Amazon Stock Falters into Weekend, Signaling Potential Headwinds for Monday

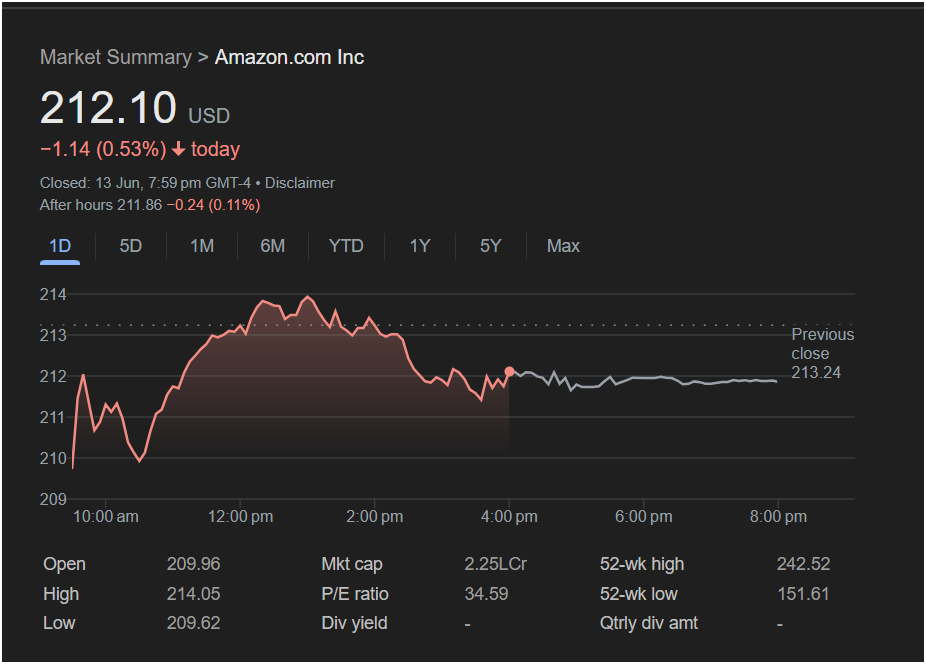

NEW YORK – Amazon.com Inc. (AMZN) shares ended the trading day on Thursday, June 13, on a negative note, with late-day selling pressure and a further dip in after-hours activity suggesting a cautious start to the new trading week.

The tech and e-commerce giant closed the official session at

1.14 (0.53%) for the day. The downward momentum continued after the bell, with after-hours trading pulling the price down an additional 0.11% to $211.86 at the time of the report.

The trading day presented a story of failed momentum. After opening at $209.96, Amazon shares saw a strong rally in the morning, pushing to a daily high of $214.05. However, the optimism faded in the afternoon as the stock steadily declined from its peak, ultimately closing below the previous day’s close of $213.24.

The trading day presented a story of failed momentum. After opening at $209.96, Amazon shares saw a strong rally in the morning, pushing to a daily high of $214.05. However, the optimism faded in the afternoon as the stock steadily declined from its peak, ultimately closing below the previous day’s close of $213.24.

This pattern, where a stock fails to hold its intraday gains and closes near the lower end of its daily range, is often interpreted by traders as a sign of weakness. It indicates that sellers overwhelmed buyers by the end of the session, a sentiment that could carry over.

Analysis for the Week Ahead:

Based on the technical signals from Thursday’s chart, the outlook for Amazon on Monday appears to be tilted towards the bearish side. Several key factors support this view:

-

Negative Close: The stock finished in the red, breaking a potential upward trend.

-

After-Hours Decline: The continuation of selling after the market closed is a strong indicator that negative sentiment persists.

-

Price Reversal: The failure to hold the day’s high of $214.05 and the subsequent slide suggests a loss of bullish momentum.

Traders on Monday will be closely watching if Amazon’s stock price can find support or if it will test the day’s low of $209.62. A break below this level could signal further declines. While the stock remains significantly above its 52-week low of $151.61, the short-term indicators from Thursday’s session point towards potential downward pressure when the market reopens.

Of course, any significant market-moving news over the weekend could alter this outlook, but based solely on Thursday’s closing data, investors should be prepared for a potentially soft start for Amazon shares on Monday.