Spotify Stock Hits 52-Week High Amid Volatility; What Should Investors Watch Today

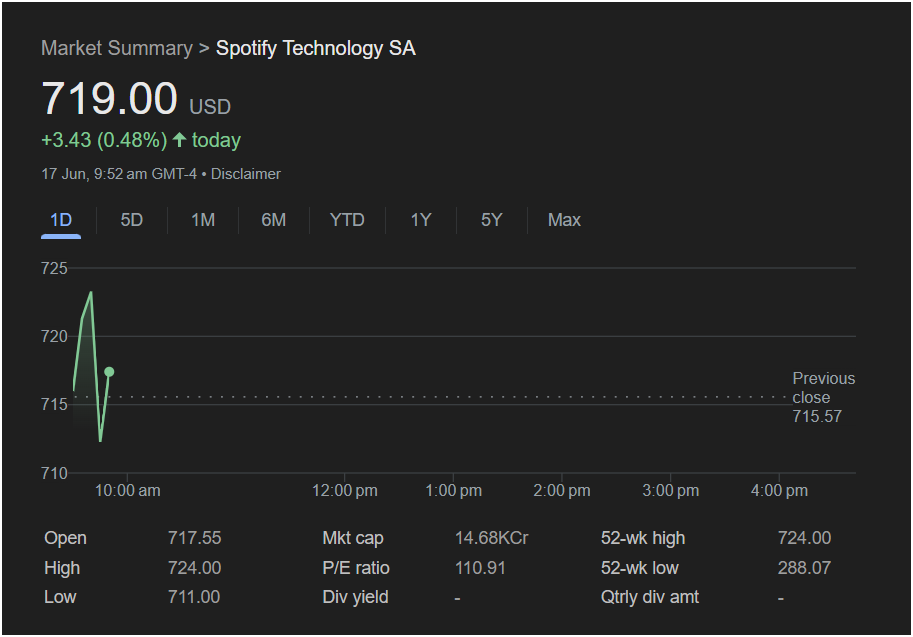

New York, NY – June 17 – Spotify Technology SA (SA) stock has captured the market’s attention in early Monday trading, surging to a new 52-week high and signaling strong bullish momentum. However, significant intraday volatility suggests that traders should proceed with a clear strategy. As of 9:52 am GMT-4, the stock is trading at

3.43 (0.48%) for the day.

This article breaks down the key data points from the morning session to provide a comprehensive outlook for investors considering their next move.

Today’s Market Performance: A Tale of Two Moves

The trading session for Spotify has been dynamic from the opening bell. Here’s what the numbers tell us:

-

Open: $717.55

-

High: $724.00

-

Low: $711.00

-

Previous Close: $715.57

The stock opened higher than its previous close, immediately dipped to a low of $711.00, and then rallied sharply to hit a new 52-week high of $724.00. This powerful upward move indicates strong buying interest. However, the subsequent pullback from that peak to the current price of $719.00 shows that some profit-taking is occurring at this new high, creating a volatile trading environment.

The Bullish Case: Momentum and Milestones

The Bullish Case: Momentum and Milestones

For investors with a bullish outlook, the primary signal is the achievement of a new 52-week high. This is a significant technical milestone that often attracts further investment, as it demonstrates the stock has broken through previous resistance levels.

Further supporting this positive sentiment is the stock’s impressive performance over the past year. Having risen from a 52-week low of $288.07, the current price reflects a substantial and sustained uptrend. Investors are clearly confident in the company’s growth trajectory, which is also reflected in the high P/E ratio of 110.91.

Points of Caution: Valuation and Resistance

While momentum is strong, traders should be aware of a few cautionary signals:

-

High Valuation: A Price-to-Earnings (P/E) ratio of 110.91 indicates that the stock is trading at a premium. This means high growth expectations are already priced in, and any failure to meet those expectations could lead to a sharp correction.

-

Intraday Volatility: The

724.00 vs. $711.00) points to significant risk. This level of price swing can present opportunities but also poses a danger of quick losses.

-

Resistance at the High: The stock’s inability to hold its peak of $724.00 suggests this level is acting as immediate resistance.

Will the Market Go Up or Down on Monday? Key Levels to Watch

The direction for the remainder of Monday’s session will likely be determined by how the stock trades around these key price points:

-

Key Resistance Level: $724.00. A sustained break above this 52-week high would be a very strong bullish signal, potentially leading to another leg up as breakout traders jump in.

-

Key Support Levels: The first line of support is the previous close of $715.57. If the stock falls below this level, it could indicate that the morning’s bullish momentum is fading. A further break below the day’s low of $711.00 would turn the outlook for the day bearish.

Conclusion: Is It Right to Invest Today?

Investing in Spotify stock today comes down to an investor’s risk tolerance. The stock is in a clear and powerful uptrend, making it attractive for momentum-based strategies. However, its high valuation and the resistance it’s facing at its all-time high introduce a significant degree of risk.

For Monday, the outlook is cautiously optimistic. The critical test will be whether buyers can push the price decisively past the $724.00 mark. If they succeed, the stock could continue its climb. If they fail, the stock may consolidate or pull back to test lower support levels. As the company does not offer a dividend (Div yield: –), any investment is purely a bet on capital appreciation.

Disclaimer: This article is for informational purposes only and is based on the data presented in the image. It does not constitute financial advice. All investment decisions should be made with the help of a qualified financial professional after conducting your own thorough research.