Abbott Laboratories Stock in Limbo: Flat Close Signals Indecision for Monday

Abbott Laboratories stock (NYSE: ABT) ended Friday’s session with a marginal gain, but the day’s erratic price action and flat-line close paint a clear picture of market indecision. For traders trying to forecast the next move, the healthcare giant offers few clues, presenting a classic case of a stock in consolidation. This analysis will break down the essential data to determine if Abbott is more likely to go up or down on Monday.

A Choppy Day with No Clear Winner

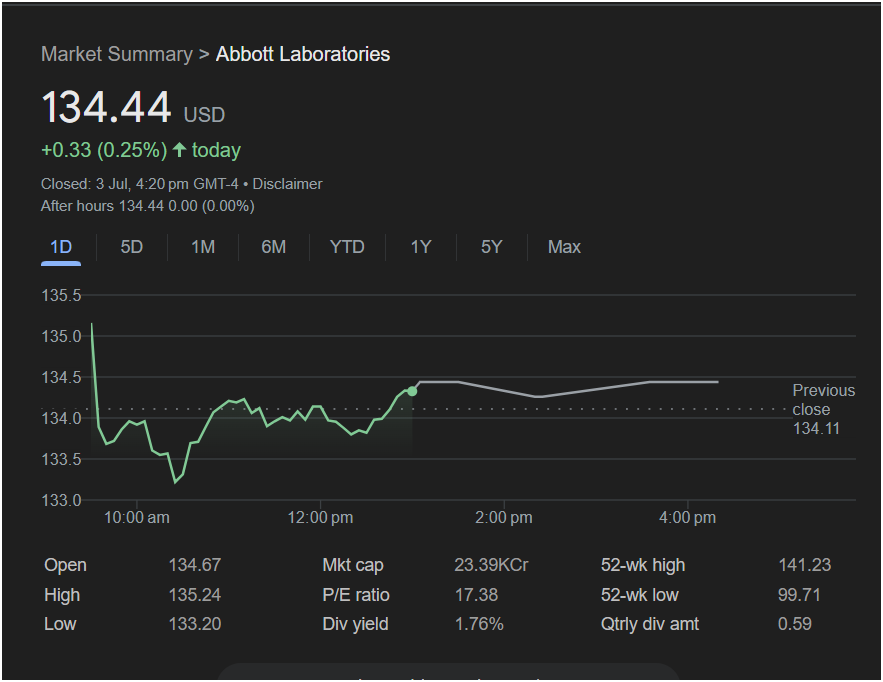

While Abbott Laboratories technically closed in positive territory on Friday, July 3rd, the intraday chart reveals a tug-of-war between buyers and sellers that resulted in a stalemate. Here’s the summary of the key data:

-

Closing Price: 134.44 USD

-

Day’s Gain: +0.33 (+0.25%)

-

After-Hours Trading: Completely flat at 134.44, showing a total lack of momentum after the closing bell.

The stock opened at 134.67, higher than the previous close of 134.11, but immediately sold off to its daily low of 133.20. Buyers then stepped in to push the stock to a high of 135.24, but this strength quickly faded. Most notably, the stock spent the entire afternoon trading in an extremely narrow, sideways range before closing. This flat-line action indicates a perfect balance between buying and selling pressure, and a distinct lack of conviction in either direction.

Key Trading Data at a Glance

To understand the stock’s position, a trader must consider all the relevant metrics. Here are the vital statistics from the session:

-

Day’s Range: A wide morning range from a low of 133.20 to a high of 135.24.

-

52-Week Range: The stock is trading in the upper tier of its 52-week range of 99.71 to 141.23, but is still well off its peak.

-

Valuation (P/E Ratio): A moderate 17.38. This suggests the stock is reasonably valued compared to its earnings, a key factor for value-oriented investors.

-

Market Cap: 23.39KCr.

-

Dividend Yield: A solid 1.76%, offering a respectable income stream.

Market Outlook: Will the Stock Go Up or Down on Monday?

The data points overwhelmingly toward continued consolidation rather than a strong directional move.

The Sideways Case (The Most Likely Scenario):

The most compelling evidence for a continued sideways trend is the price action itself. The failure to hold the opening high, followed by the failure to break down from the recovery, and culminating in a multi-hour flatline, suggests neither bulls nor bears have control. Without a significant market-wide catalyst, the stock is likely to remain “stuck” in this tight range between the day’s low (~

135).

The Bullish Case vs. The Bearish Case:

-

A Mildly Bullish View: The stock did recover from its morning low, indicating support exists around the $133 level. Its reasonable P/E ratio and decent dividend could attract buyers if the broader market is strong.

-

A Mildly Bearish View: The failure to hold onto its morning high of $135.24 shows there is selling pressure above. A weak market open on Monday could easily push the stock back down to test its lows.

Is It Right to Invest Today?

Your investment approach is the key to deciding on a course of action.

-

For Short-Term and Momentum Traders: This is a stock to avoid for now. The lack of a clear trend and the tight, sideways price action (choppiness) make it a poor candidate for a momentum play. It’s a “wait-and-see” situation; a trade might be considered only after a decisive break above $135.24 or below $133.20 on high volume.

-

For Long-Term and Income Investors: The picture is more favorable. The stock is not overvalued, it’s a stable blue-chip company in the healthcare sector, and it provides a reliable dividend. For an investor looking to build a long-term position, the current consolidation phase could be an opportunity to accumulate shares without chasing a rally.

In summary, Abbott Laboratories stock is currently in a state of equilibrium. The lack of direction from Friday’s session makes a significant move up or down on Monday unlikely without a new catalyst.

Disclaimer: This article is for informational purposes only and is based on the provided image data. It does not constitute financial advice. All investing involves risk, and you should conduct your own research or consult with a qualified professional before making any investment decisions.