Exxon Mobil’s Powerful Rally Fuels Bullish Hopes for Monday’s Market

NEW YORK – Wall Street is heading into the new trading week with a strong tailwind after energy giant Exxon Mobil (NYSE: XOM) posted a formidable rally on Friday, signaling robust investor confidence and pointing towards a higher market open on Monday.

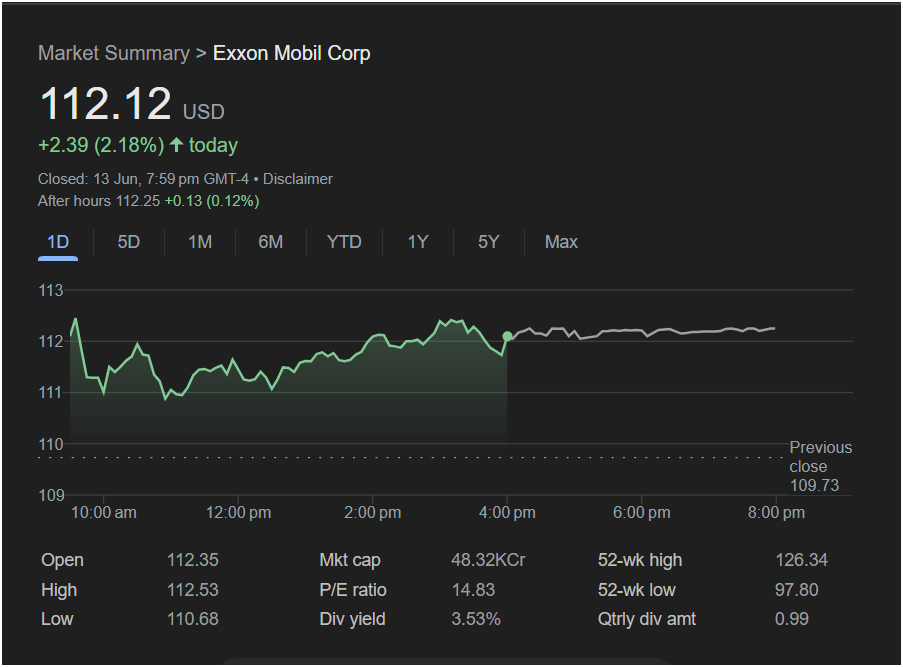

Exxon Mobil, a critical bellwether for the energy sector and the broader economy, surged an impressive 2.18% to close at $112.12. The buying pressure didn’t stop at the closing bell, with the stock ticking up another 0.12% in after-hours trading. This sustained momentum provides a compelling case for a “risk-on” start to the week.

The intraday price action was a textbook display of strength and resilience. After gapping up at the open, the stock weathered a brief period of early profit-taking, which set the session low of $110.68. From there, buyers took firm control, driving the stock on a steady and determined climb for the remainder of the day. The ability to shake off early selling and close near the session’s high is a powerful indicator of bullish conviction.

Here’s the analysis for Monday’s potential market direction based on XOM’s performance:

The Bull Case for Monday: A Resounding “All Clear”

The Bull Case for Monday: A Resounding “All Clear”

The argument for a higher market on Monday is exceptionally strong. The powerful move in a cyclical leader like Exxon Mobil suggests investors are betting on economic strength and are not shying away from risk. The key takeaways are:

-

Resilient Buying: The recovery from the morning low shows that dip-buyers are aggressive and confident.

-

Strong Close: Finishing the day near the highs, combined with a positive after-hours performance, indicates that the bullish momentum has a high probability of carrying over into Monday’s session.

-

Sector Leadership: A rally this strong in the energy sector often precedes or coincides with broad market gains as it reflects positive sentiment about global economic activity.

The Bear Case for Monday: A Contrarian View

It is difficult to construct a bearish argument from this chart. However, a determined pessimist might point out that the stock opened near its high for the day and spent the session just trying to reclaim that level. They could also argue that strength in a single sector like energy might come at the expense of others, such as technology, in a “sector rotation” scenario. This would mean that while the Dow Jones Industrial Average might rise, the Nasdaq could lag. However, this is a weak argument against the overwhelming evidence of buying pressure.

Outlook:

All signs from Exxon Mobil’s chart point to a market poised to go up on Monday. The combination of a significant daily gain, a resilient recovery from the lows, and a strong close backed by after-hours buying creates a decidedly bullish backdrop. Expect investors to carry this positive sentiment into the opening bell, with the energy and industrial sectors likely leading the charge.