Mastercard Stock Rises on Consumer Strength: Closes at $568.22 as Market Eyes Spending Trends

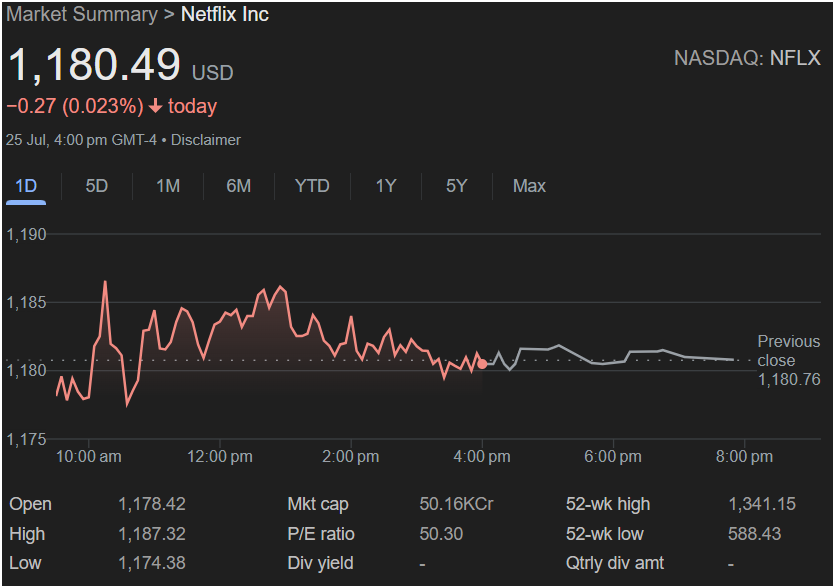

NASDAQ: NFLX holds firm above $1,180 as traders eye key Q2 performance metrics

LOS GATOS, CA — July 25, 2025 — Netflix Inc. (NASDAQ: NFLX) shares closed marginally lower on Thursday, dipping $0.27 or 0.023% to settle at $1,180.49, as investors took a wait-and-see approach ahead of the streaming giant’s upcoming earnings release. Despite the modest dip, the stock remained largely stable throughout the session, trading in a narrow range as volume eased across the tech-heavy Nasdaq.

Intraday Volatility Reflects Investor Caution

Netflix opened the day at $1,178.42 and climbed to a high of $1,187.32 before facing a midday pullback. The stock bottomed out at $1,174.38 but recovered slightly into the close, staying within striking distance of its previous close of $1,180.76. The muted movement suggests investors are holding their positions as they anticipate fresh data on global subscriber growth, advertising revenue, and content spend for Q2 2025.

Valuation Remains Elevated on Growth Expectations

With a market capitalization of $5.01 trillion, Netflix continues to trade at a premium, supported by strong fundamentals and dominant market positioning. Its P/E ratio stands at 50.30, reflecting investor confidence in the company’s future earnings potential — particularly as Netflix expands into live sports streaming, international content production, and AI-curated personalization features.

Unlike many of its tech peers, Netflix does not currently offer a dividend, choosing instead to reinvest in original content and global infrastructure. This growth-focused strategy has helped the company achieve new highs in content engagement and viewer retention, key metrics that will be closely examined in the upcoming earnings call.

52-Week Range Signals Long-Term Resilience

Netflix shares remain well within their 52-week range of $588.43 to $1,341.15, with the stock more than doubling from its yearly low — a move driven by consistent subscriber growth, strategic pricing updates, and the successful rollout of its ad-supported tier. Analysts have noted that any upside surprises in churn rates or ad revenue performance could serve as catalysts for another upward push.

Streaming Wars Enter Next Phase

As competition in the streaming sector intensifies, Netflix’s performance will be scrutinized alongside results from peers like Disney+, Amazon Prime Video, and Apple TV+. Investors are particularly interested in Netflix’s progress on monetizing non-core offerings such as gaming, sports documentaries, and branded merchandise through the Netflix Shop.

Keywords: Netflix stock price today, NFLX stock July 25 2025, Netflix earnings preview Q2, Netflix subscriber growth 2025, streaming stock update, Netflix P/E ratio, Netflix share value, Netflix market cap, live sports streaming stocks, Netflix AI personalization