AMD Stock Climbs Over 1% Amidst Volatile Morning Trading

Shares of Advanced Micro Devices Inc. (AMD) showed resilience and positive momentum on the morning of July 24th, rising more than 1% in a notably volatile session that saw the stock spike before finding its footing.

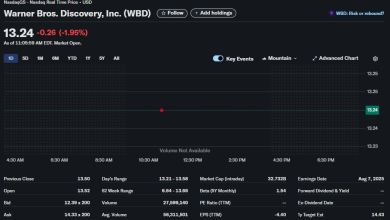

As of 10:39 am GMT-4, the semiconductor company’s stock was trading at 160.55 USD, marking a gain of $1.90, or 1.20%, for the day. The session began with significant price swings, indicating a dynamic interplay between buyers and sellers in the market.

Technical Analysis: A Story of an Early Spike and Recovery

The intraday chart for AMD reveals a classic pattern of early-session volatility.

-

Volatile Price Action: The stock opened at 162.35**, and then just as rapidly fell to a low of $158.36. This V-shaped movement suggests an initial wave of strong buying pressure was met with significant profit-taking, after which buyers stepped back in to support the price.

-

Key Price Levels: The current price of $160.55 is comfortably above the previous day’s close of $158.65. While it has pulled back from its daily high, its recovery from the daily low shows underlying strength.

-

Yearly Context: AMD is trading significantly above its 52-week low of 174.05, a key resistance level that investors will be watching.

Fundamental Analysis: A High-Growth, High-Valuation Profile

The fundamental metrics for AMD paint the picture of a company valued on its future potential.

-

Market Capitalization: The market cap is listed as 26.12KCr. This notation, likely representing Kilo Crore from an international data source, should be interpreted with caution. Investors should refer to primary US market sources, where AMD’s market capitalization is typically reported in the hundreds of billions of USD.

-

P/E Ratio: AMD has a very high Price-to-Earnings (P/E) ratio of 117.69. Such a high multiple indicates that investors are willing to pay a significant premium for the company’s shares, based on strong expectations for substantial future earnings growth, particularly in areas like AI and data centers.

-

Dividend Policy: The company’s dividend yield and quarterly dividend amount are both listed as “-“, signifying that AMD does not currently pay a dividend. This is a common strategy for growth-oriented technology firms that prefer to reinvest all available capital into research, development, and expansion to solidify their market position.

Sentiment Analysis: Positive but Contested

The overall market sentiment for AMD appears bullish, though not without some contention.

-

Positive Momentum: The 1.20% gain is a clear signal of positive sentiment driving the stock higher for the day.

-

Evidence of Profit-Taking: The sharp sell-off from the intraday high of $162.35 is a strong indicator that some traders and investors are actively taking profits, especially as the stock climbs. This creates resistance and contributes to volatility.

-

Underlying Bullish Conviction: The stock’s ability to find support and bounce back from its intraday low demonstrates that there is a solid base of buyers who see value at these levels, reflecting confidence in the company’s long-term narrative. The exceptionally high P/E ratio further solidifies this view of long-term bullish sentiment.

Conclusion

Advanced Micro Devices Inc. is navigating a positive but volatile trading session, underpinned by strong investor belief in its future growth. While the technicals show a dynamic battle between buyers and sellers, the fundamental picture is one of a company with a premium valuation driven by high expectations. The market sentiment remains positive, but investors are also demonstrating a readiness to take profits, setting the stage for a potentially active trading day.

Disclaimer: This article is for informational purposes only and is based on data from the provided image. It should not be considered financial or investment advice. All investors should conduct their own thorough research and consult with a qualified financial professional before making any investment decisions.