Walmart Stock Shows Resilience Amid Shifting Retail Landscape

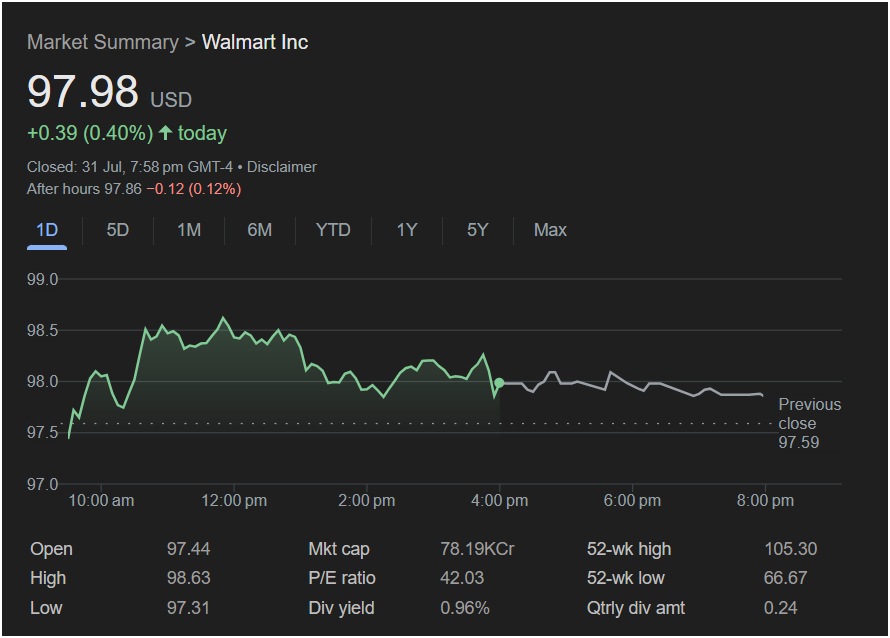

Bentonville, Ark. – Walmart Inc. (NYSE: WMT) closed at $97.98 on Thursday, July 31, 2025, marking a modest gain of 0.40% for the day.[1] The slight uptick comes as the retail giant navigates a complex economic environment, with investors closely watching for signs of consumer sentiment and spending habits. The stock saw a high of $98.63 and a low of $97.31 during the trading session.[1]

The marginal increase in Walmart’s stock price reflects a broader market assessing the resilience of consumer spending.[2] This performance precedes the company’s anticipated second-quarter earnings report, a key event that will offer deeper insights into its financial health. The consensus among many analysts remains a “Moderate Buy” to “Strong Buy” for Walmart stock.[3][4][5] Projections from 32 Wall Street analysts set an average twelve-month price target of $106.67, with some forecasts reaching as high as $120.00.[3]

Anticipation for Q2 Earnings

Anticipation for Q2 Earnings

Investors and analysts are keenly awaiting Walmart’s upcoming second-quarter earnings release for fiscal year 2026, which is expected on August 21, 2025.[6][7][8] The report is projected to show an earnings per share (EPS) of around $0.72 for the quarter.[8] This follows a strong first quarter where Walmart reported an EPS of $0.61, beating analysts’ consensus estimates.[4][6] The company’s revenue in the first quarter rose 2.5% year-over-year to $165.61 billion, also surpassing expectations.[4][6]

Walmart has demonstrated consistent performance, beating earnings estimates in the preceding quarters, which has bolstered investor confidence.[8] For the upcoming report, analysts will be looking for continued momentum in both revenue and earnings growth, particularly in the face of ongoing economic uncertainties.

Strategic Initiatives and Market Position

Walmart’s steady performance is underpinned by several strategic initiatives aimed at strengthening its market position. The company has been heavily investing in its omnichannel strategy, which integrates its vast network of physical stores with a growing e-commerce platform.[2][9] This approach has been successful, with global e-commerce sales showing significant growth.[10]

In a move to further enhance its technological capabilities, Walmart is accelerating its adoption of artificial intelligence. The company recently hired a new executive to lead its AI division and is implementing a new framework of “super agents” to improve customer experiences and streamline operations.[11] These AI-powered tools are expected to optimize everything from supply chain management to personalized shopping recommendations.[11][12]

Expanding its reach beyond traditional retail, Walmart recently announced a multi-year partnership with Major League Soccer (MLS) and the Leagues Cup.[13] This move aims to connect the brand with the rapidly growing and diverse soccer fanbase in North America.[13]

The Broader Retail Climate

Walmart’s performance should be viewed within the context of the wider U.S. retail industry, which is facing a mix of challenges and opportunities in 2025. While the overall economic outlook is cautiously optimistic, with expectations of continued growth in retail sales, the sector is also contending with shifting consumer behaviors and increased operational costs.[14][15]

Retailers are increasingly focused on personalization, sustainability, and creating seamless “phygital” experiences that blend the convenience of online shopping with the engagement of physical stores.[9][16] The “buy less, buy better” movement is gaining traction, pushing companies to prioritize high-quality, ethically sourced products.[16] Technology, particularly AI and automation, is becoming a key differentiator for success in the competitive retail landscape.[9][17]

However, some reports indicate a more cautious stance from retailers due to evolving trade policies and rising costs, leading to a slowdown in leasing activity in the first half of 2025.[15]

As the retail world continues to transform, Walmart’s ability to adapt and innovate will be crucial to its long-term success. The upcoming earnings report will provide a clearer picture of how the retail behemoth is faring and what to expect in the months ahead.