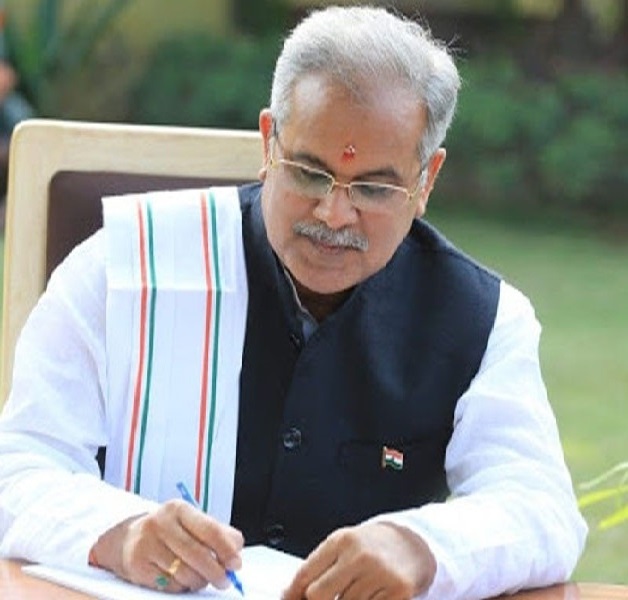

मुख्यमंत्री बघेल ने प्रधानमंत्री मोदी को पत्र लिखकर खाद्य विभाग भारत सरकार द्वारा 12 नवंबर 2021 को जारी प्लान के अनुसार नये जूट बारदानों की समयानुसार आपूर्ति की व्यवस्था सुनिश्चित करने का अनुरोध किया है। श्री बघेल ने अपने पत्र में कहा है कि प्लान के अनुसार छत्तीसगढ़ को 2.14 लाख गठान नये जूट बारदाने जूट कमिश्नर कोलकाता के माध्यम से क्रय करने की अनुमति प्राप्त हुई है।

इसके विरुद्ध राज्य को अभी तक मात्र 86,856 गठान नये जूट बारदाने प्राप्त हुए हैं, जो प्लान अनुसार अपेक्षित मात्रा से काफी कम है। राज्य को धान खरीदी के लिए 5.25 लाख गठान बारदाने की आवश्यकता है। जूट कमिश्नर द्वारा प्लान के अनुसार यदि समयानुसार शतप्रतिशत बारदानों की आपूर्ति नहीं की जाती है तो राज्य में कानून व्यवस्था की स्थिति निर्मित हो सकती है।

प्रधानमंत्री मोदी को लिखे गए पत्र में मुख्यमंत्री बघेल ने कहा है छत्तीसगढ़ में खरीफ विपणन वर्ष 2021-22 में भारत सरकार द्वारा घोषित समर्थन मूल्य पर किसानों से धान खरीदी का कार्य 01 दिसंबर, 2021 से प्रारंभ होना संभावित है, जिसके लिए सभी आवश्यक तैयारियां की जा रही हैं।

खरीफ विपणन वर्ष 2021-22 में समर्थन मूल्य पर राज्य में किसानों से 105 लाख टन धान उपार्जन होना अनुमानित है, जिसके लिए 5.25 लाख गठान बारदाने की आवश्यकता होगी। इसमें से 2.14 लाख गठान नये जूट बारदाने जूट कमिश्नर कोलकाता के माध्यम से क्रय करने की अनुमति खाद्य एवं सार्वजनिक वितरण मंत्रालय, भारत सरकार द्वारा 12 नवंबर 2021 को जारी पत्र के द्वारा दी गई है।

इसके अनुसार माह अगस्त हेतु 0.19 लाख गठान, सितंबर हेतु 0.32 लाख गठान, अक्टूबर हेतु 0.72 लाख गठान, नवंबर हेतु 0.15 लाख गठान एवं दिसंबर हेतु 0.76 लाख गठान नये जूट बारदाने की माहवार आपूर्ति किये जाने का शेड्यूल जारी किया गया है।

बघेल ने कहा है कि छत्तीसगढ़ राज्य सहकारी समिति विपणन संघ मुख्यालय नवा रायपुर द्वारा 2.14 लाख गठान जूट बारदाने क्रय करने के लिये इंडेन्ट जारी किये गये है, इसके विरुद्ध राज्य को अभी तक मात्र 86,856 गठान नये जूट बारदाने ही प्राप्त हुए हैं, जो प्लान अनुसार अपेक्षित मात्रा से काफी कम है।

जूट कमिश्नर के माध्यम से राज्य को प्राप्त होने वाले उक्त समस्त नये जूट बारदानों की शत-प्रतिशत आपूर्ति हेतु राज्य स्तर से निरंतर प्रयास किये जा रहे हैं। राज्य द्वारा किये जा रहे सर्वश्रेष्ठ प्रयासों के बावजूद जूट कमिश्नर द्वारा आपूर्ति किये जा रहे बारदानों की गति में संतोषप्रद प्रगति परिलक्षित नहीं हुई है।

बघेल ने प्रधानमंत्री को बताया है कि विगत वर्ष में न्यूनतम समर्थन मूल्य पर धान उपार्जन हेतु प्रतिदिन औसतन 10 हजार गठान बारदानों की आवश्यकता हो रही थी। ऐसी स्थिति में यदि जूट कमिश्नर कोलकाता द्वारा आपूर्ति कार्ययोजना के अनुरूप शत-प्रतिशत बारदानों की आपूर्ति नियत समय पर नहीं की जाती है, तो धान खरीदी अवधि के दौरान कानून व्यवस्था की स्थिति उत्पन्न हो सकती है।

बघेल ने पत्र में उल्लेख किया है कि खरीफ विपणन वर्ष 2021-22 में खाद्य विभाग भारत सरकार द्वारा 61.65 लाख टन चावल केन्द्रीय पूल अंतर्गत लिये जाने की अनुमति प्रदान की गई है, राज्य में केन्द्रीय पूल की आवश्यकता 16 लाख टन के अतिरिक्त शेष 45.65 लाख टन चावल केन्द्रीय पूल अंतर्गत भारतीय खाद्य निगम में जमा कराया जाना है, जिसके लिए भी नये जूट बारदाने की प्लान अनुसार निरंतर आपूर्ति की जरूरत है ।

बघेल ने प्रधानमंत्री से उपरोक्त परिस्थितियों को ध्यान में रखते हुए खाद्य विभाग भारत सरकार द्वारा 12 नवंबर 2021 के पत्र में जारी प्लान के अनुसार नये जूट बारदाने की समयानुसार आपूर्ति किये जाने के लिए खाद्य विभाग भारत सरकार एवं जूट कमिश्नर कोलकाता को निर्देशित करने का अनुरोध किया है।