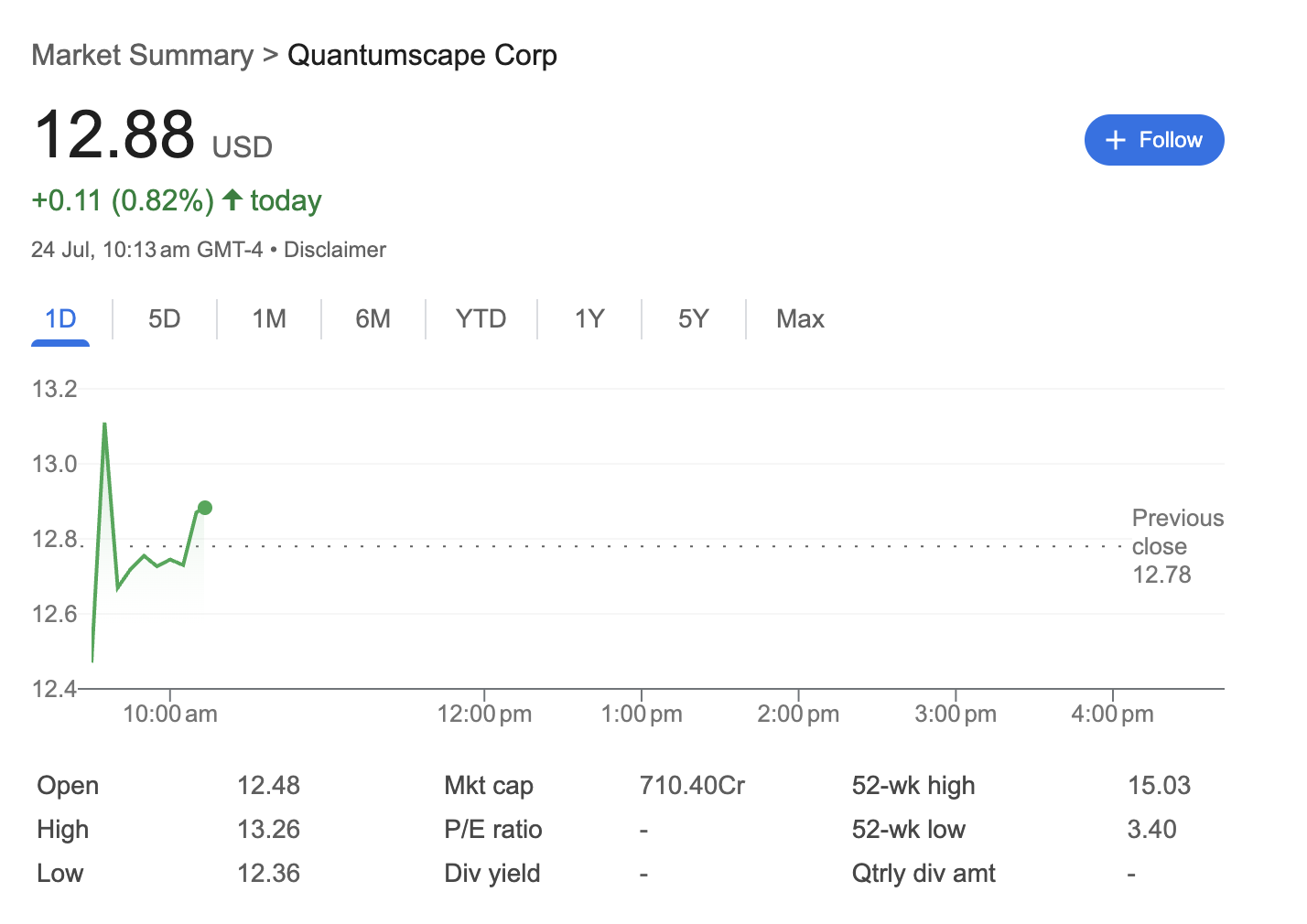

Quantumscape Stock Shows Early Volatility, Climbs into Positive Territory

New York, NY – Shares of Quantumscape Corp displayed significant volatility in early morning trading on July 24th, ultimately pushing into the green. As of 10:13 AM GMT-4, the solid-state battery developer’s stock was trading at $12.88, an increase of $0.11 or 0.82% for the session.

The stock’s movement came after an eventful opening, with the price fluctuating sharply before finding its footing above the previous day’s closing price of $12.78.

Technical Analysis

The intraday chart for Quantumscape highlights a turbulent start to the trading day. The stock opened lower at $12.48, below its previous close, and quickly hit a session low of $12.36. This was immediately followed by a powerful surge of buying pressure that drove the price to a session high of $13.26. Following this peak, the stock pulled back before settling at its current level.

Key technical levels for traders to monitor:

-

Intraday Support: The session low of $12.36.

-

Intraday Resistance: The session high of $13.26 serves as the immediate ceiling.

-

Key Pivot: The previous close of $12.78 is a critical level the stock is currently holding above.

-

52-Week Range: The stock is trading in the upper half of its 52-week range of $3.40 to $15.03, suggesting it has recovered significantly from its lows over the past year.

The “V-shaped” recovery from the morning low is a short-term bullish signal, indicating strong dip-buying interest.

Fundamental Analysis

The market data provides a snapshot of Quantumscape’s fundamental standing as a development-stage company.

-

Market Capitalization: The company has a market capitalization listed at 710.40Cr.

-

Profitability: There is no Price-to-Earnings (P/E) ratio available. This is typical for companies like Quantumscape that are still in the research and development phase and are not yet generating profits. Investor focus is primarily on the company’s long-term technological potential rather than current earnings.

-

Dividends: Quantumscape does not offer a dividend. As a pre-revenue company, it reinvests all available capital into research, development, and scaling its solid-state battery technology.

Sentiment Analysis

The market sentiment for Quantumscape appears to be cautiously optimistic but marked by high volatility. The positive percentage gain indicates that, on balance, bulls have the upper hand. However, the wide trading range between the day’s high (12.36) in such a short period points to significant disagreement among investors about the stock’s short-term valuation. The strong buying that followed the initial dip suggests positive underlying sentiment and a willingness from investors to step in on price weakness.

Disclaimer: This article is for informational purposes only and is based on market data at a specific point in time. It should not be considered financial or investment advice. All investment decisions should be made with the help of a qualified professional.