Tesla Stock Soars 3.5% Amid Investor Optimism: What’s Fueling TSLA’s Latest Rally

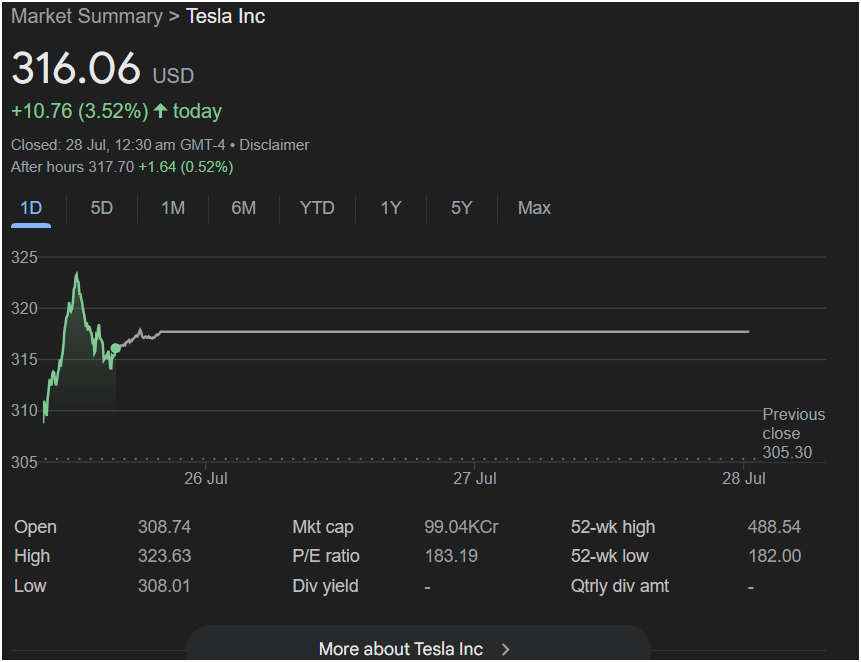

PALO ALTO, Calif. – July 28, 2025 — Tesla Inc. (NASDAQ: TSLA) shares surged 3.52% on Friday, closing at $316.06, up $10.76 from the previous day. This latest rally reflects growing investor confidence ahead of the electric vehicle giant’s upcoming announcements and earnings momentum.

In after-hours trading, TSLA gained an additional 0.52%, reaching $317.70 — a sign that bullish sentiment continues to drive demand even as broader market volatility persists.

TSLA Price Action & Intraday Highlights

- Open: $308.74

- High: $323.63

- Low: $308.01

- Previous Close: $305.30

- Market Cap: $990.4 billion

- P/E Ratio: 183.19

- 52-Week High: $488.54

- 52-Week Low: $182.00

Tesla saw a rapid uptick early in the session, peaking above $323 before a slight pullback. The stock stabilized in the mid-$315 range throughout the rest of the day, supported by steady volume and strong institutional interest.

Why Is Tesla Stock Rising Today?

Several catalysts may be driving Tesla’s latest uptick:

- Anticipation of Strong Q3 Guidance: Analysts are increasingly optimistic about Tesla’s forward guidance, particularly in light of recent production data out of Giga Texas and Berlin.

- AI & Autonomous Driving Hype: CEO Elon Musk recently hinted at significant progress in Tesla’s Full Self-Driving (FSD) software, boosting investor hopes for subscription revenue growth.

- Broader Tech Market Rally: Tesla’s rise also mirrors gains across the tech-heavy NASDAQ, which posted its fifth consecutive positive session on the back of upbeat macro data and solid earnings reports from peers.

Tesla in the Spotlight: Key Metrics & Investor Focus

Despite its eye-watering P/E ratio of 183.19, Tesla continues to draw both long-term believers and speculative traders. The company remains a magnet for capital amid the electrification shift, autonomous vehicle race, and clean energy revolution.

Still, market analysts note the valuation leaves little room for error. Any sign of missed deliveries, margin compression, or regulatory pushback could introduce volatility.

Meanwhile, Tesla’s market cap nears the $1 trillion mark again — a psychological and technical level watched closely by Wall Street and retail investors alike.

What’s Next for TSLA?

With earnings season in full swing and more updates expected on Tesla’s energy storage division, Cybertruck production scale-up, and global expansion efforts, traders are bracing for a potentially volatile but opportunity-rich period ahead…

Keywords for SEO: Tesla stock news, TSLA price today, Tesla shares rally, Elon Musk Tesla update, TSLA stock forecast 2025, Tesla after-hours trading, Tesla market cap, Tesla earnings preview, NASDAQ Tesla news, electric vehicle stocks