Arista Networks Stock Ends Week on a High Note: What’s Next for Traders

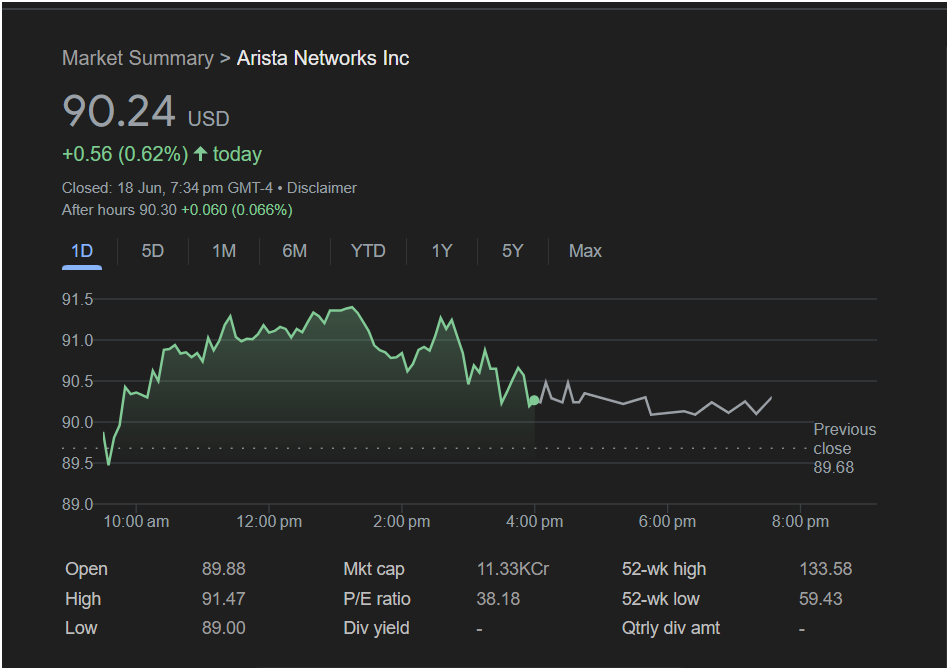

Arista Networks Inc. (ANET) concluded the trading week with a solid performance, providing traders with key signals to watch as a new week begins. The stock closed on Friday, June 18, at

0.56 (0.62%) for the day. This positive momentum, coupled with a slight uptick in after-hours trading, sets a cautiously optimistic tone for Monday’s market open.

This article breaks down the essential data from Friday’s session to help you make informed decisions.

Friday’s Trading Session: A Story of Volatility and Resilience

A closer look at the intraday chart reveals a dynamic trading session for Arista Networks stock.

-

Opening Bell: The stock opened at $89.88, slightly above the previous close of $89.68.

-

Morning Rally: It quickly found buying pressure, pushing it to a daily high of $91.47. This peak represents a key resistance level that traders will be watching closely.

-

Afternoon Pullback: After hitting its peak, the stock saw some profit-taking, pulling back through the afternoon but managing to hold its ground above the critical $90 mark.

-

Closing Strength: Despite the pullback, Arista closed firmly in the green. Furthermore, after-hours activity showed a modest continuation of this trend, with the price at $90.30, a gain of 0.066%.

The day’s trading range was significant, from a low of $89.00 to the high of $91.47, indicating both strong buying interest and afternoon selling pressure.

Key Financial Metrics for Arista Networks

To get a complete picture, a trader must consider these fundamental data points:

-

Market Cap: 11.33KCr

-

P/E Ratio: 38.18, suggesting investors expect future growth.

-

52-Week Range: The stock is trading between its 52-week low of $59.43 and a high of $133.58. At $90.24, it is positioned well off its lows but still has significant room before retesting its yearly high.

-

Dividend: The company does not currently offer a dividend, which is common for growth-oriented technology firms that prefer to reinvest earnings back into the business.

Market Outlook: Will the Stock Go Up on Monday?

Based on Friday’s closing data, there are bullish indicators for Arista Networks. The stock successfully defended the $90 level and closed above its previous day’s price. The positive after-hours trading, while minor, reinforces this sentiment.

Traders should watch two key levels on Monday:

-

Support: The day’s low of

89.68 will act as initial support levels. A break below these could signal a reversal of the positive momentum.

-

Resistance: The intraday high of $91.47 is the primary hurdle. If the stock can break through this level with strong volume, it could signal the start of another leg up.

The overall outlook for Monday appears cautiously bullish. The positive close suggests momentum may carry over, but the failure to hold the day’s high indicates that sellers are present.

Is it Right to Invest Today?

Since the market is closed, “today” means considering a position for Monday’s open. The decision depends heavily on your trading style and risk tolerance.

-

For Bullish Traders: The positive close and after-hours tick-up could be seen as a buy signal. An entry near the current levels with a stop-loss set below Friday’s low of $89.00 could be a viable strategy for those anticipating a move towards the $91.47 resistance.

-

For Cautious Investors: The pullback from the daily high might be a cause for patience. It may be prudent to wait for the stock to either decisively break the $91.47 resistance level or pull back to a stronger support level before entering a position.

In conclusion, Arista Networks stock showed strength and resilience in its last session. While the immediate momentum appears positive, traders should remain vigilant of the key support and resistance levels to navigate the potential volatility in the upcoming trading day.

Disclaimer: This article is for informational purposes only and is based on the data presented in the image. It is not financial advice. All investment and trading decisions should be made based on your own research and risk assessment. Market conditions can change rapidly.