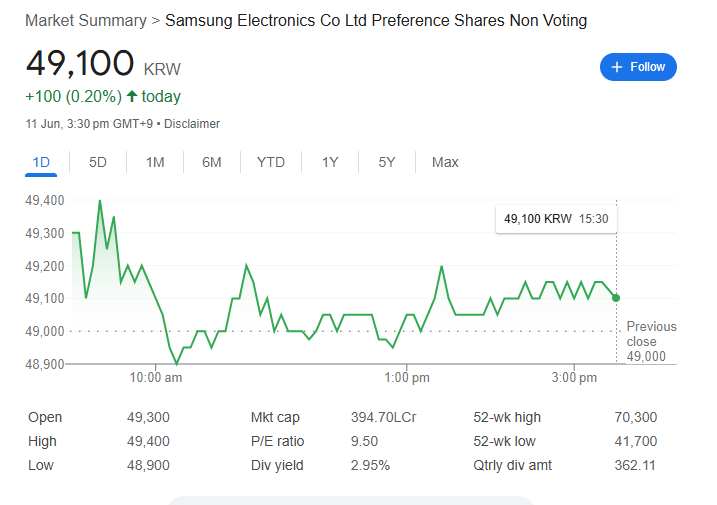

Samsung Preference Shares End Higher at 49,100 KRW: A Look at the 2.95% Dividend Yield and Today’s Volatility

Samsung Electronics Co Ltd’s non-voting preference shares navigated a volatile trading day to close in positive territory, ending the session on June 11th at 49,100 KRW. The stock posted a modest gain of 100 KRW (0.20%), demonstrating resilience after experiencing significant price swings earlier in the day.

This performance offers a glimpse into the current sentiment surrounding one of the world’s leading technology behemoths, particularly for investors focused on value and income.

A Rollercoaster Day on the Market

The trading day for Samsung’s preference shares was anything but flat. Here’s a summary of the action:

-

Opening: The stock opened strong at 49,300 KRW, well above the previous day’s close of 49,000 KRW.

-

Day’s High: Early optimism pushed the shares to a peak of 49,400 KRW.

-

Mid-Morning Dip: Following the initial high, the stock saw a sharp decline, hitting a session low of 48,900 KRW.

-

Recovery and Stabilization: Despite the drop, the shares staged a recovery and spent the remainder of the afternoon trading in a tighter range, ultimately settling at the 49,100 KRW closing price.

This pattern suggests that while there was selling pressure, buyers stepped in to support the stock, allowing it to finish the day with a slight gain.

Beyond the Daily Chart: Key Metrics for Investors

For those looking at the bigger picture, Samsung’s financial metrics reveal an interesting investment profile:

-

Market Capitalization: With a massive market cap of 394.70L Cr (approximately 394.7 trillion KRW), Samsung remains a cornerstone of the global tech industry.

-

P/E Ratio: The stock features a relatively low Price-to-Earnings (P/E) ratio of 9.50. This figure suggests that the shares may be attractively valued compared to their earnings, a stark contrast to the high P/E ratios often seen in the tech sector.

-

Attractive Dividend Yield: A key highlight for income-focused investors is the substantial 2.95% dividend yield. The company pays a quarterly dividend amount of 362.11 KRW per share, making it a compelling option for those seeking regular returns.

-

52-Week Range: The current price sits between the 52-week low of 41,700 KRW and the high of 70,300 KRW. This indicates that while the stock has recovered from its annual lows, there may still be significant room for growth to reach its prior peak.

What’s the Takeaway?

Today’s trading for Samsung Electronics’ preference shares highlights a stock with a dual identity: a global technology leader navigating daily market volatility while offering the fundamentals of a classic value and income investment. The combination of a low P/E ratio and a strong dividend yield makes it a noteworthy consideration for investors looking for stability and returns in a turbulent market.

Disclaimer: This article is for informational purposes only and is based on data available at the time of writing. It should not be considered financial advice. Please consult with a professional financial advisor before making any investment decisions.