Blackstone Ends Week with a Gain, but Intraday Weakness Raises Concerns for Monday

NEW YORK – Blackstone Inc. shares finished Friday in the green, but a day of extreme volatility and a failure to hold early highs has created an uncertain and cautious outlook for the start of the new trading week.

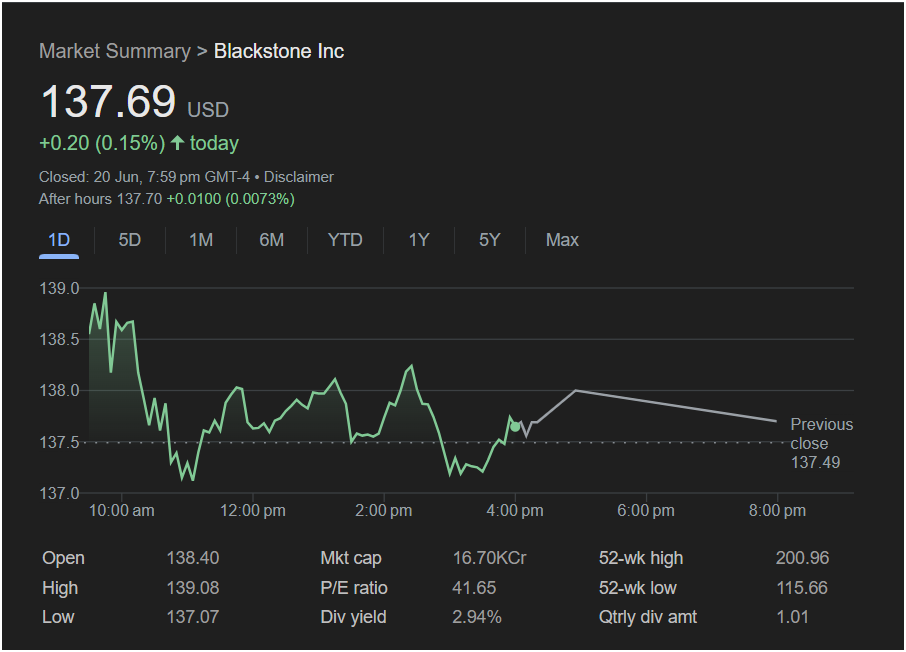

The alternative asset management giant closed the session at

0.20 (0.15%). After-hours trading was essentially flat, with the stock inching up to $137.70.

Friday’s trading chart tells a complex story. The stock opened at

139.08**. However, sellers quickly took control, erasing all gains and sending the stock plunging to a daily low of $137.07. While the stock did recover from its low, it spent the rest of the day in a choppy battle, ultimately closing well below its opening price.

Market Outlook: Will the Market Go Down on Monday?

The technical signals from Friday’s session are mixed, but lean towards a cautious or bearish start for Monday.

-

Bearish Intraday Reversal: The most significant red flag is that the stock opened high and closed low. A failure to hold opening gains and closing below the open price is a classic sign of seller dominance and distribution.

-

Rally into the Close: On the bullish side, the stock showed some strength in the final hour, rallying off its lows. This indicates that some buyers saw value and stepped in before the bell.

-

Overall Weakness: Despite the late rally, the stock was unable to reclaim its opening price, suggesting the selling pressure that dominated the morning was the day’s defining feature.

:

While Blackstone finished the day with a small gain, the underlying price action was weak. The sharp fade from the morning high is a more powerful signal than the small positive closing number. This indecisive and volatile trading suggests uncertainty. Based on the failure to hold gains, there is a higher probability that the market for Blackstone will be flat or go down on Monday, as traders look for a clearer direction. A break below the day’s low of $137.07 would be a particularly bearish signal.

Disclaimer: This article is based on the analysis of the provided image and is for informational purposes only. It is not financial advice. Market conditions are subject to change rapidly.