IBM Stock Tumbles from 52-Week High, Signaling Potential Weakness for Monday’s Open

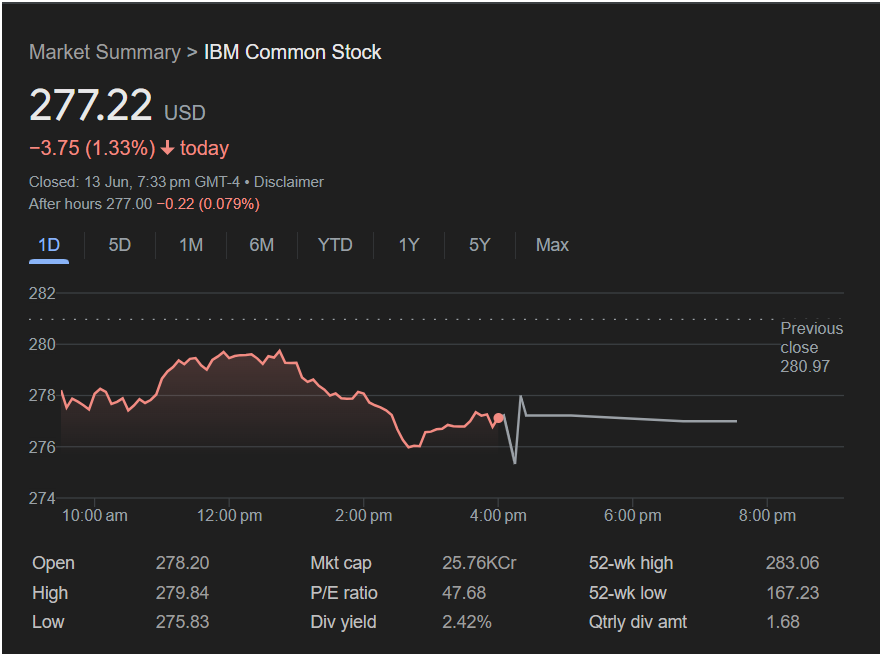

NEW YORK – International Business Machines Corp. (IBM) faced significant selling pressure on Friday, closing the week on a sour note and raising concerns among investors about its short-term trajectory. The tech giant’s stock finished the day at

3.75 (1.33%).

The bearish sentiment was evident from the start of the session. IBM opened at $278.20, already well below its previous close of $280.97. While the stock attempted a brief rally in the morning, hitting a high of $279.84, it failed to build momentum. Sellers took firm control in the afternoon, pushing the price down to a daily low of $275.83 before a modest bounce into the close.

Adding to the negative outlook, the stock continued to slide in after-hours trading, shedding another

277.00. This suggests that the selling pressure persisted even after the official market close, indicating a lack of immediate buying interest.

277.00. This suggests that the selling pressure persisted even after the official market close, indicating a lack of immediate buying interest.

Outlook for Monday: Will the Market Go Down?

The technical signals from Friday’s trading session point toward a bearish outlook for IBM at the start of next week.

-

Weak Close: The stock closed significantly in the red and nearer to its session low than its high. This indicates that sellers were in control as the trading day concluded.

-

Failed Rally: The inability of the stock to reclaim the previous day’s closing price during its morning peak is a sign of weakness.

-

Sustained Selling Pressure: The consistent downward trend throughout the afternoon, followed by a further dip in after-hours trading, creates strong negative momentum heading into the weekend.

-

Pullback from Highs: This decline comes as IBM trades just shy of its 52-week high ($283.06). A sharp rejection from a peak can often signal profit-taking and the potential for a deeper correction.

On Monday, traders will be closely watching the session low of $275.83. If IBM’s stock price breaks below this level, it could trigger further selling as it would confirm that the downtrend is continuing. For the bulls to regain control, the stock would need to overcome Friday’s high of $279.84.

While IBM’s attractive dividend yield of 2.42% may attract some value-oriented buyers on the dip, the immediate momentum is decidedly negative. Investors should be prepared for potential further downside or consolidation when the market opens on Monday.

Disclaimer: This article is for informational purposes only and is based on an analysis of the provided image. It does not constitute financial advice. Market conditions can change rapidly, and investors should conduct their own research before making any trading decisions.