Blackstone Stock Edges Up in Volatile Session, Dips After Hours

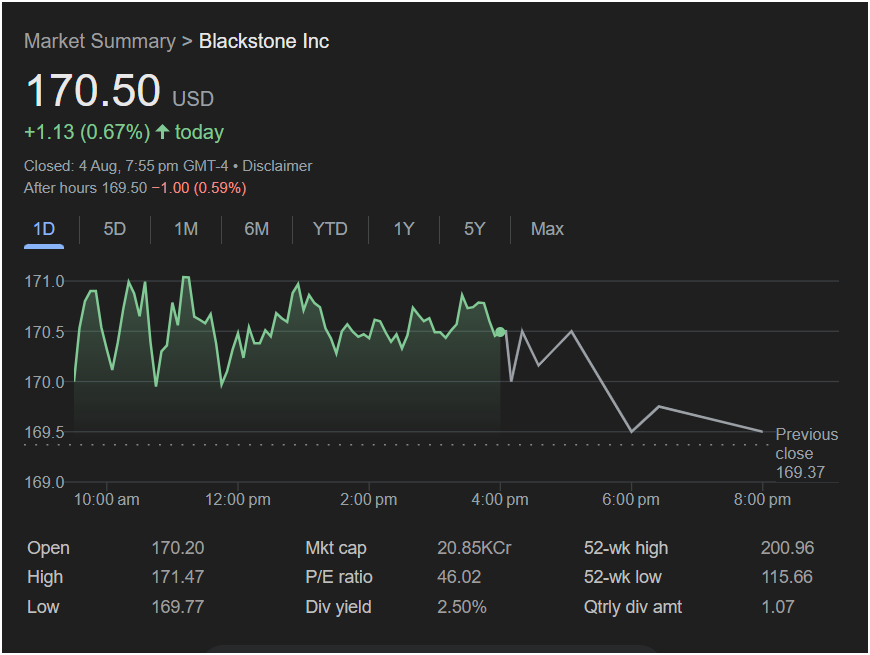

New York, NY – August 5, 2025 – Blackstone Inc. (NYSE: BX), the world’s largest alternative asset manager, saw its stock navigate a choppy trading session on Monday, ultimately closing with a modest gain before retreating in after-hours trading. The stock finished the official session at $170.50, up 0.67%, a rise of $1.13 for the day. However, the positive sentiment appeared to wane after the bell, with shares dipping $1.00, or 0.59%, to $169.50 in later trading.

The day’s trading for the financial powerhouse was characterized by intraday volatility. After opening at $170.20, slightly below its previous close of $169.37, Blackstone’s shares fluctuated between a high of $171.47 and a low of $169.77 before settling.[1] This movement comes on the heels of a strong second-quarter earnings report in late July that surpassed analyst expectations and a flurry of recent strategic activities.[2][3]

Investors are closely watching Blackstone, which boasts a market capitalization of approximately $209.74 billion, as a bellwether for the health of the private equity industry and the broader investment landscape.[4] The firm’s recent performance has been buoyed by a significant 25% spike in earnings and record assets under management (AUM) that have now surpassed an astounding $1.2 trillion.[5][6]

In its second-quarter 2025 earnings report, released on July 24, Blackstone announced revenues of $3.71 billion and a net income of $764.24 million, both substantial increases from the previous year.[7][8] The results beat analyst forecasts, with an earnings per share (EPS) of $1.21 surprising the market, which had anticipated a figure closer to $1.09.[2] This outperformance was driven largely by higher fee-related earnings, particularly from transaction revenues.[9] Following the strong report, the company declared a quarterly dividend of $1.03 per share.[3][10]

The positive earnings have been reflected in a wave of optimistic analyst ratings. In recent months, at least seven firms have issued “Buy” or equivalent ratings.[5] Price targets have also seen upward revisions, with a median target of $175 from 15 analysts, and some, like Evercore ISI Group and Deutsche Bank, setting targets as high as $197 and $192, respectively.[5]

The broader context for private equity in 2025 shows signs of a cautious recovery.[11] After a sluggish period, there is growing optimism that improving valuations and a clearer economic outlook will stimulate more deal-making and, crucially, more profitable exits.[11] Trends shaping the industry include a focus on technology and AI-driven sectors, such as data centers, as well as an expansion into new markets and alternative liquidity solutions.[12][13] Blackstone itself has been active, recently announcing a significant growth investment in network automation firm NetBrain and a major acquisition of a logistics portfolio in South Korea.[14]

However, the path is not without potential obstacles. The private equity landscape faces an evolving regulatory environment and the macroeconomic effects of potential tariff changes and tax code adjustments.[15][16] Furthermore, Blackstone’s stock currently trades with a P/E ratio of 46.02, a figure that suggests high expectations for future growth.

The firm has also been in the news for non-financial reasons. A tragic shooting at its New York headquarters on July 30th resulted in four fatalities, including a senior real estate executive, and has prompted enhanced security measures as the office officially reopened on August 4th.[10][17]

As investors digest the day’s mixed performance, they will be weighing the company’s powerful earnings momentum and strategic growth against the after-hours dip and broader market uncertainties. Blackstone’s position relative to its 52-week high of $200.96 and low of $115.66 indicates significant upward movement over the past year, but also shows it is currently trading well below its peak. The next moves for BX will likely be influenced by ongoing market sentiment, the integration of its recent acquisitions, and the unfolding trends within the global private equity sphere.