ConocoPhillips Stock Plunges 1.78%: A Warning Sign or a Dip to Buy

ConocoPhillips (COP), a major player in the energy sector, experienced significant selling pressure on Tuesday, June 18th, leaving investors to question the stock’s next move. The company’s stock closed the session with a notable loss, though a slight rebound in after-hours trading has added a layer of complexity to the outlook.

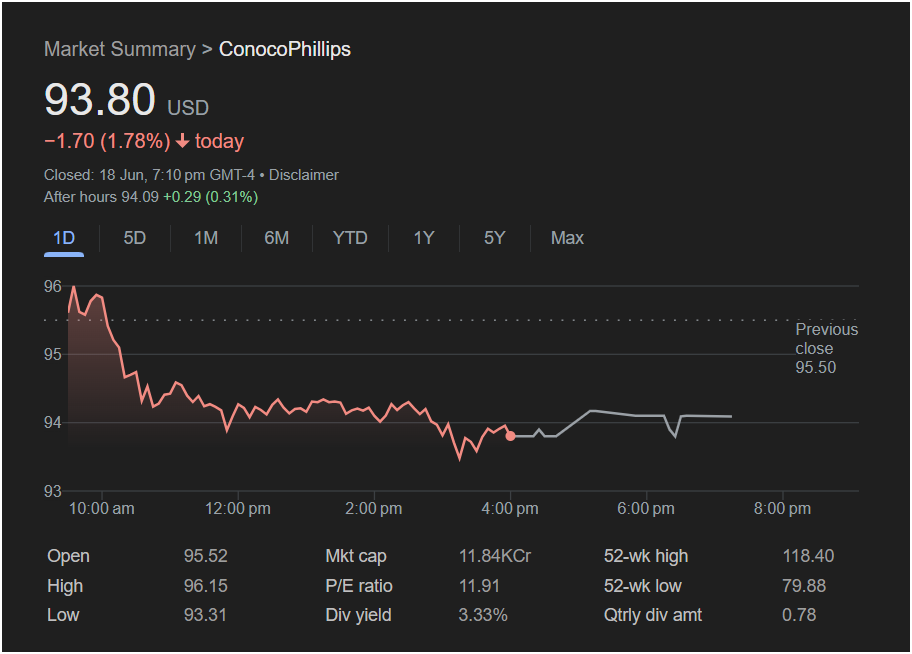

The stock finished the official trading day at 93.80 USD, a sharp decline of -1.70 (1.78%). However, after the bell, buyers stepped in, pushing the price up to 94.09, a gain of 0.31%. This late-day divergence sets up a critical test for the stock when markets reopen.

Breaking Down Today’s Volatile Trading

Breaking Down Today’s Volatile Trading

The intraday chart for ConocoPhillips tells a story of immediate and sustained bearish momentum.

-

Weak Open, Immediate High: The stock opened at 95.52, almost exactly at the previous day’s close of 95.50, and briefly ticked up to a high of 96.15. This was the peak for the day, as sellers took firm control almost immediately.

-

Sustained Sell-Off: From the morning high, the stock entered a steep and consistent decline, breaking through several potential support levels. It eventually bottomed out at a day’s low of 93.31.

-

Closing Near the Lows: While there was a minor bounce off the lows into the close, the stock finished the session much closer to its daily low than its high. This type of price action typically indicates that sellers were dominant throughout the day.

Key Financial Metrics for Your Watchlist

For any trader considering a position in ConocoPhillips, these data points are essential:

-

Previous Close: 95.50

-

Open: 95.52

-

Day’s Range: 93.31 (Low) – 96.15 (High)

-

52-Week Range: 79.88 – 118.40

-

P/E Ratio: 11.91

-

Dividend Yield: 3.33%

The stock’s P/E ratio of 11.91 is relatively low, which may suggest that it is attractively valued compared to its earnings. Furthermore, the robust 3.33% dividend yield is a significant factor that could attract income-focused investors, potentially providing a safety net against further steep declines.

Market Outlook: Will the Stock Go Up or Down on Thursday?

With the provided data, we can analyze the potential direction for ConocoPhillips. Please note that U.S. markets are closed on Wednesday, June 19th, for the Juneteenth holiday. Trading will resume on Thursday, June 20th.

The Bearish Case: The primary trend for the day was clearly down. The stock’s inability to hold its opening price and the subsequent sell-off are strong bearish signals. The most critical level to watch on Thursday is the day’s low of $93.31. If the stock breaks below this support level, it could trigger further selling and signal that the downtrend is likely to continue.

The Bullish Case: The after-hours recovery, however small, cannot be ignored. It shows that some buyers see value at these lower prices. The combination of a low P/E ratio and a high dividend yield makes a strong fundamental case for the stock. For a bullish reversal to begin, buyers will need to push the price decisively above the

95.00 psychological level.

Investment Decision: Is it Time to Invest Today?

Based on Tuesday’s performance, jumping into a new long position right now carries significant short-term risk. The bearish momentum is strong.

-

For Short-Term Traders: The prudent approach would be to wait for confirmation. A break below

94.50 might signal the bears are losing control.

-

For Long-Term Investors: This dip could represent an attractive entry point. For those focused on value and income, acquiring shares of ConocoPhillips with a 3.33% dividend yield at a lower valuation could be a sound strategy, provided they are willing to weather potential near-term volatility.

In summary, traders should remain cautious, while long-term investors may begin to see value emerging after this sharp sell-off.

Disclaimer: This article is for informational purposes only and is based on the analysis of past market data. It should not be considered financial or investment advice. All investment decisions involve risk, and you should conduct your own research or consult with a qualified financial advisor before making any trades.