General Electric Stock Surges in Pre-Market: Set to Challenge 52-Week High on Monday

General Electric Co (GE) is signaling a powerful start to the new trading week, with strong pre-market gains pointing to a higher open on Monday. This follows a robust session on Friday, June 30th, where the industrial giant forged a new 52-week high, indicating significant bullish momentum is building for the stock.

Friday’s Trading Action: New Highs Met with Profit-Taking

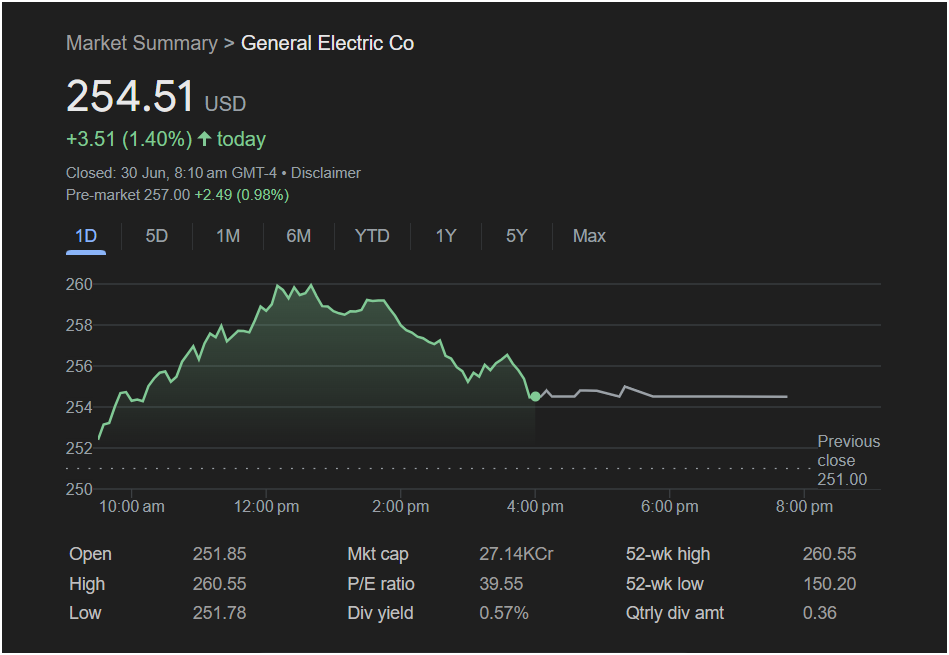

Friday’s session for GE stock was a textbook example of bullish strength meeting resistance. The stock opened at $251.85, above the previous close of $251.00, and embarked on a steady climb throughout the morning. This buying pressure culminated in the stock reaching a new 52-week high of $260.55.

However, upon hitting this peak, sellers emerged to take profits, leading to a pullback in the afternoon. Despite this fade from the highs, GE managed to hold onto substantial gains, closing the day at

3.51 (1.40%), demonstrating underlying demand even with the intraday sell-off.

Monday’s Outlook: Bullish Momentum Carries Over

The most compelling data for traders is the pre-market activity. As of 8:10 am GMT-4, GE stock is trading at

2.49 (0.98%) from Friday’s close.

This significant pre-market rally is a clear indication that General Electric stock is poised to open significantly higher on Monday. The buying interest from Friday appears to be accelerating, setting the stage for an immediate test of the recent highs.

Is It Right to Invest? Strategy and Key Levels

For traders looking to capitalize on this momentum, the decision to invest will hinge on the stock’s performance around its most critical price level.

-

Key Resistance Level: The ultimate test for the bulls is the 52-week high of $260.55. A decisive break and hold above this price would be a major bullish confirmation, suggesting the stock is entering its next leg up with clear skies ahead.

-

Key Support Levels: Once the market opens, the pre-market price of

254.51 and the day’s low of $251.78.

Investment Strategy Considerations:

-

For the Bulls: The aggressive pre-market move is a strong bullish signal. Traders might look to enter on the open, anticipating a quick run towards the $260.55 resistance. A break above that level could fuel further buying.

-

For the Bears: The only caution comes from the pullback on Friday. If the stock gaps up on Monday but fails to break the $260.55 high and reverses, it could signal buyer exhaustion.

-

For the Cautious: A prudent strategy would be to wait for the stock to prove it can break and hold above the $260.55 resistance level before committing. This avoids the risk of buying into a failed opening rally.

Comprehensive Trader’s Snapshot (Data from June 30)

-

Closing Price: 254.51 USD

-

Day’s Change: +3.51 (1.40%)

-

Pre-Market (as of 8:10 am GMT-4): 257.00 (+0.98%)

-

Previous Close: 251.00

-

Day’s Range: $251.78 (Low) to $260.55 (High)

-

52-Week Range: $150.20 to $260.55

-

Market Cap: 27.14KCr

-

P/E Ratio: 39.55

-

Dividend Yield: 0.57%

:

The outlook for General Electric stock is decidedly bullish heading into Monday. Strong pre-market performance on top of a positive close on Friday suggests that buyers are in control. The focus for the entire market will be on the $260.55 price level. A breakout above this 52-week high could ignite the next phase of the stock’s rally.

Disclaimer: *This article is for informational purposes only and is based on the analysis of the provided image. It does not constitute financial advice. All investors should conduct their own res