Amazon Stock Slides 1% in Mid-Day Trading: A Closer Look at the Numbers

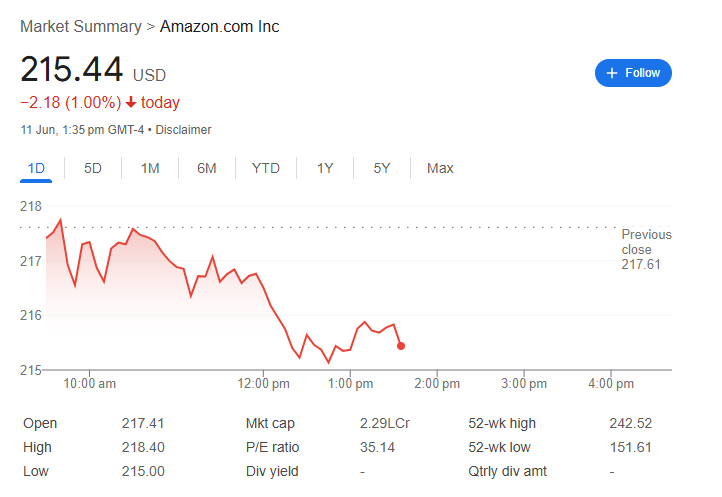

Shares of the e-commerce and cloud computing behemoth Amazon.com Inc. (ticker: AMZN) are feeling the pressure in today’s trading session. As of 1:35 PM GMT-4 on June 11th, the stock was trading at $215.44 USD, marking a decline of 1.00% for the day.

The drop represents a pullback from the previous day’s close of $217.61, painting a bearish picture for the tech giant in the first half of the trading day.

A Look at the Intraday Action

The intraday chart reveals a consistent downward trend for Amazon’s shares. After opening at 218.40** in the opening hour. However, it quickly succumbed to selling pressure, steadily declining throughout the morning.

The stock found its intraday low of $215.00 shortly after 12:30 PM before attempting a minor, tentative bounce. This price action suggests that sellers have been in control for most of the session.

Key Financials for Investors

A snapshot of the key metrics provides deeper insight into Amazon’s current market standing:

-

Market Capitalization: The data displays a market cap of “2.29LCr.” While this notation is common in some regions, it’s important to note that Amazon is a multi-trillion dollar company, solidifying its place as one of the most valuable corporations in the world.

-

P/E Ratio: With a Price-to-Earnings (P/E) ratio of 35.14, Amazon’s valuation reflects sustained investor confidence in its future growth potential, particularly in its high-margin cloud computing (AWS) and advertising segments.

-

52-Week Performance: Despite today’s dip, the current price of 151.61** and is within striking distance of the 52-week high of $242.52. This indicates a strong overall performance for the stock over the past year.

-

Dividend Policy: Notably for income investors, Amazon does not pay a dividend, as indicated by the “-” for dividend yield and quarterly dividend amount. This is part of the company’s long-standing strategy of reinvesting all profits back into the business to fuel innovation and expansion.

In conclusion, while June 11th marks a day of retreat for Amazon’s stock, the broader context reveals a company with a robust valuation and a strong long-term performance track record. Investors will be watching closely to see if the stock can find support at these levels or if the downward trend will continue into the market close.