on Monday is neutral with a slight bullish bias due to the positive pre-market action. However, the flat close signals extreme indecision, making the opening price action critical.

Should you invest today?

-

The current price represents a point of equilibrium. For short-term traders, acting now would be a gamble on direction. The more prudent approach is to wait for a clear signal.

-

A bullish entry could be considered if the stock breaks convincingly above the intraday resistance at $98.10, which would indicate that buyers have taken control.

-

A cautious or bearish stance is warranted if the stock fails at resistance or breaks below the key support zone of $97.50. This could present a shorting opportunity or a signal for long investors to wait for a better entry point.

In conclusion, Walmart’s stock is coiled for a move, but the direction is not yet clear. Monday’s session will likely be decided by whether the bulls can build on the positive pre-market sentiment and break resistance, or if the sellers and high valuation concerns will push the price back down to test its intraday lows.