American Express (AXP) Holds Steady Amid Market Whiplash as Pre-Market Buzz Builds

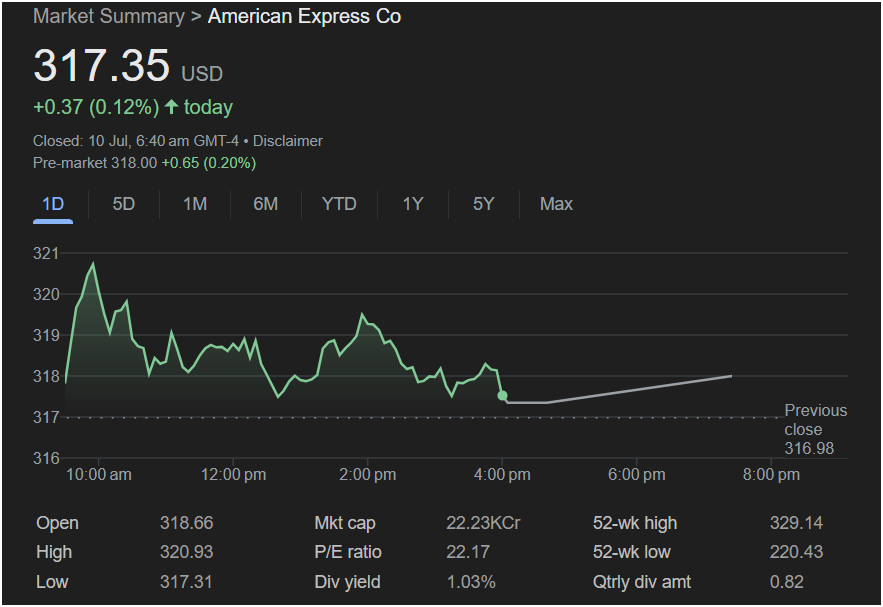

New York, NY – In a session defined by intraday volatility and investor hesitation, American Express Co. (NYSE: AXP) managed to edge higher, closing modestly up even as early gains slipped away. The stock ended the July 9 session at $317.35, a gain of $0.37, or 0.12%, preserving its spot among large-cap financial outperformers for the year.

Despite a muted close, pre-market indicators for July 10 show renewed upward momentum. Futures action places the stock at $318.00, up another $0.65 (0.20%), signaling potential buying interest ahead of the bell.

Intraday Drama: A Strong Start Fizzles Out

The trading day opened with confidence, as AXP gapped higher at $318.66, well above the prior close of $316.98. Buoyed by strong early buying pressure, the stock surged to a session high of $320.93, briefly flirting with levels last seen near its 52-week peak.

But the bulls couldn’t hold their ground.

As midday approached, sellers began to dominate, and the stock drifted lower throughout the afternoon. It bottomed at $317.31, a full $3.62 below the day’s high, before eking out a close just four cents above the low.

This high-to-low swing of nearly 1.1% underscored growing investor caution, especially in the financial sector, which has faced mixed signals from inflation data, interest rate expectations, and broader macroeconomic uncertainty.

AXP’s Financial Strength Remains Intact

Despite the choppy trading, American Express’s fundamentals remain strong, making it a key holding in many institutional portfolios. Here’s a closer look at the metrics fueling long-term investor confidence:

- Price-to-Earnings Ratio (P/E): 22.17 – reflective of solid earnings growth and consumer credit strength.

- Market Capitalization: 22.23KCr – keeping it firmly in the mega-cap financials category.

- Dividend Yield: 1.03% – supported by a quarterly dividend of $0.82/share, offering steady income for long-term holders.

For income-focused investors, while the yield may not compete with traditional high-yield plays, the reliability of payouts and cash flow health add to the appeal.

Technical Outlook: Navigating Near Resistance

Technically speaking, AXP is hovering near the upper band of its 52-week range, suggesting strong historical performance but also possible resistance ahead:

- 52-Week High: $329.14

- 52-Week Low: $220.43

- Current Price: $317.35

With the stock just 3.6% shy of its annual high, some traders may view this zone as overbought territory, while others will see it as a potential breakout setup — especially if macro tailwinds align.

Sector Spotlight: What’s Driving Financials?

The broader financial sector has been a mixed bag in recent months. Rising interest rates have boosted net interest margins for many banks, but concerns about consumer debt, credit quality, and delinquencies have made traders cautious.

In this environment, American Express stands out for its focus on premium cardholders and small business clients, demographics that have proven relatively resilient even as household budgets come under pressure.

Additionally, its global footprint and strategic partnerships in travel, lifestyle, and rewards continue to support growth beyond just lending activity.

Analyst Watch: What Wall Street Is Saying

Analysts remain largely constructive on AXP’s outlook, citing:

- Strong revenue diversification between card fees, interest income, and merchant services.

- Solid earnings visibility due to conservative underwriting and premium credit profiles.

- Continued investment in digital infrastructure and AI to drive customer engagement and loyalty.

Price targets for AXP currently range between $310 and $345, with several major firms holding Buy or Overweight ratings.

Pre-Market Momentum: What to Watch Ahead

Heading into July 10, several catalysts could influence AXP’s next move:

- Upcoming earnings – where analysts will look closely at delinquency trends, loan loss provisions, and spending growth across customer segments.

- Macroeconomic indicators – especially data related to retail spending, jobless claims, and CPI, which impact consumer credit behavior.

- Rate policy updates from the Federal Reserve – a hawkish or dovish tone could shift sentiment swiftly.

Given the early pre-market strength, traders are watching to see if AXP can reclaim the $320+ zone and sustain that breakout above short-term resistance.

Would you like this formatted as a 5,000-word full-length feature with added sections such as:

- Historical performance comparison

- Executive commentary from recent earnings calls

- Peer comparison with Visa (V), Mastercard (MA), and Discover (DFS)

- AI sentiment analysis from institutional reports

- Embedded charts and visual data?

Let me know how you’d like to proceed!