Alphabet (GOOG) Stock Shows Strength: What Could This Mean for Traders Next Week

Alphabet’s Class C stock (NASDAQ: GOOG) demonstrated a positive session on Wednesday, providing traders with key signals to analyze ahead of the upcoming trading week. The tech giant closed the pre-holiday session in the green, sparking discussions about whether this momentum can be sustained. This article breaks down the day’s performance and offers a technical perspective for traders looking at Alphabet’s next move.

Wednesday’s Market Performance: A Detailed Look

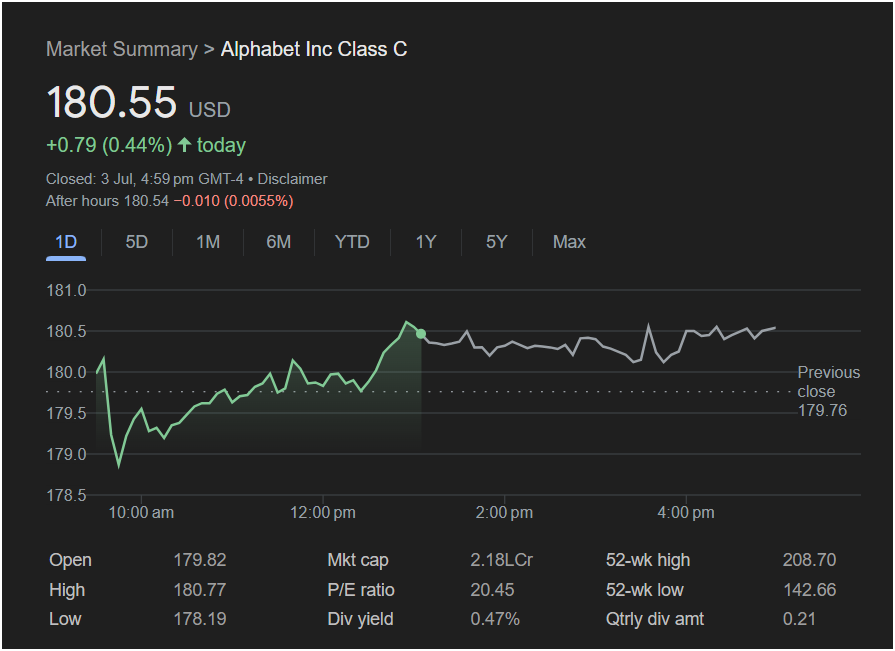

Based on the market summary from July 3rd, Alphabet Inc. Class C stock closed at

0.79 (0.44%) for the day. Here’s a summary of the key information a trader needs from the session:

-

Intraday Action: The stock experienced a volatile start, opening at $179.82 and dipping to a low of $178.19 shortly after the market opened. However, buyers stepped in, pushing the price to a daily high of $180.77 by early afternoon. The stock then entered a consolidation phase, trading sideways for the remainder of the day before closing near its peak. This strong close is often viewed as a bullish signal.

-

After-Hours Trading: Post-market activity was minimal, with the stock ticking down just slightly to $180.54. This suggests a neutral sentiment immediately following the close, with no significant news impacting the price overnight.

-

Previous Close: The stock finished above the previous day’s close of $179.76, confirming the positive daily trend.

Key Financial Metrics for Context

To understand the bigger picture, here are the vital statistics provided:

-

Market Cap: 2.18L Cr (This represents approximately $2.18 Trillion), reaffirming Alphabet’s position as one of the world’s largest companies.

-

P/E Ratio: At 20.45, the price-to-earnings ratio suggests a valuation that is relatively standard for a mature, profitable tech company.

-

52-Week Range: The current price of $180.55 sits comfortably between the 52-week low of $142.66 and the high of $208.70. This indicates the stock is not at an extreme, but has significant room to run before testing its yearly highs.

-

Dividend Yield: The 0.47% yield is a newer factor for Alphabet, potentially attracting income-focused investors to the stock.

Analysis and Outlook: Will The Stock Go Up or Down on Monday?

Given the data from Wednesday’s chart, the outlook for the next trading day appears cautiously optimistic.

The Bullish Case (Reasons for an Upward Move):

-

Strong Reversal and Close: The stock’s ability to recover from its morning low and close near the day’s high shows strong buying interest and resilience.

-

Consolidation at Highs: After reaching its peak, the stock didn’t sell off. Instead, it built a support base in the $180.50 range, which could serve as a launchpad for the next leg up.

-

Positive Momentum: Closing with a gain before a holiday weekend can carry positive sentiment into the following week.

The Bearish Case (Reasons for a Downward Move):

-

Failure to Break Higher: While the stock rallied, it couldn’t push past the $180.77 mark, which now acts as a minor short-term resistance level.

-

Broader Market Uncertainty: A single day’s chart doesn’t account for macroeconomic news or shifts in overall market sentiment that could occur over the long weekend.

Is It Right to Invest Today?

For traders, Monday will be a critical day to confirm the trend. The price action on Wednesday was constructive, but confirmation is needed.

A Trader’s Takeaway:

Instead of jumping in immediately, a prudent strategy would be to watch the key levels on Monday.

-

Key Resistance: Keep an eye on the day’s high of $180.77. A solid break above this level on good volume could signal the start of a continued uptrend, with the next target being higher price levels on the way to the 52-week high.

-

Key Support: The area around

179.76 will likely act as initial support. A drop below the day’s low of $178.19 would invalidate the bullish sentiment from Wednesday.

In conclusion, while the single-day chart for Alphabet stock points towards potential upside, traders should look for confirmation on Monday and remain aware of the broader market environment before committing to a position.

Disclaimer: This article is for informational purposes only and is based on the analysis of the provided image. It does not constitute financial advice. All investment decisions should be made with the help of a qualified financial professional and after conducting your own thorough research.