Alphabet Stock Sees Late-Day Fade, Investors Eye Key Levels for Monday’s Open

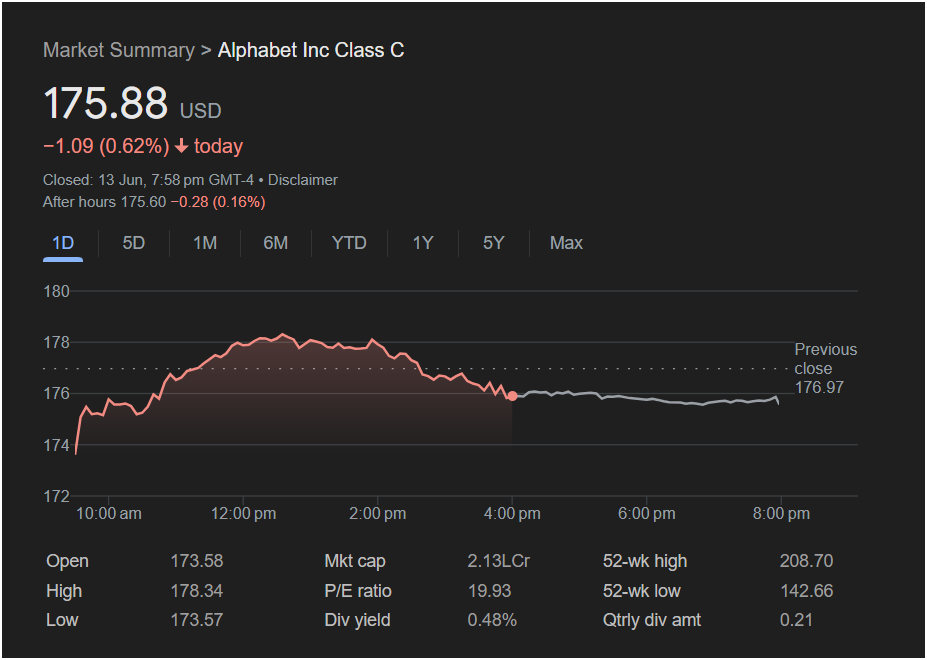

NEW YORK – Shares of tech giant Alphabet Inc. (NASDAQ: GOOG) finished a volatile trading session in the red on Thursday, closing at $175.88, a decline of 0.62% for the day. The downward pressure continued in after-hours trading, with the stock ticking lower to $175.60, setting a cautious tone for the week ahead.

The trading day was a tale of two halves. Alphabet shares initially opened lower at $173.58 but rallied strongly through the morning, reaching a session high of $178.34. This bullish momentum, however, failed to hold. Sellers took control in the afternoon, erasing all the day’s gains and pushing the stock below the previous day’s close of $176.97.

This “fade” from the daily high suggests profit-taking and some investor uncertainty after a strong run. While the stock remains significantly above its 52-week low of $142.66, its inability to maintain momentum above the $178 mark could be a point of concern for short-term traders.

Outlook for Monday:

The market will be watching closely to see if Alphabet can find its footing when trading resumes on Monday.

-

The Bearish Case: The weak close and continued dip in after-hours trading suggest that negative momentum could carry over into Monday’s session. If the stock opens and fails to reclaim the

173.50 as its next support level.

-

The Bullish Case: On the other hand, some analysts may view this pullback as a healthy consolidation. With a solid P/E ratio of 19.93 and a market capitalization well over $2 trillion, long-term investors may see this dip as a buying opportunity. If broader market sentiment is positive on Monday, buyers could step in to defend the $175 level, looking to push the stock back toward the week’s highs.

:

Given the late-day selling pressure, the market is likely to open with a cautious to slightly downward bias for Alphabet on Monday. The first hour of trading will be critical. A break below $175 could signal further declines, while a strong defense of that level could set the stage for a recovery. Investors will be monitoring broader tech sector trends and macroeconomic news for direction.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. All stock market investments carry risk.