AMD Stock Falters, Dropping Over 1% as Early Gains Evaporate

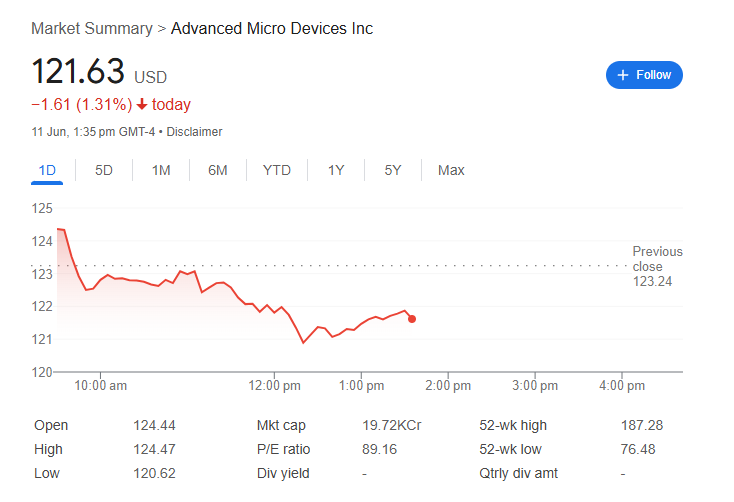

Shares of semiconductor giant Advanced Micro Devices, Inc. (AMD) are facing significant selling pressure today, retreating from an optimistic open to trade firmly in the red. As of 1:35 pm GMT-4 on June 11, AMD stock was priced at 1.61 or 1.31% for the session.

The downward move puts a spotlight on the stock’s recent volatility and its position relative to its yearly highs. Let’s delve into the data to unpack the day’s trading action.

A Tale of a Tough Trading Day

The session for AMD began on a promising note, opening at $124.44, noticeably higher than the previous day’s close of 124.47** before sellers stepped in, pushing the price steadily downward.

The selling pressure intensified through the morning, driving the stock to a session low of $120.62. This price action, characterized by a failure to hold opening gains, suggests that investors may be taking profits or expressing caution about the company’s near-term outlook.

Key Metrics Behind the Movement

Today’s performance is best understood within the context of AMD’s broader financial landscape:

-

Valuation Concerns? AMD sports a high Price-to-Earnings (P/E) ratio of 89.16. While this indicates strong investor expectations for future growth, particularly in the AI chip space, such a high valuation can also make a stock more susceptible to pullbacks during periods of market uncertainty.

-

A Look at the Annual Range: The current price sits significantly below the 52-week high of $187.28, highlighting that the stock has been in a corrective phase. At the same time, it remains well above the 52-week low of $76.48, reflecting substantial gains over the past year. This places the stock at a critical juncture for traders.

-

Growth Over Income: As is common with many high-growth tech companies, AMD does not currently offer a dividend, with investors primarily focused on capital appreciation.

-

Market Position: With a market capitalization in the hundreds of billions (noted as 19.72KCr), AMD is a cornerstone of the semiconductor industry and a key competitor in the global tech race.

What Does This Mean for Investors?

Today’s decline could be part of a broader consolidation trend for AMD. After a phenomenal run, high-valuation stocks often experience periods of correction as the market digests their future prospects. For long-term believers in AMD’s role in powering AI and high-performance computing, this dip might be seen as a potential entry point. For others, the failure to hold the high open could be a bearish signal, suggesting more downside might be on the horizon.

Investors will be closely watching whether the day’s low of $120.62 can act as a new support level or if the stock is poised to test lower prices in the coming sessions.