Broadcom’s Ticker Tells a Tale: Inside a Day of Volatility and What It Signals for the Tech Giant’s Future

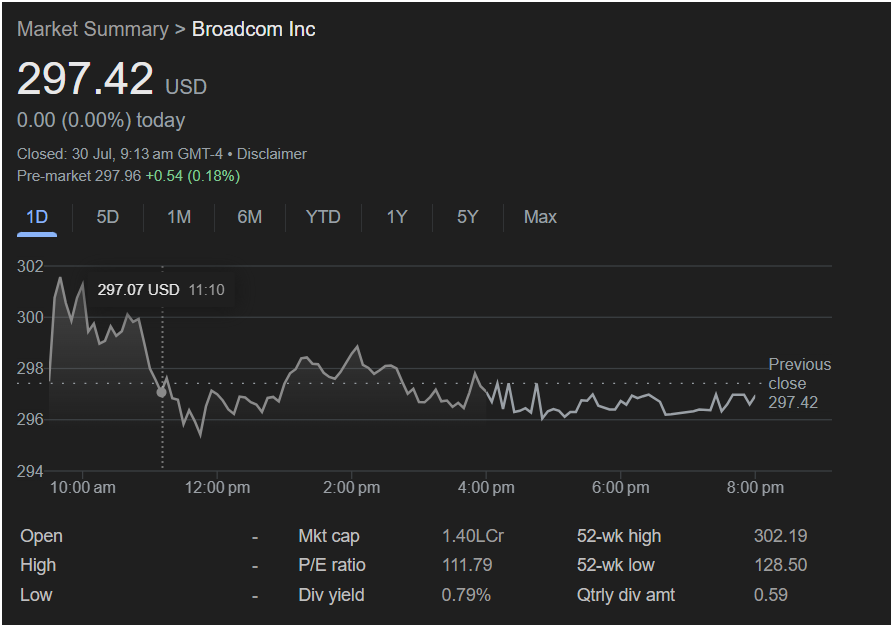

A quick glance at the market summary for Broadcom Inc. (NASDAQ: AVGO) on this particular day might suggest a period of unusual calm. A closing price of

0.00 (0.00%), paints a picture of stillness, a stock perfectly in balance. But that single, static number conceals a dramatic story—a day of sharp intraday swings, investor indecision, and the relentless hum of activity that defines one of the most important technology companies on the planet.

This snapshot in time, showing a volatile journey to a flat close, serves as a perfect microcosm for the broader narrative surrounding Broadcom. It is a company of immense scale and quiet dominance, a titan whose products form the invisible backbone of our digital world. To understand the story of this single trading day is to begin to understand the complex forces shaping Broadcom, the semiconductor industry, and the future of technology itself. This deep dive will dissect that single day’s chart, decode the critical financial metrics, and explore the vast industrial and strategic landscape in which Broadcom operates.

Anatomy of a Trading Day: The Drama Behind a 0.00% Change

The stock market is often a story of sentiment, and the day’s chart for Broadcom is a textbook example. The session didn’t open flat; it began with a struggle between buyers and sellers that played out over hours.

-

The Morning Surge and Swift Reversal: The chart indicates the stock started the day on a strong footing, pushing above the $300 mark to a high near its 52-week peak of $302.19. This early optimism could have been driven by positive pre-market sentiment, broader market strength, or company-specific news. However, this peak was short-lived. A wave of selling pressure emerged, initiating a steep decline.

-

The Mid-Morning Plunge: The most dramatic moment of the day is explicitly highlighted: at 11:10 am, the stock hit a low point of $297.07. This sharp, vertical drop of over $5 from its high represents a significant shift in intraday sentiment. Such moves are rarely random. They can be triggered by a host of factors: a key market index turning negative, a competitor’s announcement, a research note from an influential analyst, or simply a large institutional investor deciding to take profits. Whatever the cause, it was enough to erase the morning’s gains and send the stock into negative territory for the day.

-

The Afternoon Grind: Following the plunge, the stock didn’t simply rebound. Instead, it entered a long, choppy phase of consolidation. For hours, from noon until the late afternoon, the price action was a jagged line, oscillating within a tight range around the $296 to $298 level. This pattern suggests a market in equilibrium, where neither bulls nor bears could gain a decisive advantage. Buyers would step in at the lows, preventing a further slide, while sellers would cap any attempt at a significant rally. This “grind” is often the market digesting earlier news and searching for its next direction.

-

The Closing Bell: In the final hours of trading, the stock clawed its way back to where it began, ultimately settling at $297.42—the exact same price as the previous day’s close. This “flat close” is deceptive. It wasn’t a day of inactivity, but rather a day of intense conflict that ended in a stalemate, leaving investors to wonder what the next session would bring.

Decoding the Financial Vitals: More Than Just Numbers

Beneath the chart lie the fundamental metrics that provide a deeper context for Broadcom’s valuation and investment thesis. Each number tells a part of the company’s story.

P/E Ratio: 111.79

The Price-to-Earnings (P/E) ratio is one of the most-watched valuation metrics, and Broadcom’s figure of 111.79 immediately stands out. A P/E this high suggests that investors are willing to pay a significant premium for the company’s earnings, signaling massive expectations for future growth. For context, the average P/E for the S&P 500 often hovers between 20 and 30.

Why such a high valuation? It reflects Broadcom’s dominant position in high-growth sectors. The company is not just a participant but a leader in markets like networking for data centers, wireless components for smartphones, and broadband access. Investors are betting that the proliferation of AI, 5G, and the Internet of Things (IoT) will fuel extraordinary, sustained growth for Broadcom’s earnings, justifying today’s premium price. However, a high P/E also introduces risk; if growth falters or fails to meet these lofty expectations, the stock could be vulnerable to a significant correction.

Dividend Yield: 0.79% (Quarterly Dividend: $0.59)

At first glance, a dividend yield of 0.79% may not seem exciting to income-focused investors. But this is where Broadcom’s strategy becomes clear. The company is a prime example of a “dividend growth” stock. Under the leadership of CEO Hock Tan, Broadcom has adopted a policy of returning approximately 50% of its prior year’s free cash flow to shareholders via dividends.

This has resulted in one of the most aggressive dividend growth rates in the entire tech sector. While the yield based on the current stock price is modest, the focus for long-term investors is on the rapid increase of the dividend payment itself. This strategy signals management’s confidence in future cash flow generation and a commitment to shareholder returns, balancing its high-growth profile with a tangible reward for investors.

52-Week Range: $128.50 – $302.19

This vast range tells a story of incredible momentum and volatility. It shows a stock that has more than doubled from its low, reflecting a powerful recovery and a surge in investor enthusiasm for the semiconductor sector. This journey from the low to the high was likely fueled by the “semiconductor supercycle”—a period of unprecedented demand driven by digital transformation across every industry. The fact that the stock was trading near its 52-week high indicates that, despite the intraday volatility, the dominant, longer-term trend remained powerfully bullish.

Broadcom: The Tech Titan Hiding in Plain Sight

To truly understand the stock, one must understand the company. Broadcom Inc. is the result of the 2016 acquisition of Broadcom Corporation by Avago Technologies. The combined entity, led by Avago’s brilliant and demanding CEO Hock Tan, kept the more recognizable Broadcom name but retained Avago’s operational DNA and M&A-driven strategy.

Today, Broadcom operates in two primary segments:

-

Semiconductor Solutions: This is the company’s core. Broadcom designs and supplies a vast portfolio of chips that are essential for modern technology. Its products are leaders in networking (powering the switches and routers in massive data centers), broadband (enabling high-speed internet to homes), and wireless (providing critical components for top-tier smartphones, including Apple’s iPhone).

-

Infrastructure Software: Through a series of major acquisitions, including CA Technologies and Symantec’s enterprise security business, Hock Tan has built a formidable software division. The strategy is to acquire established, “sticky” software companies that serve large enterprise customers, generating stable, recurring revenue and massive cash flows. This software revenue provides a powerful counterbalance to the more cyclical nature of the semiconductor business.

This hybrid model is Broadcom’s unique strength. It leverages its dominance in mission-critical hardware while bolstering its financial foundation with the predictable cash flow from enterprise software.

The Macro Landscape: Supercycles and Supply Chains

No company, not even one as powerful as Broadcom, exists in a vacuum. Its performance is intrinsically linked to immense global trends.

-

The Semiconductor Supercycle: The world is hungry for chips. The transition to 5G, the explosion of AI and machine learning, the buildout of cloud data centers, and the proliferation of smart devices have created a structural increase in demand for semiconductors. Broadcom is perfectly positioned at the epicenter of this trend, supplying the high-performance components that make it all possible.

-

Geopolitical Tensions: The strategic importance of semiconductors has placed the industry at the heart of geopolitical competition, particularly between the U.S. and China. Policies like the CHIPS Act in the United States aim to bolster domestic manufacturing and research, creating both opportunities and complexities for global players like Broadcom.

-

Supply Chain Dynamics: The global chip shortage that marked recent years highlighted the fragility of the semiconductor supply chain. For a fabless design company like Broadcom (which designs chips but outsources manufacturing to foundries like TSMC), this environment creates a complex dynamic of pricing power and potential production bottlenecks.

The Road Ahead: Questions for Investors

The story of Broadcom is far from over. The single day of trading, with its hidden volatility and flat close, is a reminder that the path forward will be dynamic. For investors and market watchers, several key questions remain. Can the company continue to execute its ambitious M&A strategy, as seen with its more recent move to acquire VMware, without succumbing to integration risks or regulatory hurdles? Will the semiconductor supercycle continue unabated, or will macroeconomic headwinds like inflation and rising interest rates eventually cool demand? And can Broadcom maintain its leadership position against a backdrop of fierce competition and evolving technological paradigms?

The answers to these questions will be written in future earnings reports, strategic announcements, and, of course, the daily narrative of its stock chart. Each day, like the one captured in the image, will add another chapter to the ongoing story of this essential, complex, and fascinating technology giant.