Johnson & Johnson Stock: Trader’s Outlook for Monday After Quiet Session

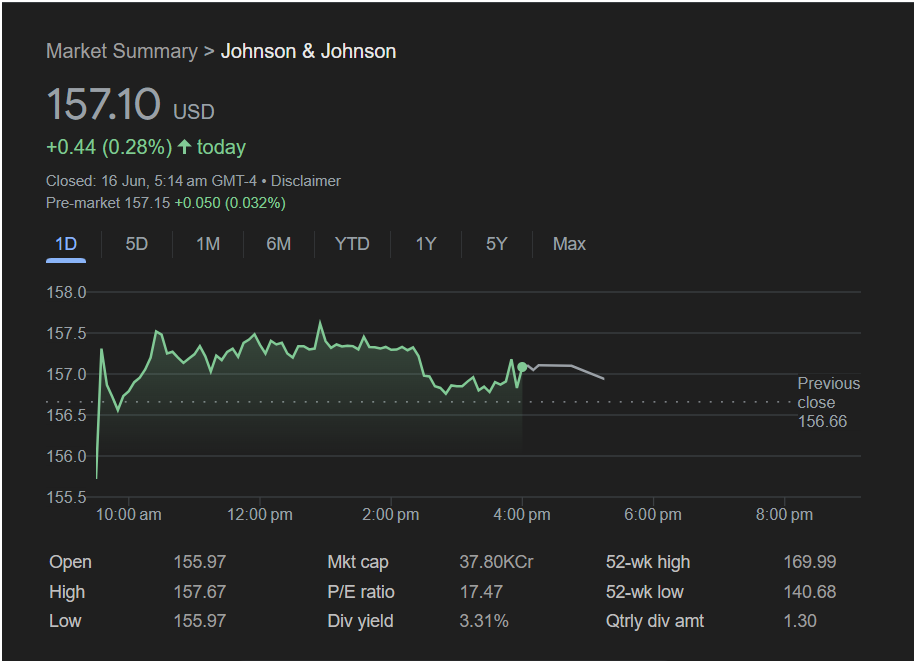

Johnson & Johnson stock (JNJ) concluded the last trading session with a marginal gain, characterized by sideways, choppy price action. While the day ended in the green, the lack of strong momentum has left traders looking for clear signals ahead of Monday’s market open. Is this stability a sign of a solid base, or is the stock simply treading water before its next move?

This article breaks down all the vital information from the chart to provide a comprehensive trading plan for Monday.

Disclaimer: This analysis is based on the provided trading data from Friday, June 16th. Market conditions can change rapidly. Always consult live, real-time data and current news on Monday before making any investment decisions.

Friday’s Market Session: The Key Numbers

-

Closing Price: 157.10 USD

-

Day’s Gain: +0.44 (+0.28%)

-

Session High: 157.67 USD

-

Session Low: 155.97 USD

-

P/E Ratio: 17.47

-

Dividend Yield: 3.31%

-

52-Week Range: 140.68 USD – 169.99 USD

The Bullish Case: Why JNJ Might Be a Stable Bet

The Bullish Case: Why JNJ Might Be a Stable Bet

For investors looking for stability and value, Johnson & Johnson presents several compelling arguments:

-

Attractive Valuation: With a Price-to-Earnings (P/E) ratio of just 17.47, JNJ appears reasonably valued, especially compared to the broader market and high-growth tech stocks. This suggests the stock is not “expensive” and may have less downside risk from a valuation standpoint.

-

Strong Dividend Yield: A dividend yield of 3.31% is a significant draw for income-oriented investors. This reliable payout provides a return even during periods of flat price action and can create a “floor” of support for the stock, as income investors are likely to buy on dips.

-

Holding Support: The stock opened at its low for the day ($155.97) and immediately moved higher, never re-testing that level. It closed above the previous day’s close of $156.66, indicating it successfully defended key support levels throughout the session.

The Bearish Case: Reasons for Caution

Momentum and short-term traders might see reasons to be cautious heading into Monday:

-

Lack of Buying Conviction: A gain of only 0.28% on a day with choppy, sideways movement indicates a clear lack of strong buying pressure. The stock failed to push past the intraday high of $157.67, showing that sellers were present at that level.

-

Weaker Long-Term Trend: The current price of

140.68) than its 52-week high ($169.99). This indicates that the stock has been underperforming over the last year and is fighting against a broader downtrend.

-

Indecisive Pre-Market: The pre-market data shows a nearly flat open (+0.032%), reinforcing the theme of indecision from Friday’s session. There is no clear overnight momentum to suggest a strong open in either direction.

Trading Plan for Monday: Key Levels to Watch

Monday’s price action will likely be dictated by these critical levels:

-

Immediate Resistance: The session high from Friday at $157.67. A sustained break above this level is needed to signal that buyers are taking control and could lead to a test of the $158 level.

-

Key Support: The session low from Friday at $155.97. A break below this level would be a bearish signal, suggesting that the recent stability is failing and the stock could head lower.

-

Pivot Point: The previous close of $156.66 will act as an important intraday pivot. Trading above this level is constructive, while trading below it may signal weakness.

Verdict: Should You Invest in JNJ Stock on Monday?

The decision hinges on your investment style and time horizon.

-

For the Long-Term Value/Income Investor: JNJ’s low P/E ratio and robust dividend yield make it an attractive candidate. The current price level could be seen as a solid accumulation zone for a long-term position, as you get paid to wait for a potential recovery.

-

For the Swing or Momentum Trader: This is currently a “wait and see” stock. The lack of clear directional momentum makes it a poor candidate for a short-term trade. A prudent strategy would be to wait for a confirmed breakout above

155.97 before committing capital.

In summary, Johnson & Johnson stock enters Monday’s session in a state of equilibrium. While its fundamentals offer a safety net for long-term investors, short-term traders should remain on the sidelines until a clearer trend emerges.