Eli Lilly And Co Stock Outlook: Pre-Market Surge Suggests a Bullish Monday

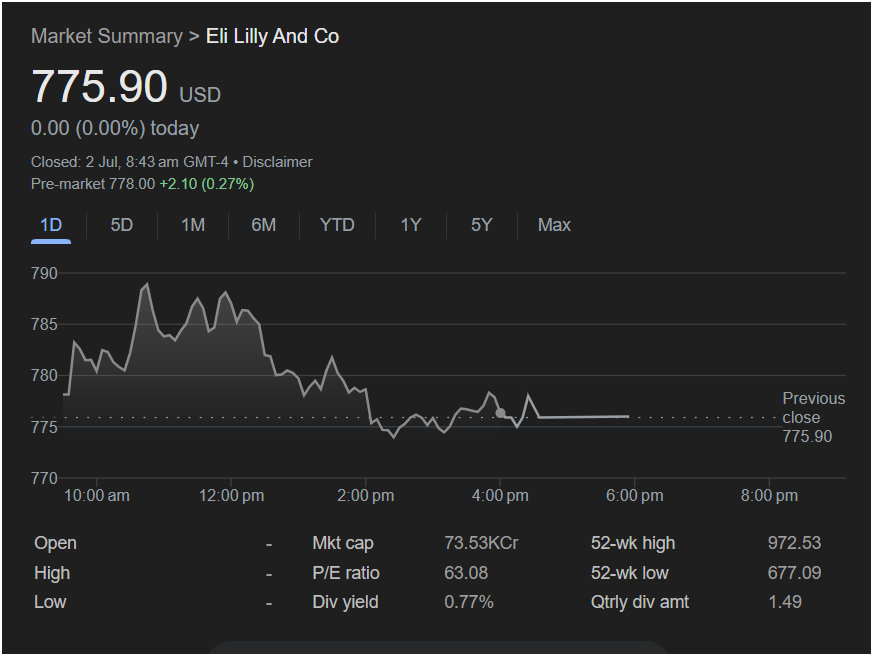

Eli Lilly And Co stock (LLY) is shaping up for a potentially strong start to the week, with early pre-market indicators pointing to renewed buyer interest. After a turbulent previous session that ultimately closed unchanged at $775.90, traders are now looking at key signals that suggest the stock could be ready to move higher on Monday.

This detailed analysis breaks down the essential data from the screenshot, providing a clear playbook for any trader considering an investment in Eli Lilly stock today.

The Positive Pre-Market Signal: A Bullish Start

The most compelling piece of data for Monday is the pre-market performance. The stock is indicated to open at

2.10 (+0.27%) from its last close.

For traders, this is a significant bullish signal. It shows that positive sentiment is building before the market even opens, suggesting that the stock may gap up at the bell and attract further buying momentum. This early strength provides a solid foundation for a potential rally during the main session.

Analyzing the Volatile Previous Session

The previous trading day was a classic tug-of-war between bulls and bears, establishing critical price levels that will be crucial for Monday’s trading:

-

Key Resistance at

790 level before facing heavy selling pressure and retreating. This point now stands as the most important resistance to overcome. A decisive break above $790 would be a major victory for the bulls.

-

Solid Support Near

775. The price bounced cleanly off this level, indicating that buyers were willing to defend it aggressively. This area now serves as a critical support zone.

-

The Indecisive Close: Closing flat at $775.90 after such wide price swings shows the market paused to digest the day’s action. However, the recovery from the lows, combined with the positive pre-market activity, tilts the balance in favor of the bulls.

Key Financials to Consider

-

P/E Ratio (63.08): Eli Lilly’s high P/E ratio reflects the market’s extremely high expectations for the company’s growth, largely driven by its blockbuster drugs. This premium valuation means the stock can be volatile, but it also shows investors are willing to pay up for its future potential.

-

52-Week Range ($677.09 – $972.53): Trading at $775.90, LLY has pulled back from its all-time high of $972.53. This pullback could be seen by some investors as a consolidation phase, offering a more attractive entry point than the peak.

Trader’s Playbook for Monday: Is It Right to Invest?

Based on the strong pre-market action and the successful defense of support, the outlook for Eli Lilly stock today is cautiously optimistic. It appears to be a good day to consider an investment, provided the right conditions are met at the open.

The Bullish Strategy: A trader looking to invest should watch for the stock to hold its opening gains above

780 psychological level. A sustained move above that could give the stock the momentum it needs to challenge the key resistance at $790.

The Bearish Reversal: Caution is still warranted. If the stock fails to hold its pre-market gains and falls back below the previous close of

775 support level would invalidate the bullish thesis and could signal further downside.

: The evidence points towards a higher open and a potential upward trend for Eli Lilly stock. For traders, this presents a potential buying opportunity. The key is to watch for confirmation of strength at the market open and to be ready to act if the stock shows momentum towards the $790 resistance level.

Disclaimer: This article is for informational purposes only and is not financial advice. All trading and investment decisions carry risk.