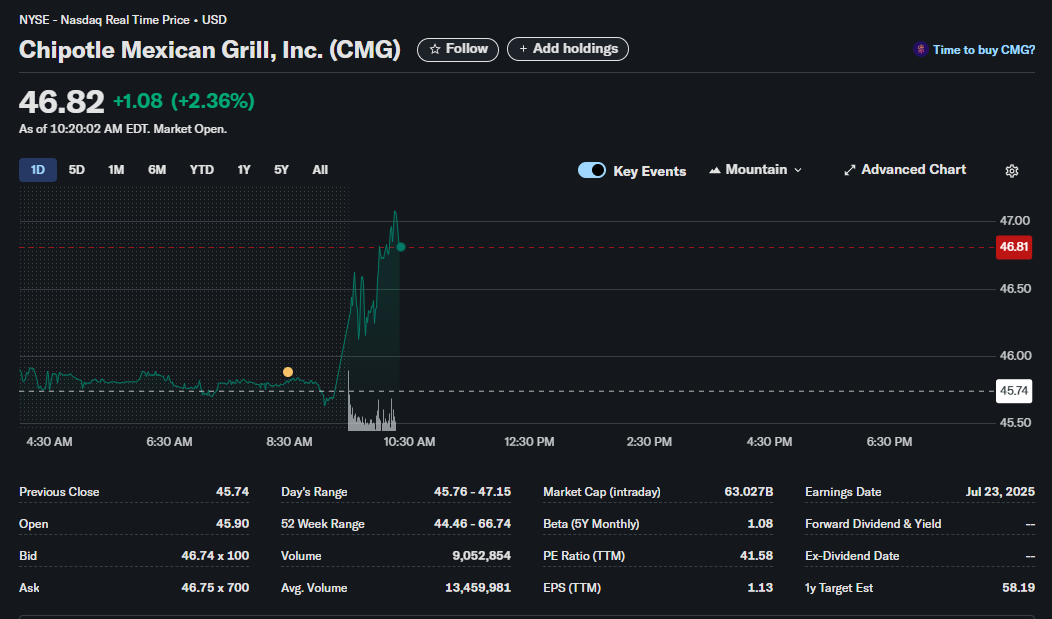

Chipotle (CMG) Stock Analysis: Breaking Down the Morning Surge

Chipotle Mexican Grill, Inc. (CMG) saw a significant surge in its stock price during early market hours, gaining over 2%. This report breaks down the available data from a technical, fundamental, and sentiment perspective to provide a comprehensive overview of the stock’s performance as of 10:20 AM EDT.

IMPORTANT DISCLAIMER: This article is for informational and educational purposes only and is based on the data presented in the provided image. It does not constitute financial advice. All investment decisions should be made with the guidance of a qualified financial professional.

Technical Analysis

Technical analysis focuses on chart patterns, trading volume, and price action to predict future movements.

-

Price Action and Momentum: The 1-day chart for CMG reveals a dramatic shift in momentum at the market open (9:30 AM). After trading in a relatively tight, flat range during pre-market hours, the stock experienced a sharp and immediate spike in price. This strong upward move indicates a sudden influx of buying pressure.

-

Volume Confirmation: Critically, the price surge was accompanied by a massive spike in trading volume, as seen in the bar chart at the bottom of the price graph. High volume on a significant price move gives the move more validity, suggesting it is driven by broad market participation rather than a small number of trades.

-

Key Levels:

-

Support: The previous close of 45.76 act as initial support levels.

-

Resistance: The intraday high of $47.15 is the immediate resistance level that traders will be watching.

-

Fundamental Analysis

Fundamental analysis examines a company’s financial health and valuation metrics to determine its intrinsic value.

-

Valuation (P/E Ratio): Chipotle’s Price-to-Earnings (P/E) Ratio (TTM) stands at 41.58. This figure, often considered high relative to the broader market average, suggests that investors have strong expectations for the company’s future earnings growth. It is a hallmark of a growth stock.

-

Company Size and Profitability: With a Market Cap of 1.13 (TTM) confirms that the company is profitable on a per-share basis.

-

Analyst Outlook (1y Target Est): The 1-year Target Estimate is $58.19. This consensus figure from analysts is significantly above the current trading price, indicating a bullish long-term outlook on the stock’s potential value.

-

Volatility (Beta): The stock’s 5-year monthly Beta is 1.08. A Beta greater than 1.0 suggests that CMG is slightly more volatile than the overall market.

Sentiment Analysis

Sentiment analysis gauges the overall mood or feeling of investors toward a stock.

-

Bullish Short-Term Sentiment: The primary sentiment indicator is the powerful positive price action (+2.36%) on exceptionally high volume. This combination demonstrates strong buying interest and overwhelmingly positive short-term sentiment from the market at the open.

-

Bid-Ask Dynamics: The bid-ask spread is tight ($46.74 vs. $46.75), indicating good liquidity. The ask size (700 shares) is notably larger than the bid size (100 shares) at this moment, which could suggest a block of shares is available for sale at that price point, but it hasn’t deterred the overall upward momentum.

-

Positive Analyst Consensus: The bullish 1-year target estimate of $58.19 serves as a strong indicator of positive long-term sentiment from the professional analyst community.

Conclusion

The morning activity for Chipotle (CMG) stock is characterized by a technically strong breakout on high volume. This is supported by fundamental metrics that portray a profitable, high-growth company, albeit with a premium valuation. Market sentiment, as reflected by both the trading activity and analyst estimates, is clearly positive. Investors will be watching to see if the stock can maintain its momentum and consolidate at these higher levels throughout the trading day.