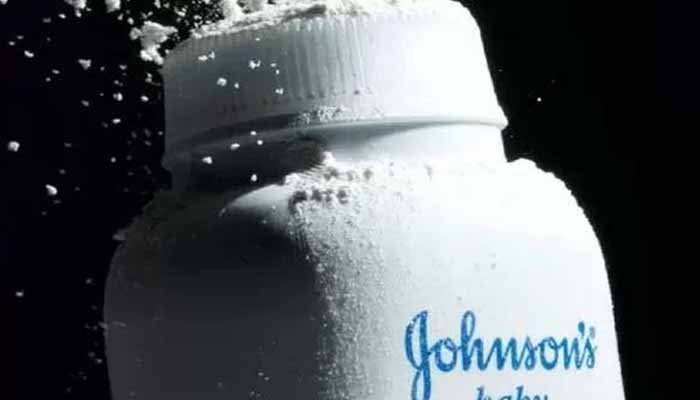

कैंसर की वजह बन रहा जॉनसन एंड जॉनसन बेबी पाउडर… पूरी दुनिया में प्रतिबंध की तैयारी…

नईदिल्ली: छोटे बच्चों और महिलाओं में फार्मा कंपनी जॉनसन एंड जॉनसन का टेल्क-आधारित बेबी-पाउडर कभी बहुत लोकप्रिय था। लेकिन इससे कैंसर होने की बात सामने आने के बाद अब यह पूरी दुनिया में प्रतिबंधित हो सकता है। ब्रिटेन में कंपनी के शेयरधारकों ने एकजुट होकर इस पाउडर की बिक्री पर वैश्विक प्रतिबंध का प्रस्ताव बनाया है। उल्लेखनीय है कि इस पाउडर की वजह से महिलाओं को कैंसर होने के 34 हजार मुकदमे जॉनसन एंड जॉनसन पर चल रहे हैं।

अमेरिका में इस पाउडर में एस्बेस्टस का एक प्रकार क्त्रिस्सोटाइल फाइबर मिला था, जिसके बाद इससे कैंसर की आशंका जताई गई यह तत्व कैंसरकारी माना जाता है। हजारों महिलाओं ने उसके पाउडर से बच्चेदानी का कैंसर होने के आरोप में मुकदमे किए। इस पर कंपनी ने सेल घटने का बहाना बना 2020 में अमेरिका व कनाडा में बेबी पाउडर बेचना बंद कर दिया। लेकिन आज भी ब्रिटेन सहित दुनिया के बाकी देशों में इसे बेच रही है।

अब ब्रिटेन में एक निवेश प्लेटफॉर्म ट्यूलिपशेयर ने कंपनी के शेयरधारकों की ओर से यह बिक्री रोकने का प्रस्ताव तैयार किया। शेयरधारक अपने शेयरों को साथ में जमा कर प्रस्ताव के लिए जरूरी शेयर संख्या जुटा रहे हैं। अमेरिका की स्टॉक मार्केट नियामक एजेंसी एसईसी को यह प्रस्ताव भेजा गया है। अप्रैल में कंपनी की सालाना बैठक है, जहां यह प्रस्ताव लाने का प्रयास हो रहा है।

अमेरिका में मिजौरी की अदालत ने कैंसर से पीडि़त महिलाओं की 22 याचिकाओं में जॉनसन एंड जॉनसन के खिलाफ निर्णय दिया था। इसमें कंपनी 200 करोड़ डॉलर (आज के करीब 15 हजार करोड़ रुपये) मुआवजे व मुकदमे के खर्च के तौर पर दे चुकी है। भविष्य में इतना मुआवजा न देना पड़े, इसलिए उसने अपनी पाउडर उत्पादन शाखा को अलग कंपनी बनाया और बाद में विवादास्पद रूप से इसे दिवालिया दिखाया।

इतना सब होने पर भी कंपनी ने कई रिपोर्टों का हवाला देकर कहा कि उसके बेबी पाउडर से कैंसर नहीं होता। पाउडर में उपयोग हो रहे सभी तत्व सुरक्षित हैं। शेयरधारकों के ताजा प्रस्ताव के खिलाफ उसने एसईसी को लिखा कि इसे गलत मानते हुए रद्द करें क्योंकि पाउडर से कैंसर होने के हजारों मुकदमे अदालतों में विचाराधीन हैं।

ब्रिटेन की लेबर पार्टी के सांसद इयान लेवरी ने पिछले वर्ष संसद में कहा था कि जॉनसन एंड जॉनसन द्वारा अमेरिका के बाहर अपने टेल्कम पाउडर उत्पादों की बिक्त्रस्ी जारी रखना अनुचित है। शेयरधारकों के प्रस्ताव को उन्होंने सही बताया। उन्होंने कहा, भयानक कैंसर देने वाला यह उत्पाद आज भी ब्रिटेन और दुनिया भर में बेचा जा रहा है और कंपनी भारी मुनाफा कमा रही है।