From Gain to Pain: Apple Stock Tumbles, Briefly Sinking Below $200 Mark

In a sharp reversal of recent fortunes, Apple Inc. (AAPL) shares faced significant selling pressure during mid-day trading on June 11th. The tech behemoth’s stock dipped, highlighting the ongoing volatility in the tech sector and giving investors a moment of pause.

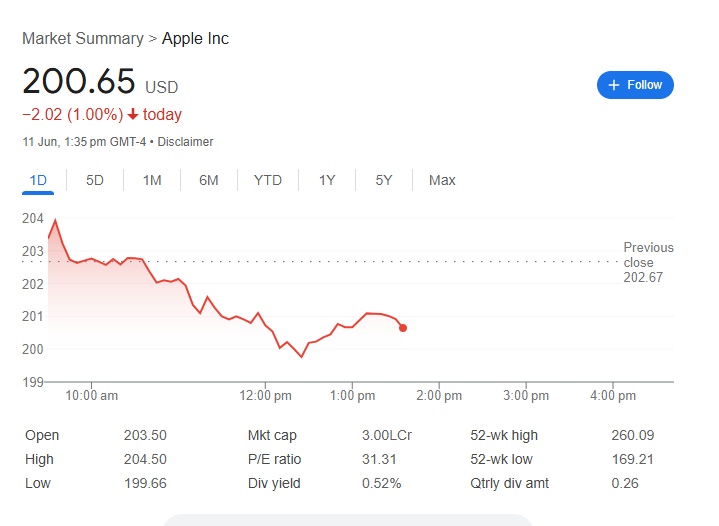

As of 1:35 pm GMT-4, Apple’s stock was priced at 200.65 USD, marking a notable decline of -2.02, or a full 1.00%, for the day. The prominent red figures painted a starkly different picture from the previous day’s marginal gains.

Unpacking the Day’s Bearish Trend

The one-day (1D) chart for Apple tells a story of sustained downward momentum:

-

Optimistic Open: The day began on a high note, with the stock opening at 203.50 USD, well above the previous close of 202.67 USD. It quickly surged to a day’s high of 204.50 USD shortly after the bell.

-

A Steady Decline: This early optimism was short-lived. The stock began a consistent descent throughout the morning, breaking through several support levels.

-

Breaching a Key Level: Critically, the stock hit an intraday low of 199.66 USD, briefly falling below the psychologically important $200 threshold.

-

Afternoon Attempt: A modest recovery attempt in the early afternoon brought the price back above $200, but it remained firmly in negative territory.

Key Financials Amid the Dip

Even with the daily drop, Apple’s core financial metrics remain formidable:

-

Market Cap: 3.00LCr – Despite the share price reduction, Apple maintains its standing in the exclusive club of companies valued at $3.00 Trillion.

-

P/E Ratio: 31.31 – The Price-to-Earnings ratio remains robust, indicating continued long-term investor confidence in Apple’s profitability and growth.

-

Dividend Details: The stock offers a dividend yield of 0.52%, which corresponds to a quarterly dividend amount of $0.26 per share, providing a consistent return to shareholders.

-

52-Week Perspective: The current price is still well above its 52-week low of 169.21 USD but has a significant way to go to reclaim its 52-week high of 260.09 USD.

Investor Takeaway

The 1% drop and the brief dip below $200 serve as a crucial reminder of market sentiment’s fluid nature. While long-term fundamentals like a $3 trillion valuation and steady dividends provide a strong foundation, short-term volatility is always a factor. Investors will be closely watching to see if the $200 level acts as a new support floor or if this downward trend has further to run.