IBM’s Powerful Rally Signals Bullish Start for Wall Street

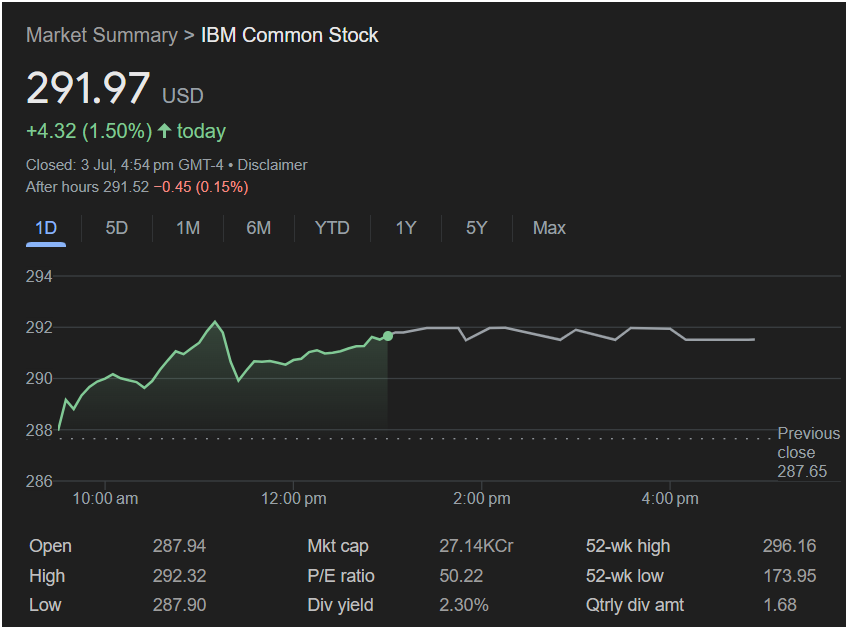

NEW YORK, NY – The market is poised for a positive start to the new trading week, propelled by a stellar performance from technology stalwart IBM on Wednesday. The “Big Blue” closed the session with a notable gain, finishing at

4.32, or 1.50%, sending a strong bullish signal to investors.

A closer look at the trading session on July 3rd reveals a picture of sustained buying pressure. After opening at $287.94, IBM’s stock embarked on a steady climb, reaching a daily high of $292.32. Crucially, the stock held onto the majority of these gains, consolidating throughout the afternoon and closing near its peak. This price action, which shows an inability of sellers to drive the price down before the bell, is a classic technical indicator of strength and suggests that positive momentum is likely to continue.

Furthermore, IBM is now trading within striking distance of its 52-week high of $296.16, underscoring the powerful uptrend the stock is currently experiencing. As a key component of the Dow Jones Industrial Average, a strong performance from IBM often reflects broader confidence in the technology sector and corporate spending.

Looking toward Monday’s market open, the outlook appears decidedly optimistic. While after-hours trading showed a marginal dip to $291.52, this slight pullback does little to diminish the powerful buying momentum seen during the regular session. Investors are likely to interpret IBM’s strong finish as a green light for risk assets, setting the stage for a potential gap up or a firm open for the broader market.

Disclaimer: This article is based on an analysis of past performance and market sentiment. Stock market predictions are inherently uncertain, and various economic and geopolitical factors can influence trading. This is not financial advice.