Intel Rollercoaster Ride: Stock Plummets Nearly 6%, Erasing Prior Gains

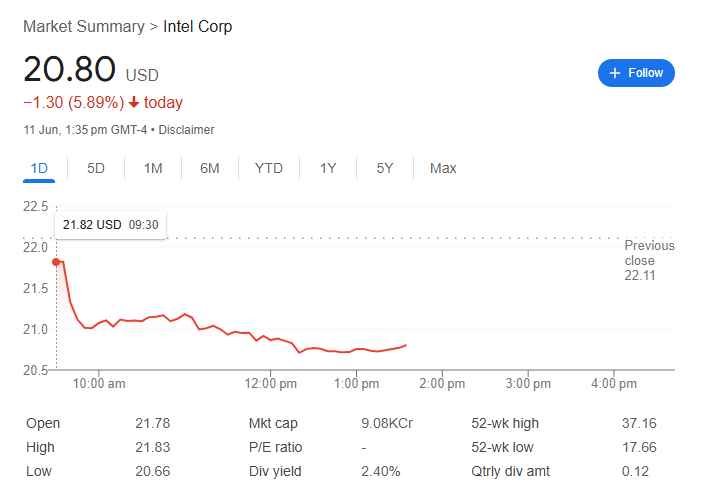

In a stark reversal of fortune, Intel Corporation (INTC) stock took a sharp downturn on Tuesday, wiping out the impressive gains from the previous trading session. As of 1:35 PM GMT-4 on June 11, the tech giant’s shares were trading at 1.30, or 5.89%, for the day.

This dramatic slide highlights the intense volatility surrounding the semiconductor giant as it navigates a complex market. The bullish sentiment from the prior day quickly evaporated, replaced by heavy selling pressure right from the opening bell.

Dissecting the Day’s Decline

The trading day began on a negative note and only worsened for Intel. The stock opened at $21.78, well below the previous close of $22.11. After a brief peak at $21.83, it began a steady and relentless descent.

As the intraday chart clearly shows, there was no recovery. The stock slid throughout the morning, establishing a new daily low of $20.66 before finding some semblance of stability around the $20.80 mark. This price action indicates a decisive shift in investor sentiment, turning yesterday’s optimism on its head.

A Snapshot of Intel’s Financials

The day’s sell-off has shifted some of Intel’s key financial metrics:

-

Current Price: $20.80 USD

-

Day’s Loss: -1.30 (-5.89%)

-

Day’s Range: $20.66 (Low) to $21.83 (High)

-

52-Week Range: $17.66 to $37.16

-

Market Cap: 9.08KCr

-

Dividend Yield: 2.40%

-

Quarterly Dividend Amount: $0.12

-

P/E Ratio: – (Not Available)

What Do the Numbers Tell Us?

This sharp decline places Intel back into a challenging position within its 52-week range. While still above the low of $17.66, it is now even further from its yearly high of $37.16, underscoring the long road ahead for its recovery.

Interestingly, the stock’s plunge has pushed its dividend yield up to 2.40%. For income-focused investors, a lower share price makes the fixed quarterly dividend of $0.12 more attractive on a percentage basis. However, the persistent absence of a P/E ratio, indicating a lack of recent net profitability, remains a significant concern for growth and value investors alike.

Today’s price action serves as a potent reminder that a single day’s rally does not necessarily signal a long-term trend. For Intel, the path forward appears to be a battle between those who believe in its long-term turnaround strategy and those who are reacting to more immediate competitive and market pressures. Investors will be watching closely to see if the stock can find a support level or if further downside is in store.