Bank of America Stock Hits 52-Week High But Stalls, Setting Up a Critical Test for Monday

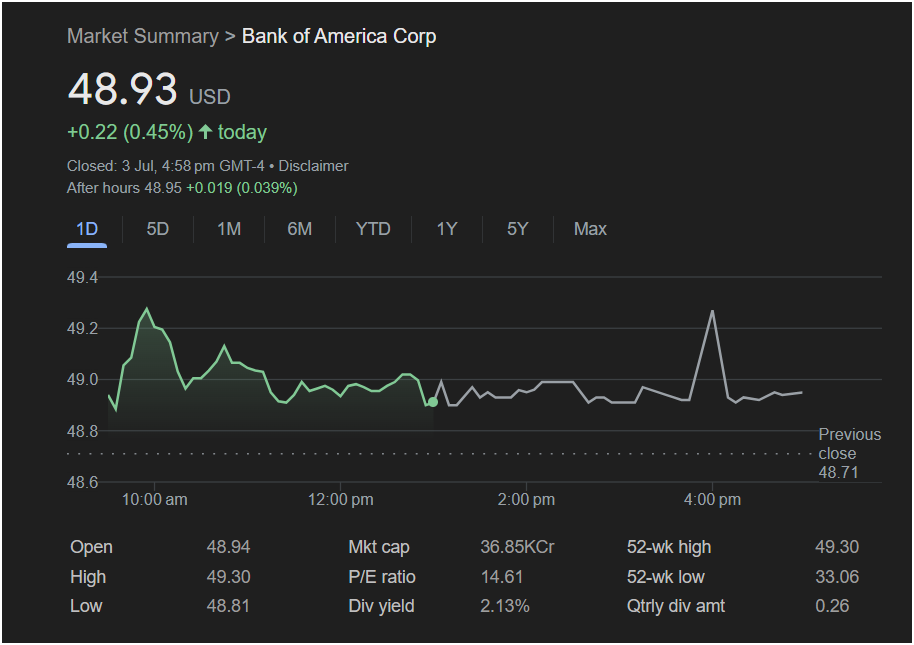

CHARLOTTE, NC – Bank of America Corp (BAC) stock showed notable strength on July 3rd, closing with a solid gain and, more importantly, touching its 52-week high. However, the stock’s failure to close at its peak creates a pivotal scenario for traders, with the next session on Monday poised to determine if a major breakout is imminent.

The financial giant ended the trading day at

0.22 (0.45%). The highlight for investors was the stock’s surge to an intraday high of $49.30, a price that matches its 52-week high. After reaching this critical resistance level in the morning, the stock pulled back and entered a prolonged period of sideways consolidation for the remainder of the day.

After-hours trading offered few clues, with the stock inching up a negligible

48.95. This flat post-market activity suggests the market is in a “wait and see” mode ahead of Monday’s open.

Today’s Key Trading Data for Bank of America (BAC):

-

Closing Price: $48.93

-

Day’s Change: +$0.22 (0.45%)

-

After-Hours Price: $48.95 (up 0.039%)

-

Day’s High / 52-Week High: $49.30

-

Day’s Low: $48.81

-

Previous Close: $48.71

Analysis for Monday: Should You Invest?

The technical picture for Bank of America stock is at a critical juncture. The outlook for Monday is neutral, with a slight bullish bias, but confirmation is essential. Here’s the breakdown for traders:

-

The $49.30 Brick Wall: The most important factor is the resistance at the 52-week high of $49.30. The stock tested this level and was rejected, indicating that sellers are active at this price. For the stock to continue its uptrend, it must decisively break through and close above this level.

-

Indecisive Sideways Action: The long period of flat trading in the afternoon, after pulling back from the high, signals a stalemate between buyers and sellers. The market is currently undecided on the stock’s next direction. The sharp spike and immediate rejection around 4:00 pm further reinforces the selling pressure near the highs.

-

Support and Value: The stock’s low P/E ratio of 14.61 and a respectable dividend yield of 2.13% provide a solid value proposition that could attract buyers and create a support floor, preventing a major sell-off.

Conclusion:

For traders considering an investment, Bank of America stock is on a knife’s edge. An immediate investment on Monday’s open would be a gamble on which direction it breaks. The most prudent strategy is to watch the $49.30 level closely. A sustained move and close above this 52-week high on strong volume would be a powerful buy signal, indicating a breakout. Conversely, a failure to break this level could see the stock drift back down to find support. Patience will be key on Monday.

Disclaimer: This article is for informational purposes only and is based on an analysis of past stock performance. It should not be considered financial advice. All investing involves risk, and you should conduct your own research before making any investment decisions.