Mastercard Suffers Major Sell-Off, Braces for a Bearish Monday

NEW YORK – Mastercard Inc. (MA) shares took a severe beating in Friday’s trading session, wiping out a significant portion of its value and leaving investors on edge as they look towards the new week. The negative sentiment appears poised to carry over, suggesting a difficult start for the stock on Monday.

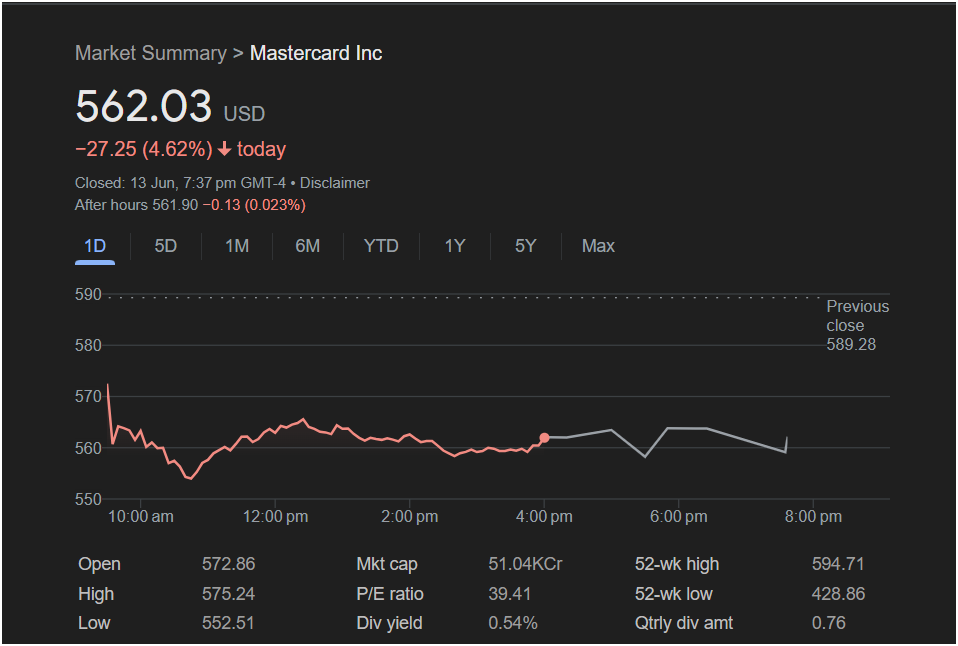

The financial services giant closed the day at

27.25, or 4.62%. The day’s trading was overwhelmingly negative from the start. Opening at $572.86, well below the previous close of $589.28, the stock saw intense selling pressure that drove it to a low of $552.51. While it managed to claw back some of those losses before the bell, the recovery was minor in the face of the day’s massive drop.

To make matters worse, after-hours trading offered no relief. The stock dipped a further $0.13, indicating that the selling pressure, while slowing, has not yet reversed.

Analysis for Monday:

The outlook for Mastercard heading into Monday is decidedly bearish. Here’s the breakdown of the technical signals:

-

Magnitude of the Drop: A single-day loss of over 4.5% is a powerful bearish signal. Such a significant move often indicates a fundamental shift in investor sentiment or a major technical breakdown, and it frequently leads to follow-through selling in the subsequent session.

-

Weak After-Hours Action: Unlike stocks that show a recovery after the bell, Mastercard’s slight dip in extended trading suggests a lack of buying interest. Bulls did not step in to buy the dip, signaling that caution remains the dominant mood.

-

Breach of Support: The stock crashed through its previous closing price, creating a significant price gap that now acts as a heavy resistance level.

Outlook:

Given the brutal sell-off and the absence of any positive signals after the market close, investors should prepare for continued downward pressure on Mastercard shares come Monday morning. The most likely scenario is a lower open as the market continues to process Friday’s steep losses. The key level to watch will be the day’s low of $552.51. If the stock breaks below this point, it could trigger another wave of selling. A relief bounce is always possible after a large drop, but the prevailing evidence points towards a tough start to the week for Mastercard.