Berkshire Hathaway Stock Analysis: Strong Gains Today Could Signal Momentum for Next Week

Berkshire Hathaway Inc. Class A (BRK.A) stock posted a robust performance in today’s trading session, leaving investors and traders to question whether this bullish momentum will carry over into the start of next week. An analysis of the day’s activity provides key insights into the stock’s current health and potential future direction.

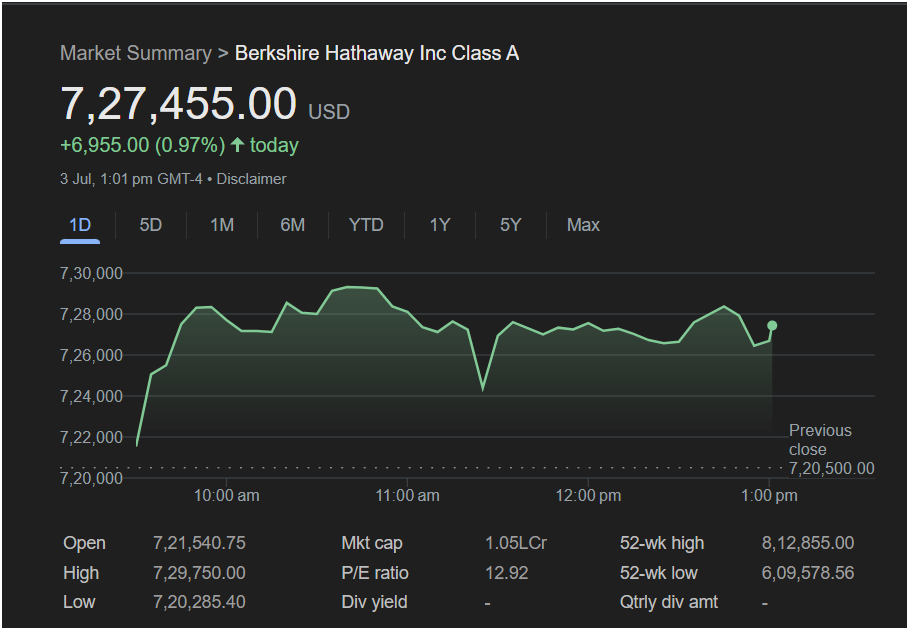

As of 1:01 PM GMT-4 on July 3rd, the stock was trading at

6,955.00 (+0.97%) for the day. This positive movement suggests strong buying pressure and investor confidence.

Today’s Trading Action: A Detailed Look

A closer look at the intraday chart reveals a compelling story for traders:

-

Strong Open: The stock opened at $721,540.75, gapping up slightly from the previous close of $720,500.00.

-

Morning Rally: Following the open, the stock experienced a sharp rally, climbing to an intraday high of $729,750.00 before 11:00 AM. This indicates aggressive buying in the first part of the session.

-

Healthy Consolidation: After hitting its peak, the stock pulled back but found solid support, trading mostly in a range between $726,000 and $728,000 for the remainder of the morning. This consolidation after a sharp rise is often seen as a constructive sign, suggesting the gains are holding.

-

Resilience: Despite a brief dip, the stock showed resilience and was trending upwards at the time of the snapshot, pointing to sustained interest into the afternoon.

Key Metrics for Your Watchlist

Beyond the price chart, several key data points offer a broader perspective for any potential investor:

-

P/E Ratio: At 12.92, Berkshire Hathaway’s P/E ratio is relatively modest, suggesting the stock may be reasonably valued rather than speculatively over-inflated.

-

52-Week Range: The current price is comfortably situated between the 52-week low of $609,578.56 and the 52-week high of $812,855.00. This shows that while the stock is in a long-term uptrend, it still has significant room to run before re-testing its all-time highs.

-

No Dividend: As is characteristic of Berkshire Hathaway, the stock does not offer a dividend (Div yield is “-“). Investors should be seeking capital appreciation rather than income.

Outlook for Monday: Will the Stock Go Up or Down?

Based on today’s technical picture, the outlook leans positive. The strong close, the ability to hold most of the day’s gains, and the resilience shown after the morning rally are all bullish indicators. This suggests a potential for follow-through buying momentum when the market reopens on Monday.

However, traders should remain cautious. The key resistance level to watch is the day’s high of $729,750.00. A decisive break above this price on Monday could signal the next leg up, potentially targeting the $730,000+ range. Conversely, a failure to hold the support level around the $726,000 mark could indicate that the momentum is fading.

Is It Right to Invest Today?

For a long-term investor, Berkshire Hathaway’s fundamentals and history as a value-compounding machine remain its core appeal. One day’s trading activity is less critical, but today’s strength at a price well below the 52-week high could represent a solid entry point for a long-term position.

For a short-term trader, the signs are tentatively bullish. The positive momentum makes it an attractive stock to watch for a continued climb on Monday. However, the market can be unpredictable, and external news over the weekend could influence the opening. A prudent strategy would be to watch the pre-market action on Monday and look for a confirmed break of today’s high before entering a trade, while using the day’s low of $720,285.40 as a potential stop-loss indicator to manage risk.

Disclaimer: This article is an analysis based on the provided image and does not constitute financial advice. All investment decisions should be made after conducting your own thorough research and considering your personal risk tolerance.