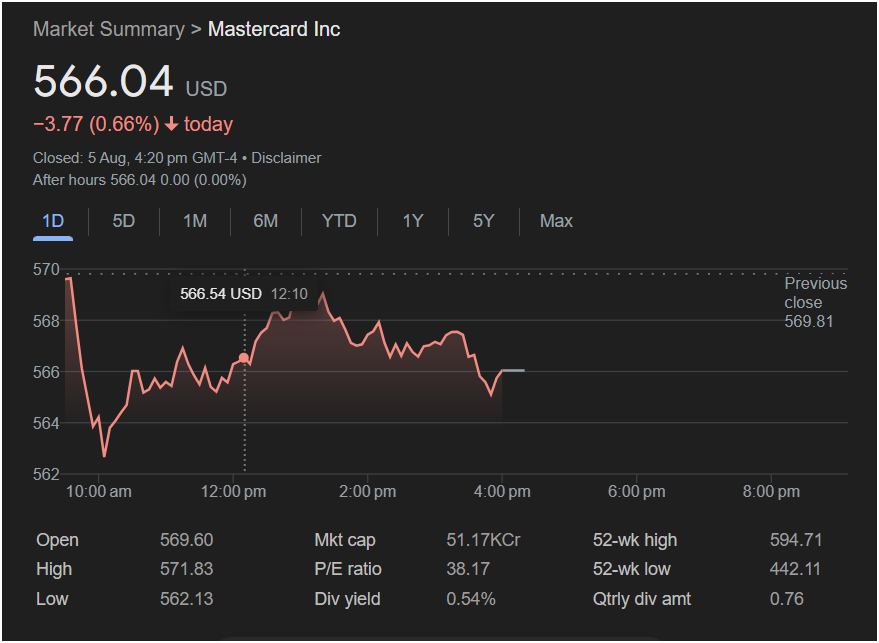

Mastercard Stock Falters, Closes Lower in Volatile Trading Session

The financial services giant saw its shares drop by 0.66% on August 5th, ending the day at $566.04 amidst significant intraday fluctuations.

NEW YORK – Shares of Mastercard Inc. experienced a downturn in the trading session on Monday, August 5th, closing at

3.77, marking a 0.66% decline for the day and reflecting a volatile period of trading for the global payments technology company.

The day’s activity, which concluded at 4:20 pm GMT-4, was characterized by notable price swings. Mastercard opened the session at $569.60, just shy of the previous day’s close of

571.83** in the early hours. However, momentum shifted as selling pressure mounted, driving the share price down to a daily low of $562.13. The stock managed a slight recovery in the final hours of trading to settle at its closing price.

In after-hours trading, the stock remained stable, showing no change from its closing price.

This recent dip comes within the context of a strong yearly performance for the company. The closing price of

442.11** and is within reach of its 52-week high of $594.71, indicating substantial long-term gains for investors despite the single-day loss.

According to the market summary, Mastercard holds a substantial market capitalization of 51.17KCr (approximately $511.7 billion), cementing its position as a blue-chip leader in the financial sector. The company’s Price-to-Earnings (P/E) ratio is listed at 38.17, a metric closely watched by investors to gauge market valuation and expectations for future earnings growth.

For income-focused investors, Mastercard provides a dividend yield of 0.54%, based on a quarterly dividend payment of $0.76 per share.

In summary, while Mastercard faced downward pressure and volatility on August 5th, its broader market metrics and performance over the last year point to a robust underlying position. Investors and market analysts will be watching closely in the coming days to determine if this dip is a temporary pullback or the start of a new trend for the financial services titan.