Johnson & Johnson Stock Pops Late in the Day — What Triggered the Sudden Upswing

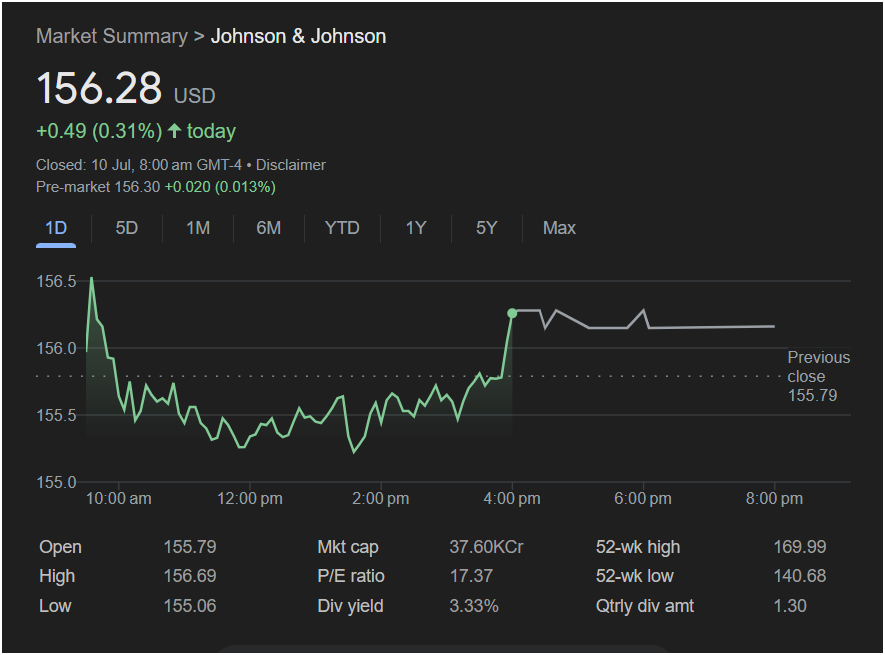

NEW BRUNSWICK, NJ — Johnson & Johnson (NYSE: JNJ) stock turned heads on Wall Street Wednesday with a surprise late-day surge that pushed shares into the green after a turbulent trading session. Closing at $156.28, up $0.49 (0.31%), the healthcare giant defied bearish midday trends to end with a confident upward tick.

The day started on a steady note, with shares opening at $155.79, marginally above the previous close. Bulls made an early charge, sending the stock to a daily high of $156.69. But as the hours passed, investor enthusiasm cooled. JNJ dipped as low as $155.06, raising red flags for day traders and long-term holders alike.

Then, in the final trading window, everything changed.

Then, in the final trading window, everything changed.

A wave of aggressive buying activity swept in, reversing earlier losses and signaling renewed market confidence. Analysts suggest a combination of institutional repositioning, algorithmic trades, and favorable market sentiment around defensive healthcare plays may have fueled the move.

Despite recent volatility, Johnson & Johnson’s stock remains comfortably within its 52-week range of $140.68 to $169.99, underscoring its stability amid broader market uncertainty. The company’s blue-chip status and diversified healthcare portfolio continue to attract investors seeking both growth and reliable income.

From a fundamentals standpoint, JNJ boasts a price-to-earnings (P/E) ratio of 17.37, reinforcing its reputation as a value-rich play in the sector. Meanwhile, dividend investors are keeping a close watch: the stock offers a robust dividend yield of 3.33%, supported by a quarterly payout of $1.30 per share.

As of the latest pre-market data, JNJ was trading at $156.30, a minor uptick of 0.013%, suggesting continued investor interest. Market watchers will be monitoring Thursday’s opening bell closely for signs of follow-through momentum.