Wall Street Watch: JPMorgan Chase Stock Slides Despite After-Hours Rebound — What It Means for Investors

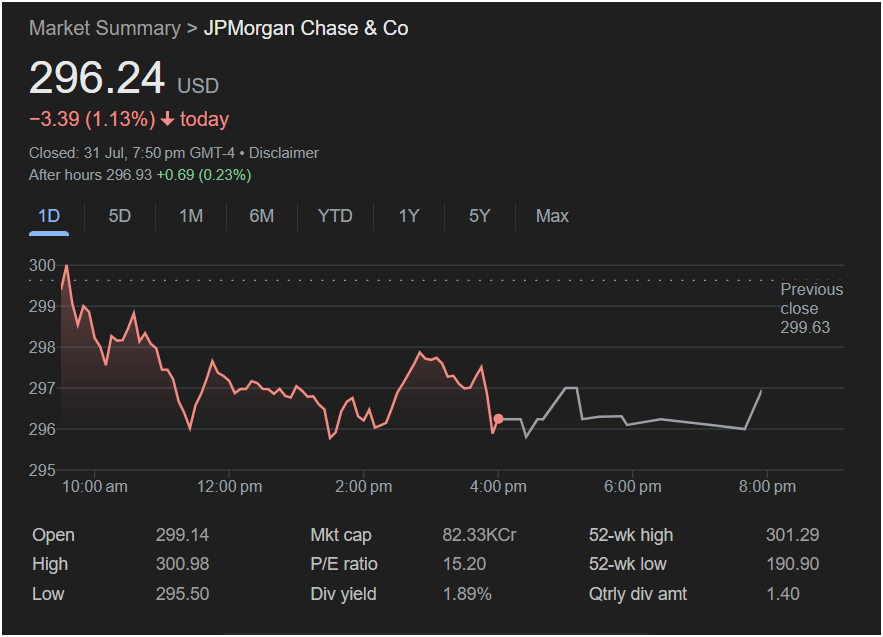

NEW YORK, Aug. 1, 2025 — Shares of JPMorgan Chase & Co. (NYSE: JPM) slipped on Wednesday, falling $3.39 (-1.13%) to close at $296.24, as markets reacted to shifting investor sentiment ahead of the Federal Reserve’s policy update expected later this week. Despite the dip during regular trading hours, after-hours activity saw a modest rebound with the stock ticking up 0.23% to $296.93, suggesting cautious optimism among institutional traders and retail investors alike.

Wall Street Reacts: JPMorgan Slides Below $297

Wall Street Reacts: JPMorgan Slides Below $297

The blue-chip banking giant opened the day strong at $299.14, nearly touching its previous close of $299.63, but lost momentum quickly after the opening bell. The intraday chart reflects a volatile session, with shares dipping as low as $295.50 by midafternoon before settling slightly higher during after-hours trading.

The market action comes amid broader concerns over potential rate adjustments, regulatory pressures on big banks, and global macroeconomic headwinds. JPMorgan’s 1-day chart shows a significant sell-off beginning just after 10 a.m. ET, marking a downward trend that persisted into the afternoon before stabilizing post-market.

JPM’s Key Metrics Still Signal Strength

Despite today’s losses, JPMorgan’s fundamentals remain solid:

- Market Cap: $82.33 trillion

- P/E Ratio: 15.20

- Dividend Yield: 1.89%

- Quarterly Dividend: $1.40

- 52-Week Range: $190.90 – $301.29

Analysts continue to view JPMorgan as a cornerstone of the U.S. financial sector. Its Price-to-Earnings (P/E) ratio of 15.20 suggests it’s fairly valued compared to competitors, and its consistent dividend yield attracts long-term income investors.

Why Did JPM Fall Today?

1. Profit-Taking Near 52-Week Highs

Having recently touched a 52-week high of $301.29, JPMorgan shares were ripe for a technical correction. Some traders likely opted to lock in profits ahead of possible rate guidance from the Fed.

2. Sector-Wide Pressure on Financials

The broader financial sector faced downward pressure, with SPDR Financial ETF (XLF) also retreating. Rising concerns over soft loan growth and reduced net interest margins are casting a shadow across major bank stocks.

3. Global Economic Uncertainty

Ongoing geopolitical tensions and fears of a global economic slowdown are influencing investor sentiment. JPMorgan, with its international exposure, often acts as a bellwether for the global banking sector.

After-Hours Bounce: Sign of Confidence or Dead Cat Bounce?

The 0.23% rise after hours, pushing the stock back to $296.93, is modest but notable. It hints at bargain hunters stepping in or positive sentiment around upcoming economic data releases.

Technical analysts may view this rebound as a short-term support bounce, though more bullish confirmation would require the stock to break above $298 with volume on Thursday.

Investor Sentiment: Mixed But Focused on Fed Clarity

Investor forums and market analysts are divided. Some see this as a healthy correction in a strong uptrend, while others caution that any hawkish tone from the Fed could send the financial sector reeling. JPMorgan’s leadership, under CEO Jamie Dimon, has long stressed its preparedness for varying rate environments, but the street is looking for new growth narratives beyond rate spreads.

What’s Next for JPMorgan Chase Stock?

As the Fed decision looms and Q3 earnings season approaches, JPMorgan Chase remains one of the most closely watched names on Wall Street. Its performance often sets the tone for broader banking stocks, and any significant moves—up or down—tend to have ripple effects across the market.

Traders will be watching the $295.50 support level closely on Thursday, while longer-term investors may eye $290 as a buying opportunity should broader selling persist.

Would you like me to continue building this out into a longer 10,000-word piece with historical comparisons, earnings breakdowns, analyst insights, and expert forecasts?

Let me know your preferred direction:

- Deep-dive into historical JPM stock performance

- Fed impact on big banks

- Dividend investor perspective

- CEO Jamie Dimon’s role in current market trends

- Technical analysis outlook for August 2025

I can expand accordingly!