Union Pacific Stock Under Pressure: A Trader’s Guide for Monday, June 17

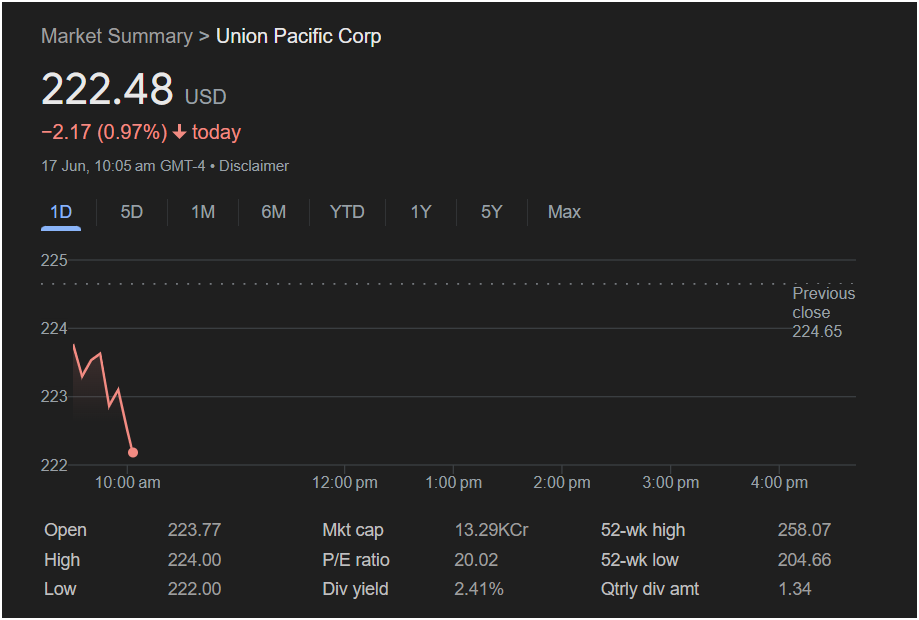

Union Pacific stock (NYSE: UNP) is facing significant selling pressure at the start of the week, signaling a bearish sentiment among traders on Monday. As of 10:05 am GMT-4, the railroad giant’s shares are trading at 222.48 USD, a notable drop of -2.17 (0.97%) for the day.

For traders looking to make a move, understanding the forces behind this dip is crucial. This article provides a comprehensive breakdown of Union Pacific’s current market position and what key indicators to watch.

Intraday Analysis: A Clear Downward Trajectory

The one-day (1D) chart paints a clear picture of the morning’s trading session. The stock’s performance shows sustained downward momentum from the opening bell.

-

Previous Close: The stock ended the prior session at 224.65 USD.

-

Opening Price: It opened lower at 223.77 USD.

-

Session Action: The price briefly ticked up to a high of 224.00 USD before sellers took firm control, pushing the stock down to a daily low of 222.00 USD.

The current price of 222.48 USD is hovering just above this critical daily low. This relentless decline suggests that bearish sentiment is dominating the early session, with the stock struggling to find a support level.

Key Financial Metrics and Market Context

Key Financial Metrics and Market Context

A deeper look at the financials provides essential context for any trading decision:

-

Market Cap: 13.29KCr (This likely represents Indian numbering for Crores, translating to approximately $159 billion USD, cementing its status as a blue-chip industrial leader).

-

P/E Ratio: 20.02. This price-to-earnings ratio is reasonable for a stable, mature company in the industrial sector.

-

Dividend Yield: 2.41%. This is a relatively strong dividend, which may attract income-focused investors, especially at lower price points.

-

52-Week High: 258.07 USD

-

52-Week Low: 204.66 USD

The 52-week range is particularly telling. At its current price, Union Pacific stock is trading much closer to its 52-week low than its high. This indicates that today’s drop is not an isolated event but part of a broader trend of weakness or correction over recent months.

Is It the Right Time to Invest Today?

Given the strong bearish momentum, today’s trading environment for Union Pacific stock is challenging and requires a clear strategy.

-

For the Bearish Trader: The trend is currently your friend. If the stock breaks decisively below the daily low of 222.00 USD, it could signal a continuation of the sell-off, potentially heading towards lower support levels closer to the 52-week low.

-

For the Bullish Trader (Contrarian View): Buying into such strong downward momentum is risky, often described as “catching a falling knife.” However, a contrarian trader might watch for a reversal. A strong bounce off the $222 level, confirmed by increasing volume, could indicate that buyers are stepping in. The attractive dividend yield might provide a floor of support as value investors become interested.

: The immediate outlook for Union Pacific stock is bearish. The strong downward pressure and proximity to the daily low suggest that caution is warranted. Traders should closely monitor the $222.00 support level. A firm break below could open the door for further losses, while a powerful defense of this level could present a high-risk, high-reward entry point for those betting on a reversal.

Disclaimer: This article is for informational purposes only and is based on a single point-in-time screenshot. It does not constitute financial advice. Stock market conditions are highly volatile and can change rapidly. All investors should conduct their own thorough research and consult with a qualified financial advisor before making any investment decisions.