Disney Stock Slips as Wall Street Awaits Earnings and Grapples With Streaming Regulations

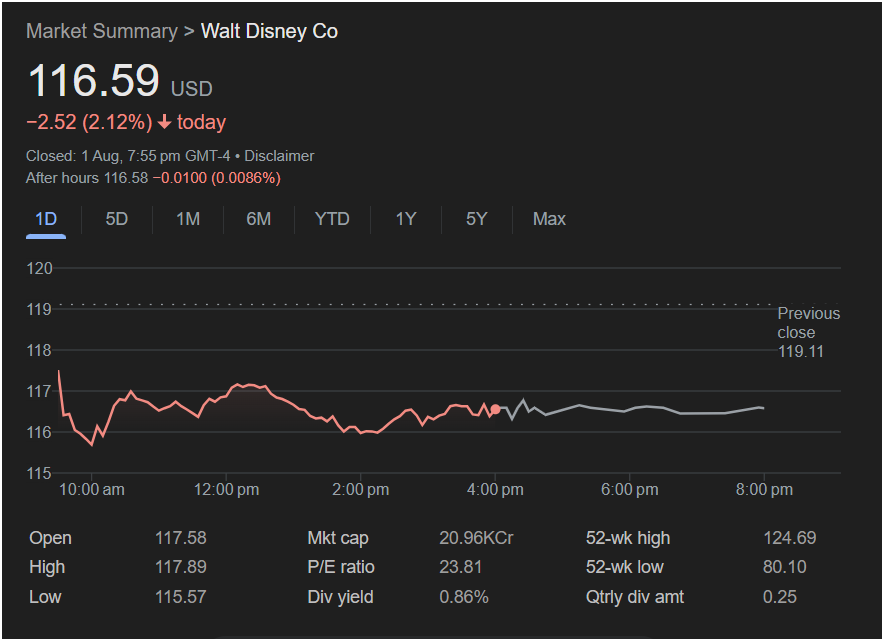

BURBANK, CA – August 1, 2025 — Shares of The Walt Disney Company (NYSE: DIS) continued their downward slide Friday, closing at $116.59, a decline of 2.12% for the day and marking the seventh straight day of losses. The dip comes amid broad market weakness, heightened regulatory scrutiny, and investor caution ahead of the company’s Q3 earnings release, slated for August 6, 2025.

Trading activity on Friday saw Disney open at $117.58, reaching an intraday high of $117.89 before retreating to a low of $115.57. The after-hours session reflected continued unease, with shares inching slightly lower. Compared to its previous close of $119.11, the stock has now shed more than 3% over the past week, raising questions about short-term investor sentiment in the face of rising uncertainties.[1][4][5]

Regulatory Headwinds Cloud the Streaming Outlook

Regulatory Headwinds Cloud the Streaming Outlook

Among the key catalysts dragging on Disney’s performance is a new amendment to California’s Automatic Renewal Law, which took effect July 1. The updated regulation imposes tighter restrictions on subscription-based services, particularly requiring companies to provide simplified cancellation processes and clearer disclosures for renewals.[5]

With Disney+ playing a central role in the company’s future, the law could add friction to subscriber acquisition and retention efforts in the largest U.S. media market. While analysts haven’t revised long-term streaming forecasts yet, many are watching closely to see how Disney and other platforms adapt to avoid regulatory penalties and retain users.

Streaming Metrics Under Scrutiny

Investor attention is firmly fixed on Disney+ subscriber numbers, which stood at approximately 124.6 million global users as of Q1 2025.[11][12] Although the platform has experienced quarterly fluctuations, it remains a pillar of Disney’s direct-to-consumer strategy. Analysts are expected to dissect new sub counts, churn rates, and average revenue per user (ARPU) in next week’s earnings release.

Adding to the intrigue, Disney has slated major content drops in August, including “Eyes of Wakanda,” an animated entry in the Marvel Cinematic Universe that could offer a mid-quarter boost to engagement metrics.[13]

Earnings Preview: Market Braces for Clarity

Wall Street is bracing for Disney’s third-quarter fiscal 2025 earnings report. Analysts currently forecast earnings per share (EPS) of approximately $1.45 on $23.7 billion in revenue — a year-over-year improvement, albeit in a tighter operating environment.[2][3][8]

The earnings call is likely to offer fresh insight into the company’s multi-pronged strategy, including performance across Parks and Experiences, broadcast and cable networks, and international operations.

Despite short-term volatility, Disney has maintained a “Moderate Buy” consensus among analysts, with some firms raising their price targets in recent months. Market participants appear divided between near-term caution and long-term optimism surrounding Disney’s intellectual property moat, diversified revenue streams, and leadership in entertainment assets.[3][9][10]

Theme Parks: Expansion Amid Operational Adjustments

Away from the digital front, Disney’s Parks, Experiences and Products division continues to evolve. Construction is actively underway on the new Tropical Americas land at Animal Kingdom, which will feature an attraction based on the film “Encanto.”[14]

Meanwhile, Walt Disney World has introduced more “Good-to-Go Days” in August for Annual Passholders, aimed at increasing flexibility and visitation.[15] However, some operational pauses remain in effect — including a brief suspension of the “Wonderful World of Animation” nighttime show at Hollywood Studios through early August.[16]

These updates reflect the company’s ongoing strategy to balance crowd control, guest experience, and cost efficiencies amid post-pandemic recalibrations.

A Complex Week Ahead for Disney Investors

Disney’s latest stock pullback comes during a week of heightened market sensitivity. Broader indexes were under pressure Friday, as the Dow, S&P 500, and Nasdaq all registered losses exceeding 1%, weighed down by a disappointing July jobs report and a renewed global tariff dispute stoked by the White House.[6]

While macroeconomic turbulence plays its role, company-specific narratives — from streaming regulation and content performance to upcoming earnings and subscriber trends — will likely define the next chapter for Disney’s stock.

The next few trading sessions could prove pivotal as Disney attempts to reassure Wall Street and realign its story for the second half of 2025. Investors and analysts alike will be watching closely for commentary on the future of streaming growth, regulatory compliance strategies, and the continued monetization of its powerful intellectual properties.