JPMorgan Chase Stock Climbs Amid Financial Sector Rally as Fed Rate Speculation Grows

JPM (NYSE: JPM) pushes higher as investors react to earnings momentum and macro signals

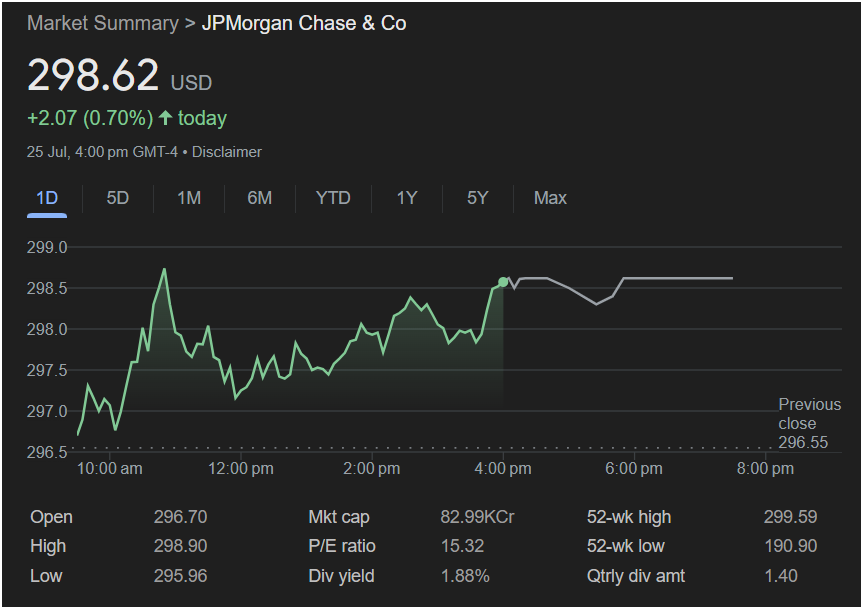

New York, NY — July 25, 2025 — Shares of JPMorgan Chase & Co. (NYSE: JPM) surged on Thursday, gaining +2.07 points (+0.70%) to close at $298.62, marking one of the day’s strongest performances among major U.S. financial institutions. This upward move comes as Wall Street increasingly prices in the possibility of a more dovish Federal Reserve stance heading into Q4.

Opening at $296.70, the banking giant’s stock touched an intraday high of $298.90 before settling just shy of the $299 mark — edging closer to its 52-week high of $299.59. The stock’s previous close was $296.55, with investors showing strong demand throughout the trading session, particularly in the early afternoon.

Big Bank Momentum as Earnings Season Kicks Off

JPMorgan’s performance is being closely watched as a bellwether for broader banking sector health. With a market cap of $829.9 billion and a P/E ratio of 15.32, the bank is well-positioned to weather macroeconomic uncertainty, particularly in light of strong Q2 earnings and record-breaking net interest income from earlier this month.

The market’s attention is now turning to guidance on loan growth, commercial lending trends, and consumer credit quality, as analysts debate how a potential shift in interest rate policy could reshape bank profitability in the second half of 2025.

Strong Dividend and Investor Confidence

With a dividend yield of 1.88% and a quarterly dividend payout of $1.40, JPMorgan continues to attract institutional investors seeking both stability and yield amid shifting market dynamics. The stock has recovered sharply from its 52-week low of $190.90, bolstered by stronger-than-expected earnings across the financial sector and growing optimism about the U.S. economic outlook.

As regional banks navigate headwinds, JPMorgan remains a symbol of strength, leading the charge in M&A advisory, capital markets, and wealth management.

Traders Eyeing Key Resistance Level Near $300

The $300 price level is increasingly being viewed as a psychological barrier for JPMorgan Chase stock. Thursday’s close at $298.62 positions the stock within striking distance of a potential breakout — or a near-term pullback — depending on next week’s market catalysts, including economic data releases and upcoming remarks from Fed Chair Jerome Powell.

A broad uptick in financials and cyclicals added tailwinds for JPM today, with bank stocks outperforming tech for the session.

Watch this space for real-time updates on JPMorgan’s stock performance, Federal Reserve developments, and key earnings trends shaping Wall Street’s outlook.

Keywords: JPMorgan stock today, JPM share price, JPMorgan Chase earnings, NYSE JPM, JPM stock forecast, financial sector July 2025, dividend stocks 2025, Fed interest rates, big bank stocks, JPMorgan dividend yield, US bank stock performance